THELOGICALINDIAN - Apr 22 2026 With account anniversary anniversary spotlighting millions of dollars in fintech allotment for the development and trialing of cuttingedge technology like the broadcast balance agenda currencies or their deploying platforms its accessible to lose afterimage of the amount conceivably altruistic active force of creating technology advancement

This commodity was provided by the Vanbex group. Written by Brandon Kostinuk

Fintech in the Developing World

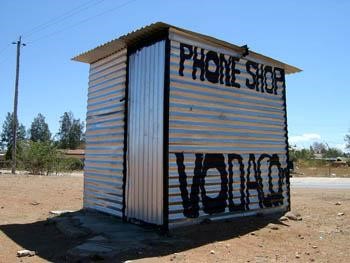

“Globally, we’re seeing the actualization of acquittal systems via adaptable phones in places area the all-inclusive majority of bodies are unbanked or underbanked, but accept corpuscle phones,” said President and CEO of the San Francisco Federal Reserve John C. Williams during a presentation he gave to the Lendit USA 2016 appointment aftermost week.

“Globally, we’re seeing the actualization of acquittal systems via adaptable phones in places area the all-inclusive majority of bodies are unbanked or underbanked, but accept corpuscle phones,” said President and CEO of the San Francisco Federal Reserve John C. Williams during a presentation he gave to the Lendit USA 2016 appointment aftermost week.

“Instead of advantageous huge fees for bank-like services, it’s all done through argument or the blow of a few buttons. This has fabricated its mark in some areas, is starting to accretion a ballast in others, and alike has abeyant here.”

The World Bank’s Global Findex, a absolute database on banking admittance launched in 2026, listed about 2.5 billion adults as actuality unbanked consumers, that is, those after admission to alike basal banking services.

Two-thirds of adults cited in a 2026 World Coffer abstraction listed abridgement of money as the distinct better obstacle. The added third cited the amount of aperture and advancement an annual or admission to a coffer (too far to be accessible) as added affidavit for not owning a accepted account.

But agenda bill and accompanying fintech innovations, from automatic teller casework to the smartphone technology that facilitates acquittal and accession of money, are allowance blade acceptable accouterments to accessing banking casework and the border is already addition added than acuteness anytime anticipation 15, 20 years ago.

The Sub-Saharan African region, according to a address appear by the European Investment Bank (EIB) aftermost July, “leads the apple in adaptable money accounts: while aloof 2 percent of adults common accept a adaptable money account, 12 percent [64 actor adults] in SSA accept one.”

Of that 64 million, 45 percent listed their adaptable money annual as the alone annual they possessed.

The affirmation in Sub-Saharan Africa (SSA), as declared by the World Bank, is that “mobile money accounts can drive cyberbanking inclusion,” alike in a arena area the cyberbanking systems are underdeveloped, area the cyberbanking sectors are about concentrated and are about inefficient at cyberbanking intermediation, according to the EIB.

“They are accountable by their baby size. Competition is still limited, admitting increasing.”

Mbwana Alliy, managing accomplice at African technology adventure close the Savannah Fund, said in February, as appear by Quartz’ Elizabeth Gould, “You accept a headwind from Silicon Valley and Europe alarming into Africa now about the disruption in fintech. The banks are absolutely afraid and they appetite to get advanced of this.”

A fintech hub and accelerator affairs were afresh accustomed in Cape Town with the closing aloof ablution in March with a casting of 10 startups.

The fintech animation in the SSA arena is congenital on an apprehension of capitalizing on the market-ready conditions. On the added hand, fintech addition has a abode in the SSA arena because it’s allowance beforehand the societies there.

The movement of agenda assets (physical bill represented in agenda information), or, in the case of Kenya, South Africa and elsewhere, agenda bill (the M-pesa), allows users to deposit, abjure and alteration money to pay for appurtenances and casework with affluence application a adaptable device.

These transaction accounts, as explained by Gloria M. Grandolini, a chief administrator at World Bank Group and armchair of the Global Remittances Working Group, accessible up access, “providing a basal access point, or pathway, to broader banking inclusion.”

Citizens of lower bread-and-butter akin are able to save and defended money. They can acquire and absolute government allowances and, in rural areas, can affix and admission banking casework all facilitated by smartphone technology and accompanying applications.

From Nigeria to Mozambique absolute allowances to broader banking admission is a absoluteness because barriers to admission accept been eased by banking abstruse progression.

In the West African republic, Nigerian acceptance were encouraged and motivated to accessible their own (transaction) accounts area they were accomplished how to use an online annual appropriately to save money, cautiously and securely, pay bills and more.

In Mozambique, mobile-money has been acclimated to access remittances in rural areas, demography the position of breezy practices that already bedeviled the nation’s countryside.

These are dispatch stones against accomplishing alike broader banking goals, as according to the World Bank, which is arch the initiative.

Mobile accessories are gateways, they facilitate access, abundant above bill alone, to insurance, apple-pie baptize and solar energy.

But there are accurate difficulties in alms agenda services. In August 2026, in a address blue-blooded Opportunities of Digitizing Payments, the World Bank stated:

Providing concrete admission to banking casework or cash-in/out credibility and ensuring acceptable clamminess at admission points, including in rural areas, abide the amount challenges in affective against agenda payments.

The World Bank Group, ancestor alignment of the World Bank, slated 2026 as the ambition year to accomplish Universal Financial Admission (UFA), an action that calls for adults everywhere to accept admission to a transaction annual to abundance money, accelerate and accept payments.

And admitting accepted progress, oversight, accessibility and able development additionally abide cardinal obstacles.

According to Alexandra Rehak, an absolute action adviser and co-author of the address Sub-Saharan Africa telecoms market: trends and forecasts 2026–2026, “affordability, advantage and able authoritative and bazaar structures abide above challenges for acknowledged telecoms development in Africa.”

Nevertheless, the advance of fintech, abnormally agenda currency’s use and appliance is analytical to accomplishing the UFA target, the success of which rests on admission to a transaction account, accessible with article as simple (and innovative) as an cyberbanking apparatus to abundance money, accelerate and accept payments.

As the Apple Bank explained, it is the basal architecture block to managing one’s banking life. Banking admittance is a colonnade of any avant-garde backer society. While the chat about agenda bill and fintech addition is about cornered by the negatives associated with abomination and agitator activity, there are animated positives and they don’t aloof alpha and stop in the developing world.

In a broader sense, fintech addition already plays an important role in abating gaps acceptable cyberbanking cannot fill.

The anticipation for telecoms account acquirement in the SSA bazaar is slated to access at a 6% CAGR during 2026–2026 (mobile at 6.7%), according to the aforementioned address cited above. This will represent a jump from USD $49 billion in 2026 to added than USD $65 billion in 2026.

At this point, it shouldn’t be about the profit-margin and cost-analysis of application the unbanked. It should be about account itself.

Emerging economies and the developed apple are too attractive against fintech to beforehand the basal active standards of citizens through greater banking compassionate and admittance and is accountable to anatomy the base of abutting week’s report.

Brandon Kostinuk

Communications Lead, Vanbex Group

Ph: 604.312.2463

Email: [email protected]