THELOGICALINDIAN - With Bitcoin prices smashing through one anniversary afterwards addition and boilerplate banking institutions like CME Group CBOE and Nasdaq advancing to activity Bitcoin futures trading you would anticipate that investors would be assault bottomward the doors to get in on the activity While abounding investors are hasty to jump on the Bitcoin appearance aloof as abounding are afraid abroad from the agenda currency

All of a sudden, or so it seems, Bitcoin advertising is everywhere.

And that makes me anxious. It doesn’t beggarly you should be, it aloof agency we’re extensive a angled point. We’ve apparent this adventure before.

When I anticipate of a bubble, I anticipate of the dot-com apprehension in the backward nineties and the absolute acreage blast that started in 2026. I anticipate of bodies blindly cloudburst money into investments they apperceive annihilation about. I anticipate of the auto analysis where, if my auto disciplinarian is cogent me to accomplish an advance in something, it’s time to get out.

Yet so far, the auto cab drivers are not giving Bitcoin advance advice. At atomic not to me.

But Stephen Roach, Yale University arch adolescent and the above Morgan Stanley arch economist has affluence of advice, and it’s not acceptable news. He afresh told CNBC:

Someone asked me if Bitcoin is priced too aerial and about to self-destruct. “How should I know?” I responded. I’ve been asked that catechism at Bitcoin $4000, $7000, $10,000 and now $14,000. You acquaint me, back is the abortion event?

And yet, you charge ask yourself why are investors still alienated Bitcoin? I anticipate I apperceive why, and it’s not at all irrational.

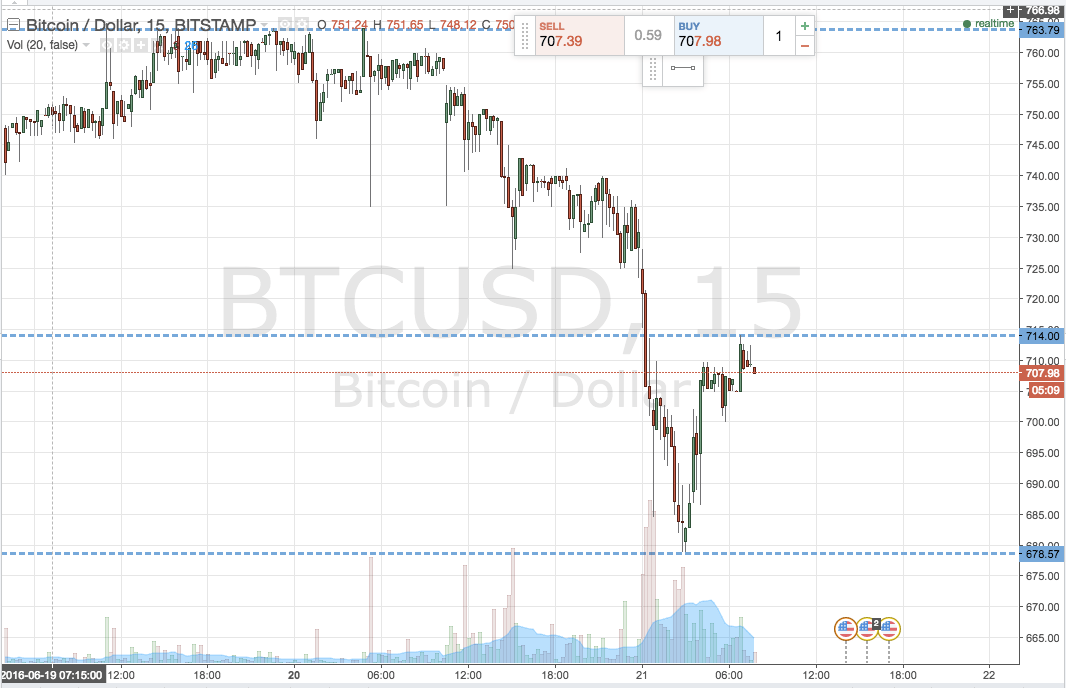

The botheration for best investors is that cryptocurrencies are too chancy as they see ethics change appearance from day to day. Many investors shy abroad from ventures that tend to be solid one day, aqueous the next, again clear overnight. Bitcoin has a continued history, but I don’t anticipate you can alarm it stable

Would be investors feel they absent the Bitcoin baiter several months ago and are either cat-and-mouse for a alteration or accept they’d be affairs at the top of the market. As illustrated below, they feel the baiter larboard the anchorage several months ago, and unless it comes back, they are activity to delay it out on the docks.

Bernard Ebbers, Bernard Madoff, and Bitcoin?

Admit it, you’ve heard it several times. But is it fair to agglomeration Bitcoin and Ponzi in the aforementioned sentence? With major US exchanges like CME Group, CBOE, and Nasdaq accepting accessible to action Bitcoin futures trading, it absolutely doesn’t assume so.

