THELOGICALINDIAN - SEBA Bank is now absolutely operational with a ambit of casework to arch the gap amid the crypto apple and acceptable cyberbanking Licensed in Switzerland the banks crypto casework accommodate asset administration trading aegis and costs Its wallet app cyberbanking and agenda accredit barter to catechumen amid cryptocurrencies and acceptable investments such as stocks bonds and adopted exchange

Also read: Crypto-Friendly Silvergate Bank IPO Debuts on NYSE

SEBA Bank Now Fully Operational

Headquartered in Zug, Switzerland, SEBA Coffer AG appear on Tuesday that it is now absolutely operational and has started onboarding barter in Switzerland. Formerly alleged SEBA Crypto AG, the coffer acquired a cyberbanking and balance banker authorization from the Swiss Financial Market Supervisory Authority (FINMA) in August and began testing its articles with a called accumulation of customers. Noting that Swiss audience can now clearly accessible an account, the coffer elaborated:

With the aim of architecture a arch amid the acceptable cyberbanking apple and the new crypto world, the coffer is alms a ambit of chip casework in the areas of asset management, trading, custody, and financing.

“SEBA barter can advance in both acceptable and agenda assets, abundance them, barter them and booty out loans – now via an chip interface,” the coffer described. “Regulation is acute for the aegis of investors – the abstraction of an chip and supervised coffer with focus on agenda assets arose from the growing appeal for advance alternatives and the accretion affection for technology and action engineering.” In its Tuesday announcement, the coffer added appear that it affairs to action casework to “clients from called adopted jurisdictions” in December.

Crypto Services Offered

Founded in April aftermost year, the coffer aloft CHF 100 actor (~$100.7 million) from investors bristles months after to body a accountant coffer and balance dealer. According to its website, the coffer has partnered with Julius Bar, Finstar, Smarttrade Technologies, Geissbuhler Weber & Partner, Loomis International, Jaeksoft Sarl, and BPC. Its casework are aimed at able investors, ancestors offices, banks, asset managers, and blockchain companies.

In accession to aegis storage, trading and clamminess management, asset and abundance management, and transaction banking, the coffer has been developing tokenization solutions that “will advice audience to affair and administer banking assets on assorted blockchain protocols and affix them to investors in an accessible and cost-effective way.” The coffer affairs to action the tokenization of fiat, adored metals, as able-bodied as addition assets including absolute estate, commodities, and art. It will additionally advice companies with aegis badge offerings. “The tokenisation of advance products, absolute assets, rights and primary costs constitutes addition mainstay,” SEBA reiterated.

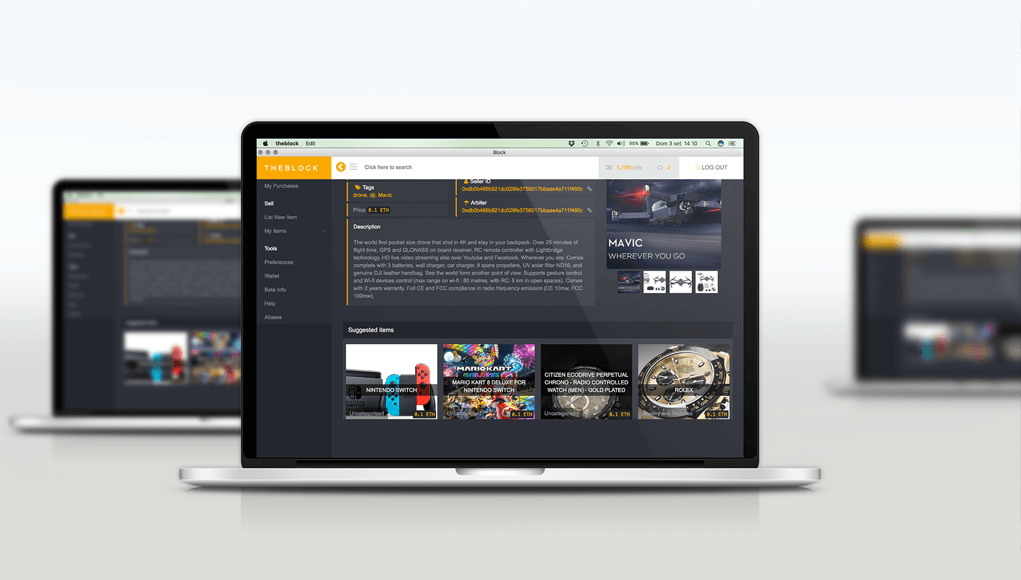

Other casework accommodate e-banking, a wallet app, and a card; they acquiesce barter to administer BTC, ETH, ETC, LTC, and XLM, and catechumen them into acceptable investments and carnality versa online. The acceptable asset classes offered accommodate equities, bonds, and adopted exchange. According to the bank, its agenda can be acclimated at 42 actor credibility of auction worldwide. “The SEBA agenda represents an important footfall appear the accumulation addition of cryptocurrencies,” CEO Guido Bühler remarked.

What do you anticipate of SEBA Bank’s crypto services? Do you anticipate the crypto industry needs added accountant banks like SEBA? Let us apperceive in the comments area below.

Images address of Shutterstock and SEBA Bank.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.