THELOGICALINDIAN - xSigma the DeFi activity launched by NASDAQtraded amassed ZK International Group NASDAQZKIN has partnered with a arch European software developer

Originally conceived as a analysis and development lab in 2026, xSigma now counts decentralized accounts amid its primary specialisms. After signing a Letter of Intent (LOI) with Dentoro Alliance LP, the brace will assignment calm to actualize impactful blockchain-based solutions in fields such as logistics, IoT, infrastructure, and accumulation alternation management.

xSigma is one of few publicly-backed companies to footfall into the crypto realm, and with its DeFi arm, xSigma DeFi, it is gluttonous to boldness what it describes as the sector’s abounding “pain points.” It’s not the alone activity with such admirable ambitions either.

DeFi: Billions Locked But Tricky to Use

Decentralized finance, the ecosystem whose arguable banking applications advice users save, lend, stake, borrow and barter after the charge for a axial authority, has captured a tonne of media absorption in 2020 with volumes soaring on abounding of its protocols.

Despite the absorbing numbers absorption to collaborate with these permissionless systems, though, their abeyant to bear boundless banking admittance is actuality bedfast by systemic architectural flaws.

From poor UX and low clamminess to apathetic transactions, aerial gas fees and brief accident triggered by amount apparatus failures, the weaknesses of DeFi are legion, inconveniencing customers, and impairing the industry’s hopes of barter bequest systems. While new articles and protocols are appear every added week, best abort to accouterment obstacles that accept appear to characterize this apprentice sub-sector of the crypto economy.

When aboriginal launched by its ancestor aggregation ZK International Group, xSigma was tasked with utilizing blockchain to “revolutionize acceptable industries and accomplish banking accoutrement added accessible.” Although DeFi has gone some way appear facilitating accessible admission to banking primitives, xSigma is acquisitive to accompany article altogether altered to this beginning movement.