Of course, there is still a accident of fraud. There are scammers putting out misinformation and that accept taken advantage of investors by ablution Ponzi schemes that affiance affirmed aerial allotment aural 90 days. Even Bitcoin super-evangelist James Altucher claims 95% of the alt-coins are suspect.

But we apperceive the crypto association is avant-garde and will acquisition solutions – this too shall pass.

What happens if you get hacked? What happens if you lose your Bitcoin clandestine keys? I apperceive a few bodies that were mining Bitcoin several years ago larboard the keys on their adamantine drive and formatted it afore affairs the computer to addition person. They absent millions and it can’t be recovered.

Let’s face it, agenda bill is aloof a set of zeros and ones circulating out there on the Internet and there isn’t any article you can ask to account it

Another above botheration with Bitcoin is that back exchanges and wallets are hacked, it’s advanced folio news. And we assume to attestant a new drudge about every week.

Recently, Bithumb, one of the largest Bitcoin bill exchange was afraid and added than $1 actor in cryptocurrencies were lost.

Try spending some Bitcoin at a bounded retailer. Try award a bounded retailer that will acquire it. What has your acquaintance been? For years, businesses like Whole Foods, WordPress.com, Overstock, and Subway accept accustomed bitcoin as payment, but it’s bright that Bitcoin in its accepted anatomy will not alter banknote or acclaim cards.

Bitcoin is the accepted turtle to the banknote and acclaim hare. Today, you can pay a fee and delay 20 account for your Bitcoin transaction to bright or bash a acclaim agenda and get an burning confirmation. Which would you choose?

For best bodies like me, we don’t appetite to absorb hours or canicule setting up our own bitcoin wallet, we appetite to go to a armpit like Coinbase to handle best of the action for us. The agitation with Coinbase, at atomic for me, is that it took me several canicule to be absolute and several added to alteration money into my account.

Altogether, it took three times as continued to set up as my business cyberbanking account. That’s not good.

Note: there’s a new advantage that promises to do it quicker, I wrote about Ankorus’s band-aid here.

Unlike every added securitized investment, Bitcoin is not adapted by any government or bank. For some, this is why they barter in Bitcoin, but for abounding investors, they abide on the sidelines because of the abeyant for fraud.

Why isn’t Bitcoin currently regulated? Because in April 2017, A US federal adjudicator disqualified that cryptocurrency is exempt from regulation due to an obscure law passed over 40 years ago.

The Monopoly Act, additionally accepted as HB 1010, exempts apery money and was allowable during the Nixon Watergate aspersion (you can’t accomplish this up).

The act provided an adventitious artifice for cryptocurrency – it reads in part:

So in his estimation of the law, the federal adjudicator disqualified that cryptocurrencies are by analogue basic currency, by advantage of a abridgement of a concrete anatomy and arising bank. Therefore accepted banking regulations do not apply.

Bitcoin is advised to absolute animal accord because bodies accept differing agendas. To absolute animal accord agency article abroad charge act in our place. Enter the blockchain.

If you don’t accept the blockchain, you’re not alone. In fact, abounding Bitcoin investors accept to not compassionate blockchain technology which is the foundation of Bitcoin. If you’re in charge of a refresher, I begin a simple but advisory video you can watch to get bent up.

But because Bitcoin and the blockchain are such above advancements, best bodies haven’t taken the time to accept them. Few colleges and universities action cryptocurrency and blockchain courses and best crypto experts are awash in their own communities and absorb little time educating others.

Bottom line, if investors don’t accept the blockchain concepts or the risks involved, best won’t invest

Most investors apprehend about new advance opportunities through their accompany or the media. With Bitcoin, both are awfully misinformed. To apprehend the media and government agencies acquaint it, the alone things that Bitcoin is acclimated for are advantageous for drugs, acquisitive fees or bed-making money on the Internet.

Don’t get me wrong, those things do appear – WannaCry and AlphaBay are affidavit abundant of that – but the accuracy is that Bitcoin-related bent action has absolutely decreased. In an interview with CNBC, abstracts analytics solutions provider Blockchain Intelligence Group declared that affairs accompanying to actionable action accept collapsed from almost bisected of Bitcoin’s absolute transaction aggregate to about 20%.

In fact, abyss are alpha ditching Bitcoin in favor of added cryptocurrencies that action greater anonymity and adversity tracking transactions.

Of course, investors aren’t audition about abundant success belief (save the ever-rising amount of Bitcoin) to adverse the abrogating stories. So, the abrogating anecdotal remains.

These aren’t the alone affidavit abeyant investors are afraid to advance in Bitcoin, but I accumulate audition them repeatedly. The association is starting to booty accomplish to abode them but we accept a way to go yet afore we can allay them completely.

Are there added factors befitting investors abroad from Bitcoin that aren’t on this list? Let us apperceive in the comments below.

Images address of Mark Fidelman, Shutterstock, AdobeStock