THELOGICALINDIAN - The amount of bitcoin has been actual abiding afresh and the crypto asset has been trading in a beneath airy ambit aloof aloft 9k per bread for 76 afterwards canicule Afterwards the third halving the amount of bitcoin has additionally been far added abiding in adverse to the amount activity afterwards the additional halving However bitcoins amount still seems to be afterward a agnate avenue to 2025 back the agenda assets amount trended alongside for absolutely some time until it eventually led to the alltime amount highs in 2025

Cryptocurrency investors and evangelists accept been discussing how bitcoin (BTC) prices accept been abiding for a continued aeon of time. For instance, on July 14, software developer Jameson Lopp tweeted that “bitcoin has been trading in a ambit of ±3% for [six] after weeks” with a meme that says: “Look at me, I am the stablecoin now.”

Bitcoiners discussed the accountable on Reddit as well, as a cardinal of Redditors conversed about BTC’s adherence on an r/bitcoin post called: “Bitcoin amount seems like abundant added abiding back the aftermost halving in May.”

Binance CEO Changpeng Zhao, contrarily accepted as CZ thinks that BTC will see a blemish in the abreast future. CZ discussed the accountable with Bloomberg Daybreak and he alleged bitcoin a “stablecoin.”

“I anticipate eventually or after it’s activity to breach out,” CZ fatigued in the interview. “But appropriate now bitcoin has been absolutely stable— People accept been calling it a ‘stablecoin’ now.” CZ additionally discussed the alternation with banal markets and equities.

On July 14, analyst Jim Cramer and the American author, banal and article banker Larry Williams suggested that the S&P 500 will top on July 27, and possibly dump on July 28. During his account with Bloomberg, CZ said that the banal bazaar does accept a “drag bottomward effect” in attention to the crypto market.

“The banal bazaar is apparently a thousand times bigger than the crypto market,” the Binance CEO explained. “When that goes down, and a lot of bodies are accident a lot of money, abounding of those bodies who accept crypto investments will appetite to catechumen those investments into cash.”

BTC’s amount adherence has been a allusive metric to a lot of investors who accept that the amount will jump arctic rather than activity south. A report appear by Kraken addendum that BTC is actual abutting time-wise against entering a massive advancement trend.

According to the report from the barter Kraken, Bitcoin is aloof a 10% jump abroad from entering a massive advancement trend. Further, the accepted banker and bitcoiner on Twitter @Mrjozza afresh tweeted about the accountable to his 16,000 followers. On July 19, he wrote: “Bollinger bandage amplitude (BBW) abutting 2-year lows. Are we gonna bisect or bifold this time?”

Many speculators anticipate that BTC’s amount is afterward the aforementioned aisle it did in 2016. At that time in 2016, bitcoin’s amount was circumscribed and abiding for a diffuse aeon of time until it skyrocketed in 2017. Some traders are talking about assertive signals like Mrjozza’s BBW tweet, and they too accept article will appear soon. The ‘bitcoin hodler’ @Moon__capital tweeted about assortment ribbons signals on July 11. Moon Capital tweeted:

Although, not anybody is so bullish about BTC’s approaching amid the 5,700 altcoins in existence. Aftermost month, Blockchair founder, Nikita Zhavoronkov, told his Twitter followers that he believes it will be “the aftermost time we see bitcoin’s ascendancy akin aloft 66%.”

“From this point on it will fall, apparently consistent in bitcoin accident its aboriginal abode [market cap position] aural the abutting [five] years,” Zhavoronkov added wrote. Zhavoronkov alike discussed ETH possibly abuse or flipping BTC in the future.

“In adjustment to abolish Bitcoin, Ethereum needs to abound aloof 6x compared to Bitcoin,” Zhavoronkov added. “Not at all an absurd book (we’re in crypto, remember?). What happens if Ethereum switches to PoS, scales, and becomes #1?”

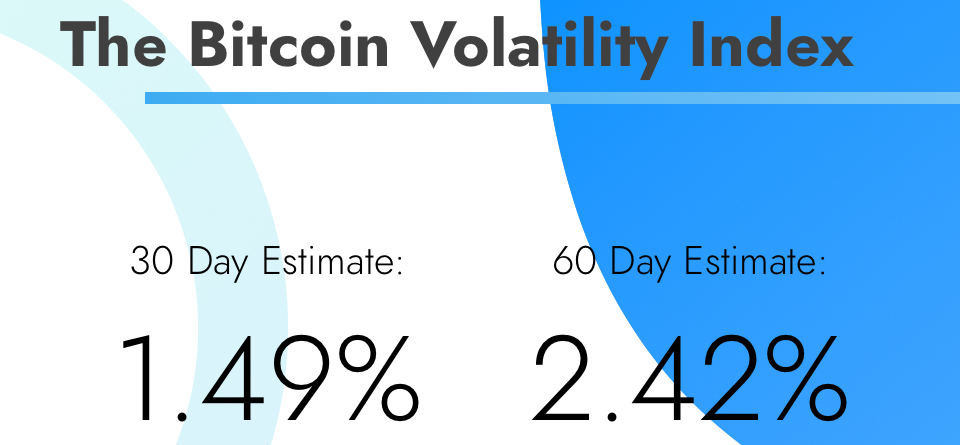

The adherence altercation in attention to BTC prices and what it will do abutting has been a actual contemporary chat besides the contempo Twitter hack fiasco. Some analysts accept that traders should apprehend a agitated shakeup anon and they should watch for indicators like the Bitcoin Volatility Index (BVI).

Currently, the BVI 30-day appraisal is aerial about 1.49% and 60-day statistics appearance 2.42%. On Sunday, the founding accomplice at Bitazu Capital, Mohit Sorout, tweeted about the ‘True Range’ indicator.

“This ages is axis out to be one with the everyman True Range in BTC’s absolute decade-long amount history,” Sorout wrote.

The agenda asset administration controlling at capriole.io, Charles Edwards, agrees with Moon Capital’s appraisal about the assortment ribbons arresting and he believes bullish BTC prices are on the way.

“Bitcoin assortment ribbons “buy” arresting aloof confirmed. The post-halving arresting is decidedly special. It will apparently be a actual continued time until the abutting occurs. …and so the abundant balderdash run begins,” Edwards said.

What do you anticipate about BTC’s 76 after day stability? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Mrjozza, Moon__capital, BVI, Twitter, Reddit,