THELOGICALINDIAN - Digital bill markets accept slipped decidedly in amount during the aftermost two weeks and the lower prices accept not sparked college barter volumes Data shows cryptocurrency atom bazaar aggregate has slipped from 14 abundance in November 2026 to this months 593 billion in aggregate Bitcoin futures accessible absorption and volumes accept alone appreciably over the aftermost two months as well

Crypto Volumes Slide Month-Over-Month Since November

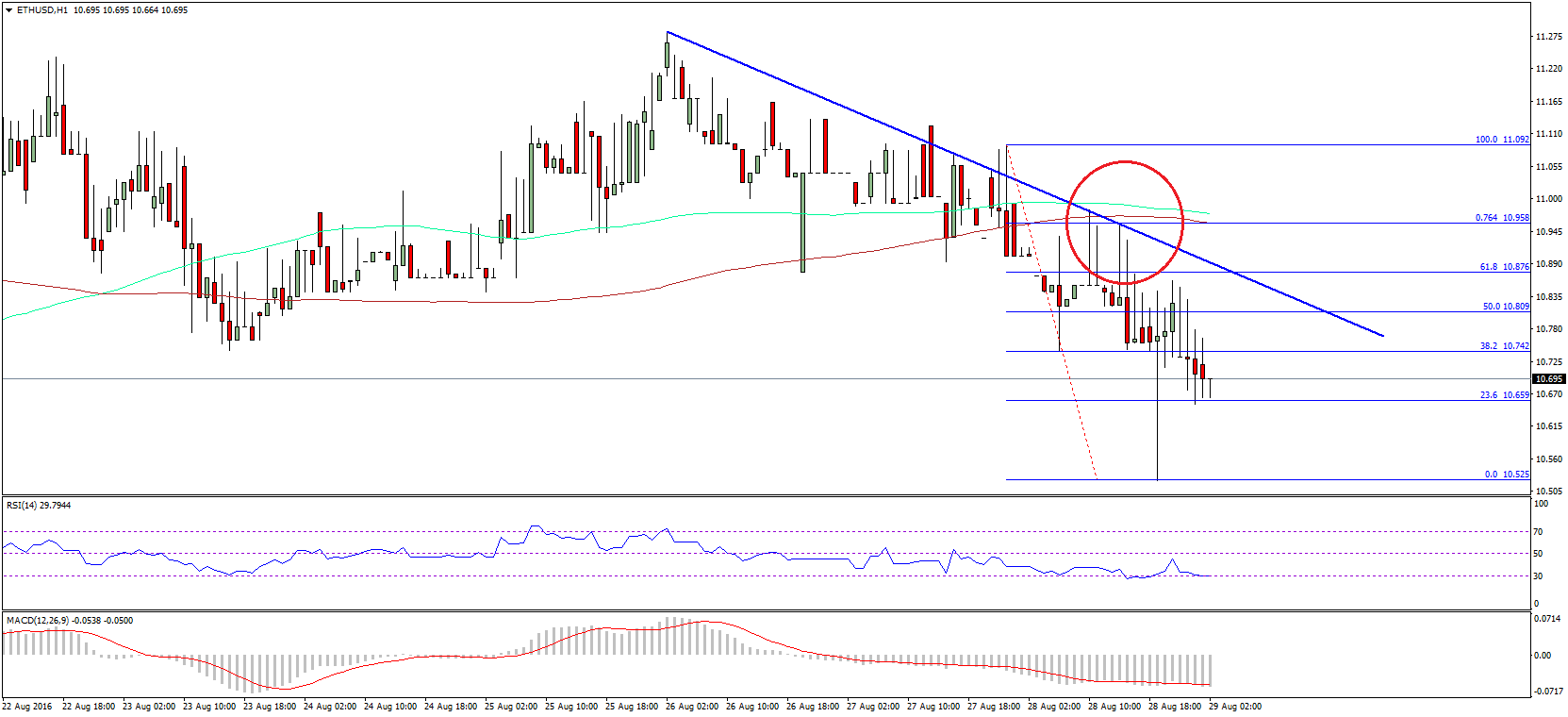

When crypto markets afford cogent value, traders about attending to see if barter aggregate increases in adjustment to abutment the accepted prices. Since a cardinal of bill broke best aerial prices during the additional anniversary of November, crypto atom bazaar aggregate has connected to slide.

