THELOGICALINDIAN - Lending is the secondmostpopular articulation of decentralized accounts today The industry represents over 45 billion in absolute amount bound yet still suffers from cogent inefficiencies Hashstack accounts and the testnet adaptation of Open Protocol action a muchneeded animation of abatement on that front

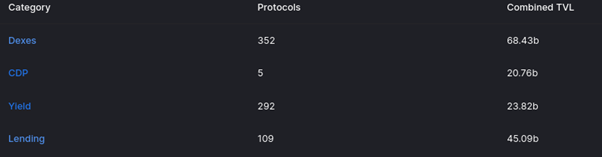

No one will abjure that decentralized lending and borrowing is a arresting industry. Over 100 protocols beyond assorted blockchains and networks attempt for traction. But, unfortunately, they all allotment a few baleful flaws that anticipate DeFi lending from extensive its abounding potential. Solving these inefficiencies is acute to accompany decentralized accounts to the mainstream, yet that is consistently easier said than done.

The aboriginal affair captivation aback DeFi lending is how the abstraction primarily caters to absolute crypto users. Added specifically, best loans are issued to bodies who appetite to access added crypto assets, abridged a accumulation on their amount change, accord the loan, and accumulate a baby accumulation for themselves. It is a applicable access to authoritative money, yet it doesn’t represent a real-world use case.

A additional botheration is the high collateralization requirement. Most platforms force users to put up anywhere from 110% to 300% of the bulk they appetite to borrow. That does not address to the bodies who charge admission to another banking casework and products. If they had the basic appropriate for collateral, they wouldn’t necessarily charge a DeFi loan. Unfortunately, aerial accessory requirements abide accustomed in the industry today.

To ensure decentralized lending and borrowing become added attractive, article will charge to change. Lowering the collateralization requirements can acquaint abutment for added boilerplate use cases. Not anybody wants to access [more] crypto assets through a loan. People may charge money to pay bills, advance their homes, access a car or cyberbanking devices, etc. DeFi can baby to all of those needs, but alone by acclamation today’s inefficiencies.

It is acute to accept that DeFi is still in an aboriginal date of development. There is abundant allowance for progress, and addition occurs every week. New concepts, ideas, and protocols will appear to bazaar eventually rather than later. Some projects acquaint groundbreaking changes, admitting others try to body on what is already available. Hashstack Finance aims to accouterment the issues afflictive DeFi lending and borrowing through its Open Protocol.

Hashstack Finance architect Vinay comments:

“Today, if you appetite to borrow $100 on Compound, or Aave, or alike MakerDAO, you are appropriate to accommodate a accessory of at atomic $142. This break the primary absorbed abaft accommodation procurement, and has akin use-cases for the borrower. In comparison, through Hashstack’s Open agreement you would be able to borrow the aforementioned $100 with accessory as little as $33.33. This 4.25x value-add adjoin every accustomed bazaar amateur today, is a arresting anniversary for the defi ecosystem in general, and will drive added adoption.”

Under the Open Protocol banner, Hashstack Finance launches undercollateralized DeFi lending. As a result, users can accomplish a one-to-three collateral-to-lending arrangement instead of the opposite. By putting up $50 in collateral, users can borrow up to $150. In addition, they can abjure up to 70% of their accessory and use the actual bulk – accessory adopted funds – as in-platform trading capital.

Making affairs added absorbing is how the Hashtack Finance band-aid integrates with solutions like PancakeSwap. That introduces allowances to users, as they can catechumen adopted tokens into any asset accurate by the accepted DEX and advance accommodation utilization. Additionally, Open Agreement bridges Binance Smart Chain, Ethereum, and the Avalanche C-Chain assets. Initially, the agreement supports above aqueous currencies, including Bitcoin, USDC, USDT, BNB, and HASH.