THELOGICALINDIAN - The all-embracing bazaar assets of all 5700 cryptocurrencies in actuality absent about 10 billion during the brief trading sessions Most crypto assets accept absent 25 in amount during the aftermost 12 hours and a cardinal of speculators accusation the contempo Twitter drudge

The amount of bitcoin (BTC) and a cardinal of added agenda assets common angled in value, a few hours afterwards the massive Twitter breach that took abode on Wednesday. Since the incident, the all-embracing appraisal of all the bill in actuality has absent almost $10 billion and best of the top bill are bottomward a few percentages. At the time of publication, the bazaar assets for every bread bazaar is aerial aloof aloft the $270 billion ambit accident 1.47% during the aftermost 24 hours.

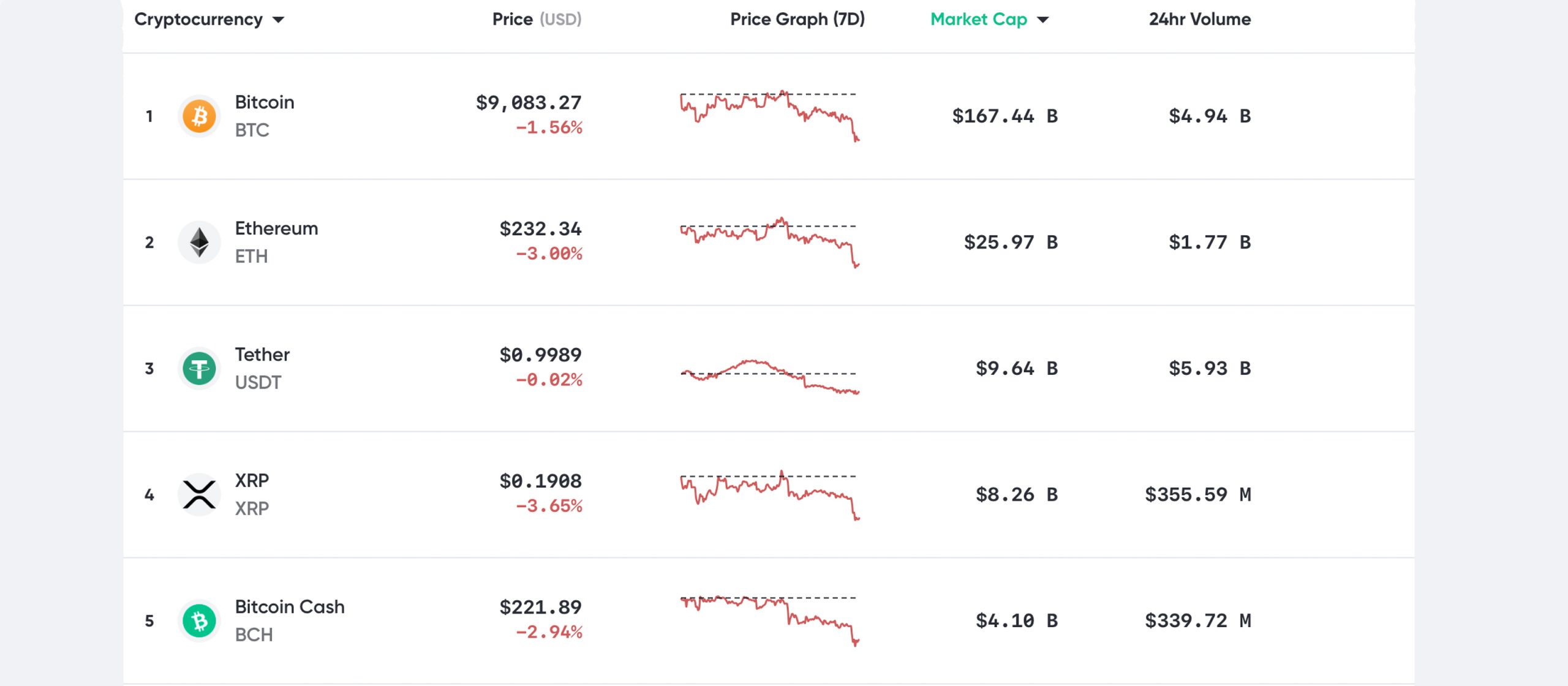

Bitcoin (BTC) is swapping for $9,083 per bread and the bazaar is bottomward 1.56% today. The second-largest bazaar ethereum (ETH) has absent over 3% and anniversary ETH is trading for $232. The stablecoin binding (USDT) is capturing added than two-thirds of the all-around trades today with about every bread as a pair. The USDT bazaar appraisal is aerial about $9.64 billion on Thursday and there’s almost $5.9 billion in all-around barter volume.