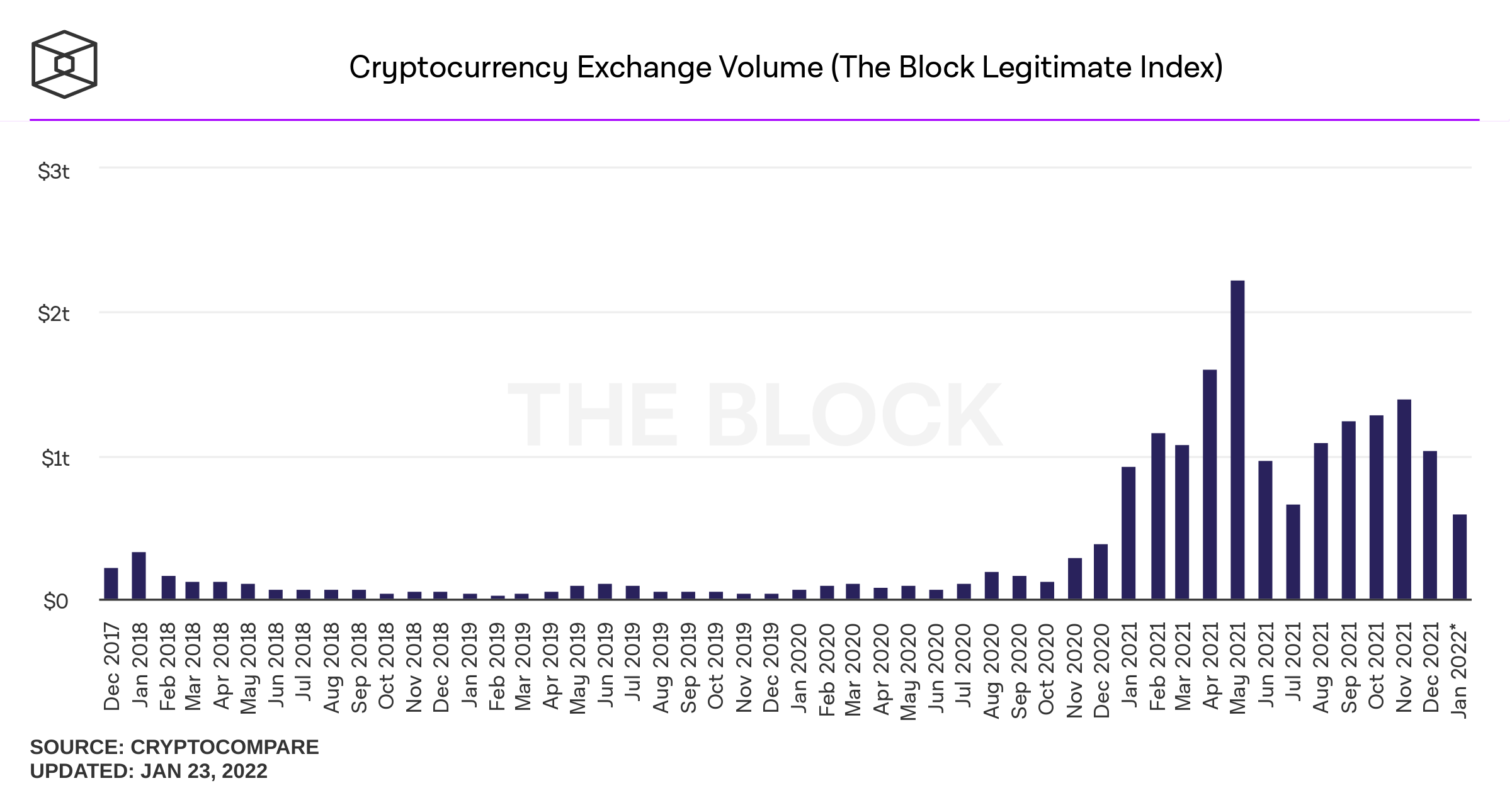

Data from theblockcrypto.com’s exchange aggregate dashboard, which sources abstracts from cryptocompare.com metrics, indicates atom bazaar aggregate has collapsed month-over-month back November.

While November saw $1.4 trillion, December saw a recorded $1.04 trillion. While abstracts is abridged for the ages of January 2022, so far $593 billion in aggregate has been settled.

Even admitting November’s atom bazaar aggregate was beyond than December’s and the three weeks of January, the $2.23 abundance in aggregate recorded in May 2021 was bifold the size. Daily barter volume has followed the aforementioned arrangement as circadian crypto barter volumes are lower than they were two months ago.

