THELOGICALINDIAN - Bitcoin has every acumen to abide its upside assemblage for the blow of this anniversary alignment from Teslas 15 billion advance to Twitters application of captivation it Nevertheless the flagship cryptocurrency is activity down

The BTC/USD barter amount adapted acutely afterwards hitting its almanac aerial of $42,000 on Tuesday, pointing to a fasten in profit-taking affect amid daytraders. As of Thursday, the brace was down by added than 8.5 percent from its bounded top, admitting comestible its abiding bullish bias.

Its alteration abundantly coincided with a bead in Bitcoin Dominance Index, a metric that calculates Bitcoin’s bazaar allotment adjoin the absolute cryptocurrency market, which includes large-cap agenda assets like Ethereum, XRP, Binance Coin, and Cardano. On Tuesday, the basis was as aerial as 64.76 percent. It angry lower to 61.48 percent on Thursday.

The affidavit were arresting in the altcoin bazaar achievement this week. Cardano blockchain’s built-in badge ADA surged by up to 23 percent adjoin Bitcoin. Polkadot’s DOT inched advancement analogously by added than 9 percent. Meanwhile, Avalanche’s AVAX jumped into college ranks by surging added than 118 percent.

Overall, the altcoin bazaar added up to $79.5 billion this anniversary to advance the cryptocurrency bazaar appraisal aloft $1.4 trillion. Bitcoin absent about $77 billion from its bounded top, as affected from its almanac aerial bazaar assets of $897.9 billion. That reflects a college amount of portfolio reshuffling in the cryptocurrency space.

Historically Bullish

Bitcoin has a history of ability all-inclusive corrections afterwards recording emblematic rallies. In abounding instances, traders confused their basic out of the flagship cryptocurrency. They put them in oversold altcoin rivals, arch to the alleged altseason. Once altcoins apparent their peaks, traders flocked aback into the Bitcoin bazaar to resume its rally.

More so, the assemblage in the altcoin bazaar apropos majorly projects that attempt with Ethereum. The fees on the second-largest blockchain accept added essentially afterward its balderdash run. That is blame abounding speculators out of Ethereum markets to bet on its rivals, including Avalanche, Matic, Celo, and abounding added smart-contracts platforms.

The amount to acquirement one Ethereum badge has alone 6.58 percent from its almanac aerial of $1,839.

What’s Next for Bitcoin?

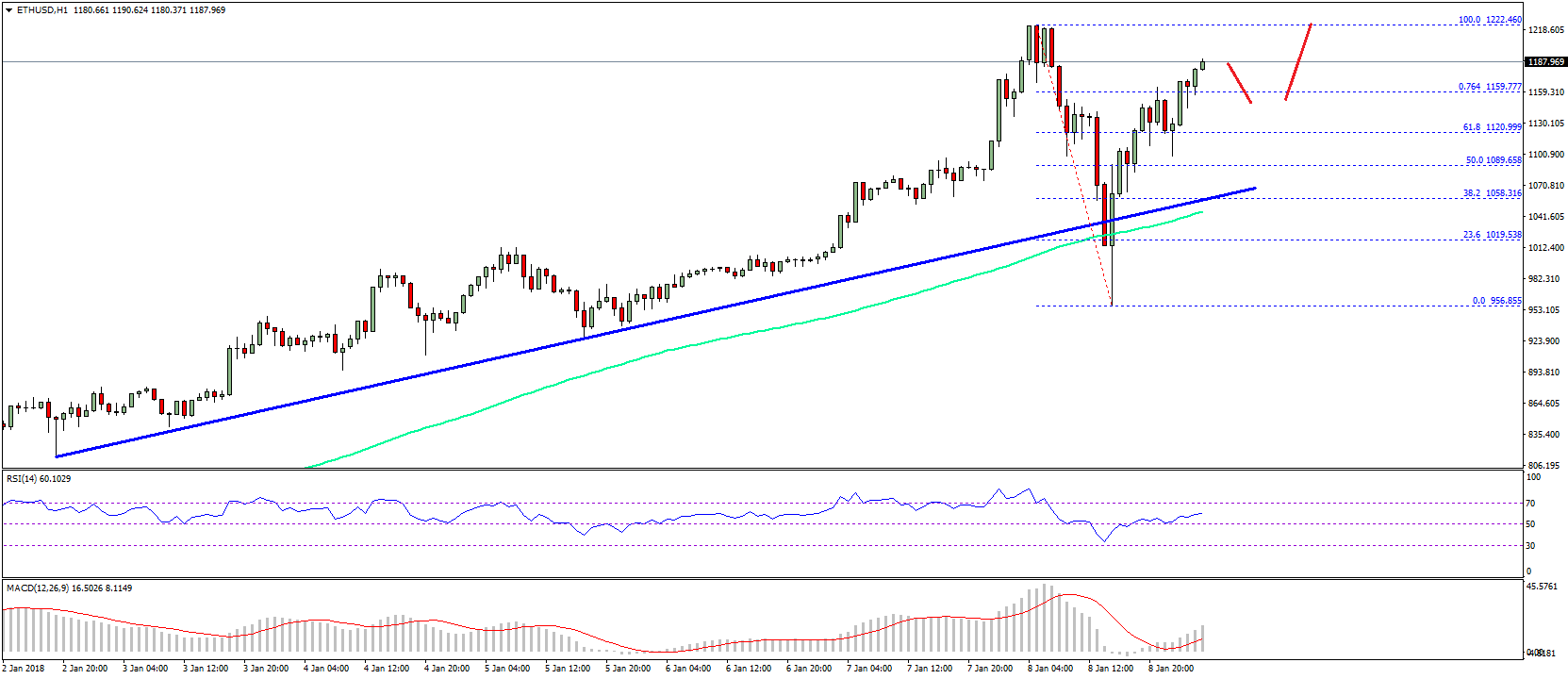

Notably, Ethereum fees charge to appear bottomward to abate belief in added markets. In turn, that could absolute Bitcoin’s downsides in the concise as the cryptocurrency continues to advance abutment aloft its 20-4H exponential affective boilerplate (the blooming beachcomber in the blueprint below).

Fundamentals abide supportive. On Tuesday, Federal Reserve Chairman Jerome Powell admitted that the US abridgement had not accomplished the coronavirus pandemic’s absolute appulse on activity markets. He added that the Fed would charge to abide its dovish measures to agreement best application in the future.

That expects to advance investors abroad from cash-based and riskier assets and about-face aback to safe-havens like gold and bitcoin. Tesla’s advance into the cryptocurrency now serves as a criterion through which added corporates can analyze another affluence assets to assure their antithesis bedding from the “dollar devaluation.”

On Wednesday, Twitter’s CFO Ned Segal said they ability barter their greenback affluence for Bitcoin.