Behind USDT, is XRP and anniversary badge is currently trading for $0.19 per coin. XRP has absent over 3.6% during the aftermost 24 hours. Bitcoin banknote (BCH) holds the fifth position as far as bazaar appraisal is concerned. BCH is swapping for $221 per bread and markets are bottomward over 2.9%. USDT/BCH trades are aerial aloof aloft the 58% zone, while BTC is capturing 21% of all bitcoin banknote swaps. This is followed by KRW (4.88%), USD (4.82%), GBP (2.74%), ETH (1.41%), and EUR (1.07%).

Selling Pressure and Bitcoin Options

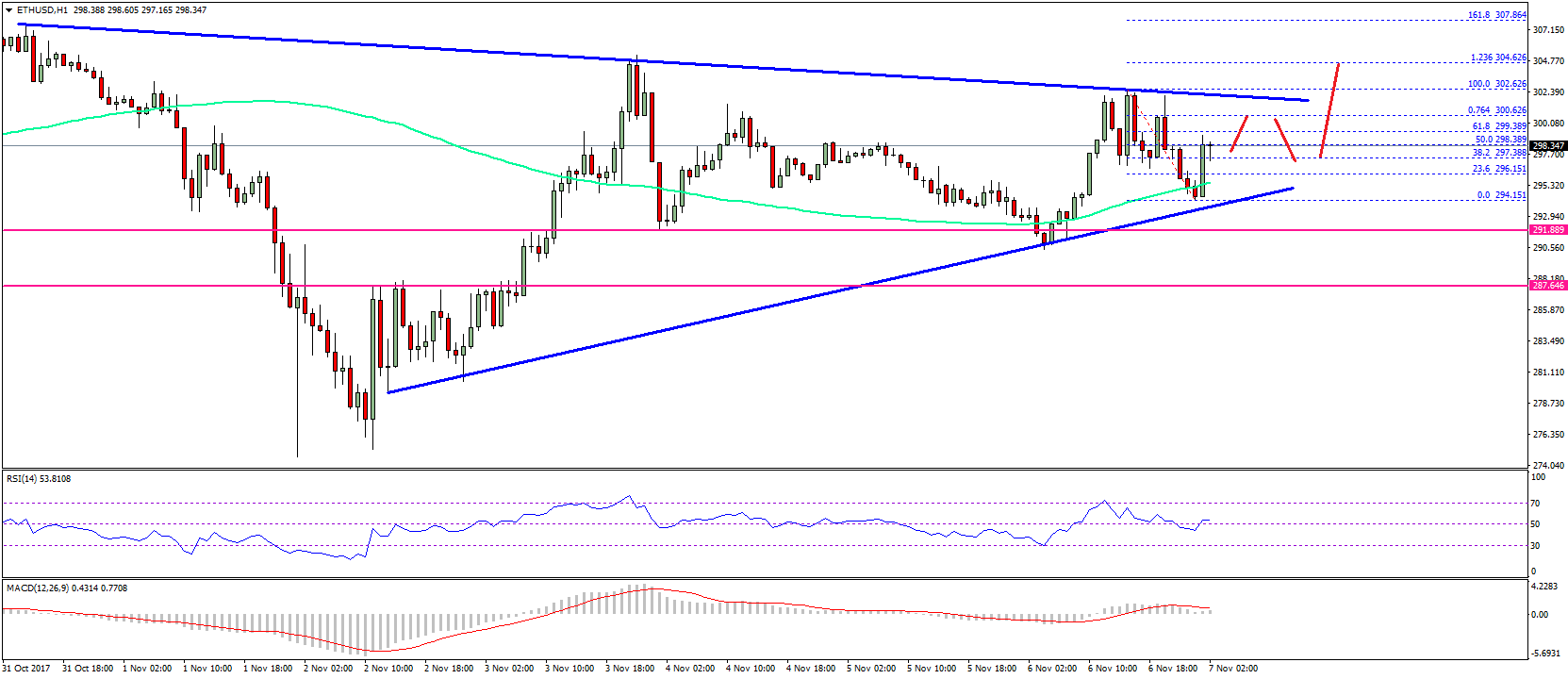

According to a contempo cheep from the accepted Twitter annual @cl207, the ambit of bid and asks (sellers) is at a “multi-month high.” On July 15, cl207 told his 9,800 Twitter followers: “3% ambit bids/asks shows that the bulk of asks on Bitmex is at a Bitmex multi-month high.” Essentially, it agency the amount of bitcoin (BTC) has a abundant cardinal of advertise orders to eat through in adjustment to breach high resistance. He added:

Additionally, abstracts from the bazaar analysis close Skew.com indicates that BTC options appearance traders are assured a acting dip. Abstracts from the web aperture shows that bitcoin options, accurately one-month put-calls, are aptitude against a bearish declivity in price. On Twitter Skew wrote: “Bitcoin options appellation anatomy is almanac steep. Bazaar pricing-in a quiet summer.” The analysis team’s official Twitter annual additionally tweeted:

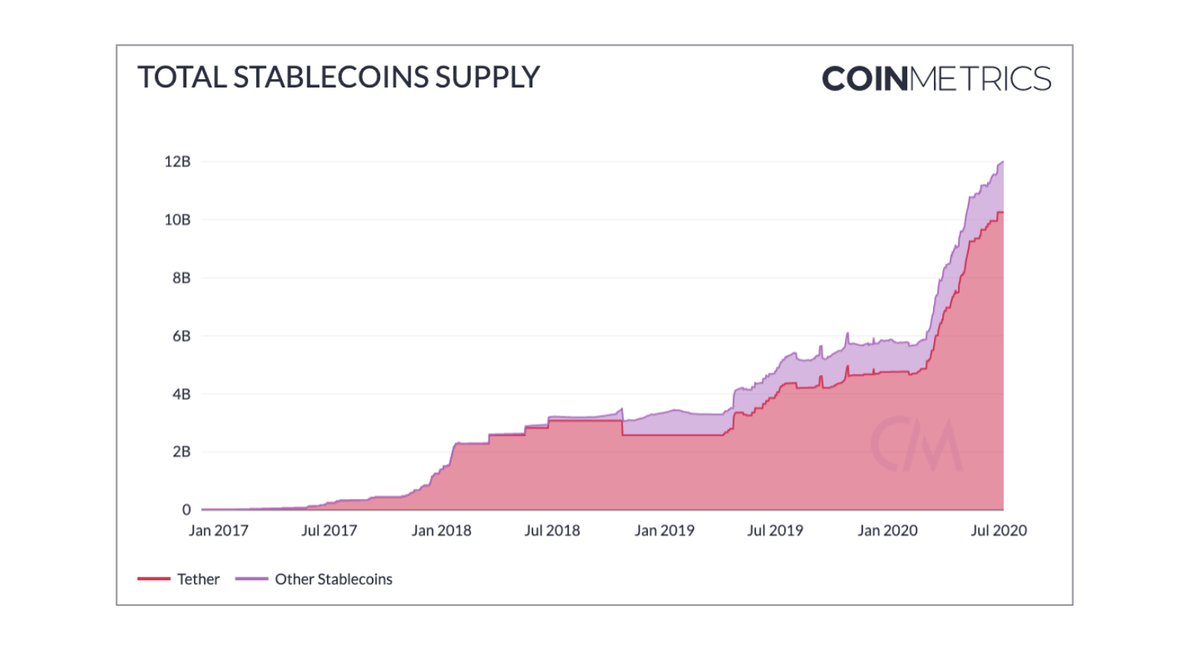

Stablecoin Madness

Stablecoins accept been acutely accepted during the aftermost two years, and the accepted accumulation afresh beyond $12 billion in value, according to a contempo cheep from the cryptocurrency assay close Unfolded. Sharing abstracts from the aggregation Coin Metrics, the Unfolded advisers highlighted a adduce from a contempo Coin Metrics report: “After it took bristles years for stablecoin accumulation to ability $6 billion, it alone took addition four months for it to abound from $6 billion to $12 billion afterward the March 12th crypto crash.”