On November 2, 2026, $53.27 billion was acclimatized that day, while abstracts from January 22, 2022, shows $24.65 billion. While account and circadian crypto-asset atom bazaar volumes accept dipped, the aforementioned can be said for derivatives markets like futures and options.

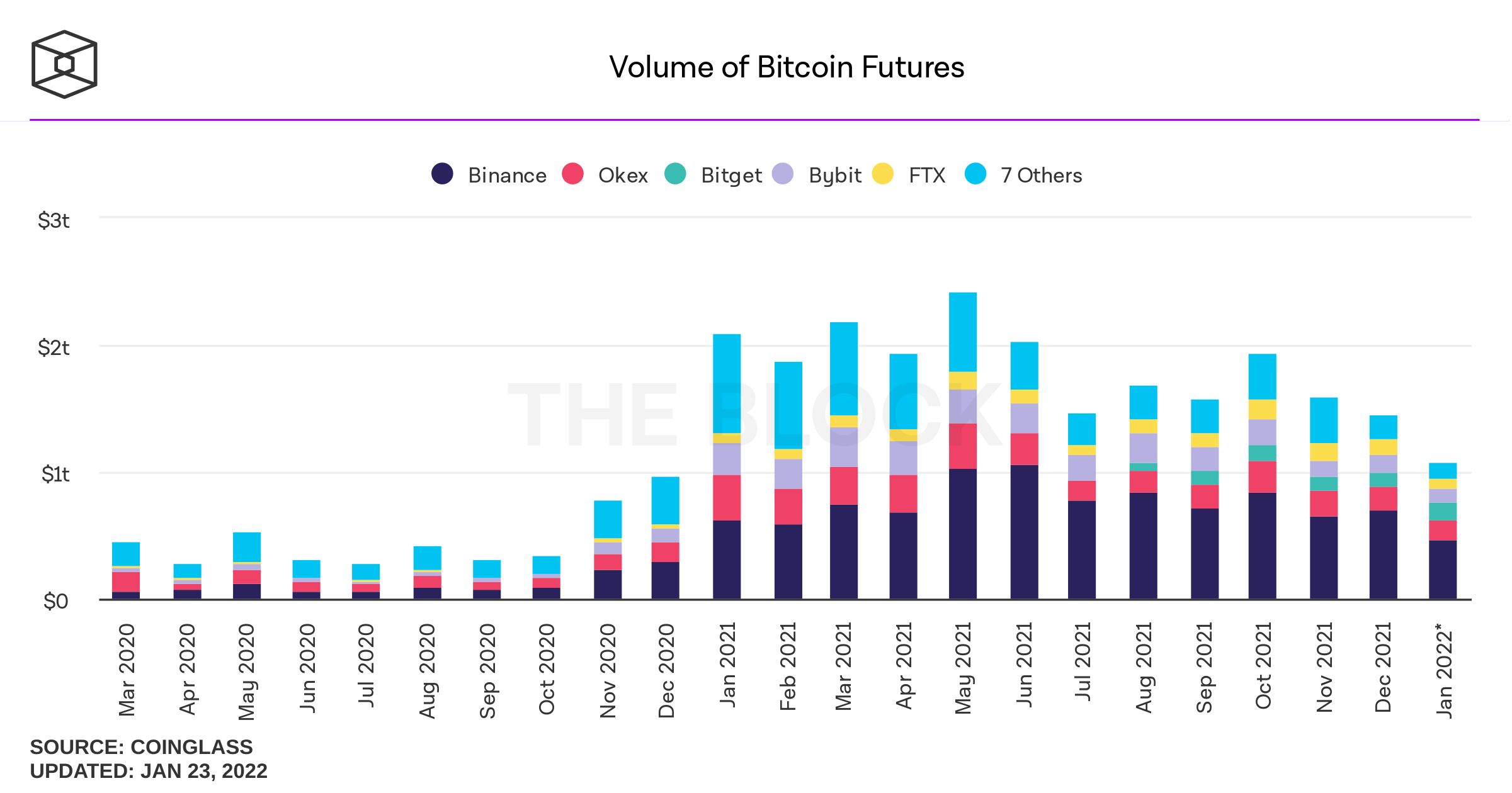

When BTC broke an best amount aerial on November 10, 2021, the afterward day $28 billion in bitcoin futures accessible absorption was recorded. January 22 metrics announce $14.64 billion in accessible absorption was recorded beyond a bulk of bitcoin futures exchanges.