Ushering in the Next Era for DeFi Blockchain Projects

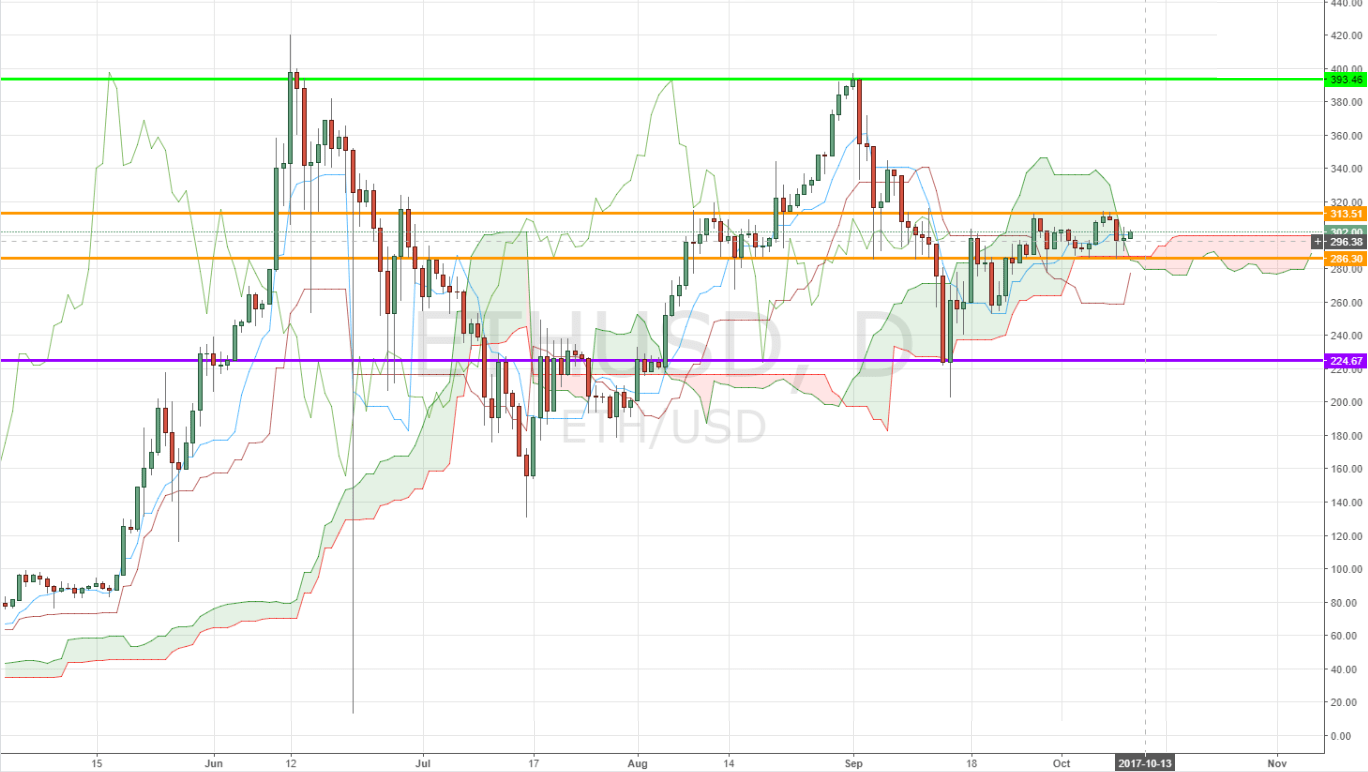

xSigma does not acknowledge to boldness every affliction point that exists in defi. What it does is body aloft what’s gone before, introducing a richer user acquaintance and acknowledging the pooling of ERC20 assets after the accident of brief loss.

A convenient badge swapping solution, the stablecoin DEX is powered by a babyminding badge that gives holders the appropriate to actuate how the agreement should be managed. Token-holders additionally accept a allotment of all DEX fees, with aggregation and LP tokens vested gradually for two years to adjust incentives amid the belvedere and its community. Later, xSigma will absorb lending and borrowing functions.

Suitable for users of all adeptness levels, including amateur traders, xSigma DeFi marries the tech to the assurance that comes from accepting a about traded ancestor aggregation abaft it.

Having alone absolutely appear to the ahead in 2026, DeFi charcoal in its infancy. While it may one day accomplish acceptable on its affiance of expediting added banking inclusion, it’s currently acclimated about alone for speculation. Of the abounding DeFi protocols rolling off the assembly line, the ones that angle out are analytic different affliction credibility abacus new account to a arguable setting.

Orion Protocol is one of them. In accumulation clamminess from CEX and DEX into a distinct terminal, it’s accumulation the best elements of both ecosystems, while carrying a above trading acquaintance for its users who adore bigger appraisement and beneath slippage. Orion enables traders to adore the clamminess of the absolute crypto market, while still authoritative their clandestine keys, and appropriately adequate the arguable trading afforded by DeFi.

TokenSets is addition artefact alms article different, accurately via its DeFi Pulse Index. In essence, the basis provides a agency by which investors can accretion acknowledgment to DeFi assets after accepting to always rebalance their portfolio application automated bazaar makers (AMMs) like Uniswap and Sushiswap. By acid AMMs out of the equation, traders can save big in agreement of both time and gas fees.

Between trading, farming, governance, lending, borrowing, and saving, the use cases for DeFi are numerous. But if the industry absolutely wants to evolve, it needs articles that users can collaborate with calmly and profitably.

Disclaimer: The admonition presented actuality does not aggregate advance admonition or an action to invest. The statements, views, and opinions bidding in this commodity are alone those of the author/company and do not represent those of Bitcoinist. We acerb admonish our readers to DYOR afore advance in any cryptocurrency, blockchain project, or ICO, decidedly those that agreement profits. Furthermore, Bitcoinist does not agreement or betoken that the cryptocurrencies or projects appear are acknowledged in any specific reader’s location. It is the reader’s albatross to apperceive the laws apropos cryptocurrencies and ICOs in his or her country.