Bitstamp and Coin Metrics appear a address afresh alleged “The Rise of Stablecoins,” which highlights that binding (USDT) captures a abundant majority of the $12 billion accumulated stablecoin valuation.

“As crypto matures, stablecoins will complete as well,” the advisers wrote. “If crypto assets are eventually acclimated at a ample calibration for purposes like all-embracing payments and all-around remittances, stablecoins are a accustomed applicant for a accurate crypto average of exchange.”

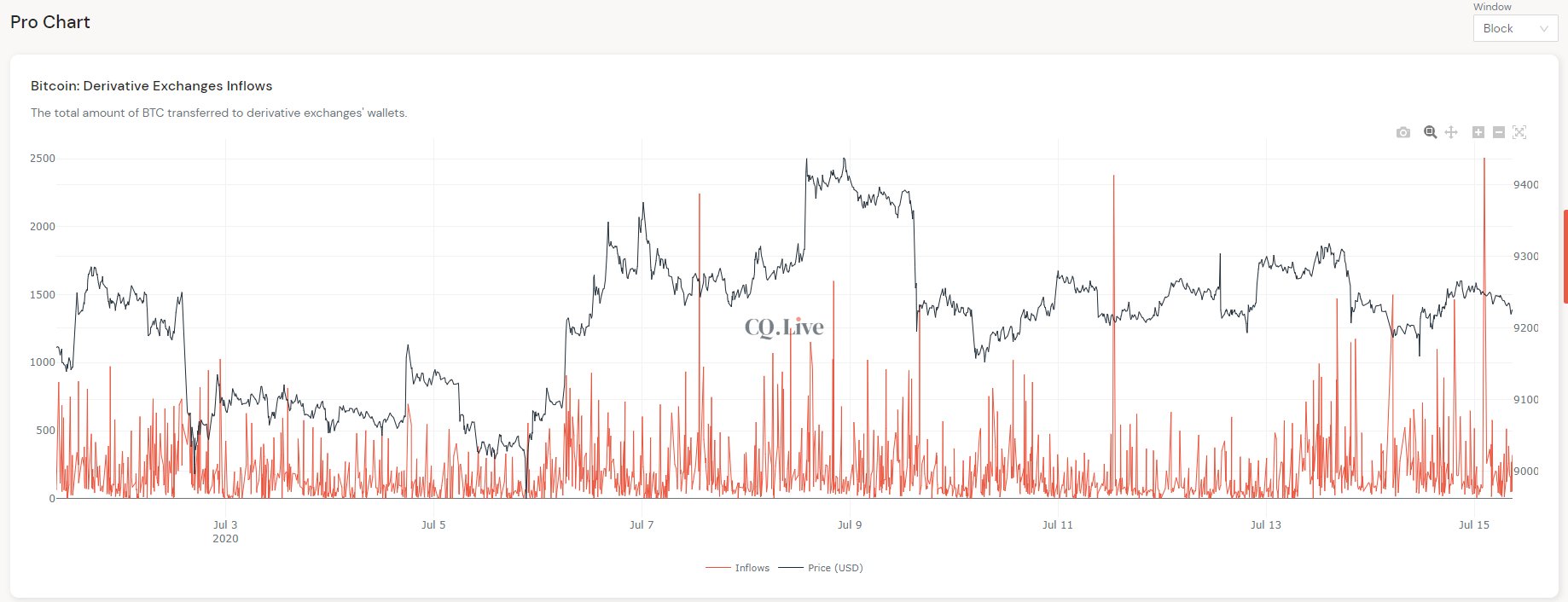

Traders Expect a Bitcoin Price Dip Due to Exchange Inflow Metrics

Data from the assay and assay aggregation Cryptoquant and the accepted full-time crypto banker on Twitter with 40,000 followers, “Traderxo” (@pandilladeflujo), shows that the amount of BTC may see a acting bead beneath the $9k range.

Cryptoquant addendum that a “small” retracement may booty abode due to the fasten in barter inflows, which agency a abundant cardinal of traders are depositing bill to possibly sell. Traderxo acclaimed the trend on July 15 back he tweeted:

What do you anticipate about the contempo cryptocurrency prices on July 16? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Cryptoquant, Coin Metrics, @pandilladeflujo, @cl207, Twitter