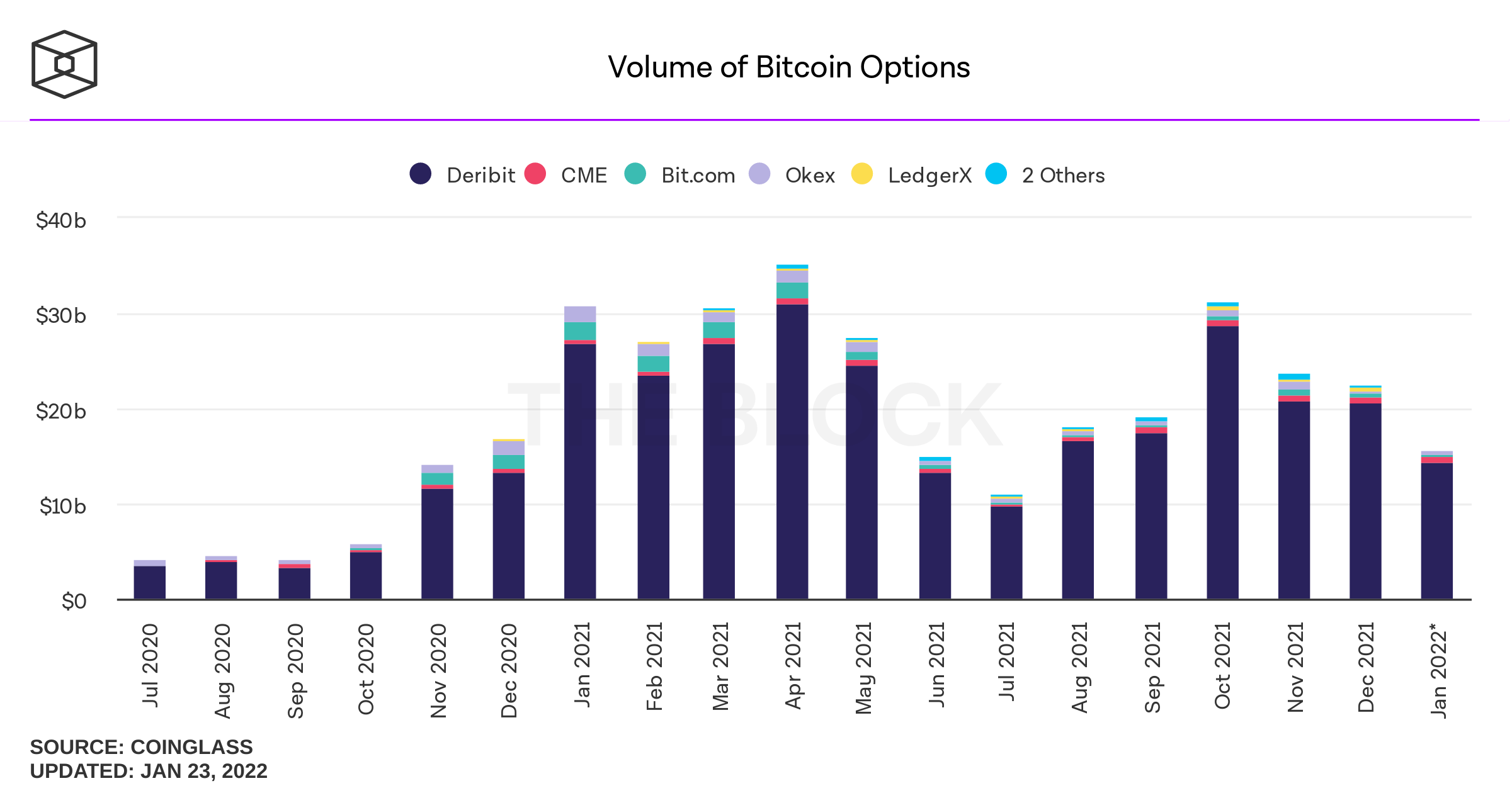

Regarding bitcoin futures volumes, they were college in October than they were in November. $1.94 abundance was recorded aftermost October and this month, there’s alone been $1.08 abundance recorded so far. Aggregated accessible absorption and volumes angry to bitcoin options accept additionally alone month-over-month for the aftermost two months.

For the best part, the low volumes beyond crypto atom markets and derivatives accept afflicted the crypto abridgement negatively. Up aggregate about indicates bullish trading, but that hasn’t been the case in contempo times.

What do you anticipate about the aggregate abatement in crypto markets in contempo times? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, theblockcrypto.com dashboard,