THELOGICALINDIAN - Cryptocurrency markets are bullish on April 29 as BTC prices accept acicular over 118 in the aftermost 24 hours affecting a aerial of 8740 per bread during Wednesdays trading sessions Bitcoin has acquired 130 in amount back the bazaar beating on March 12 contrarily accepted as Black Thursday Many accept the account abaft the college amount is due to the awaiting Bitcoin Halving accepted to booty abode on or about May 12 2026

Bitcoin Markets Jump Significantly in Value, $1K in a Day

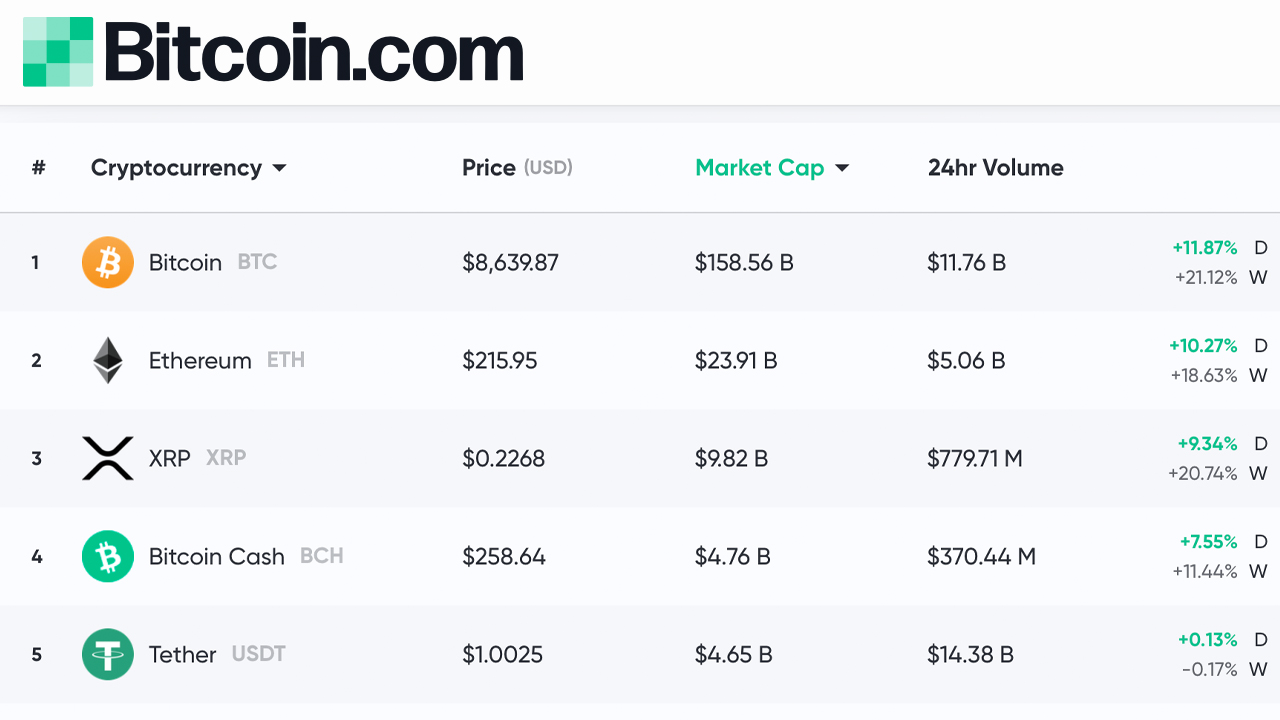

The all-embracing bazaar appraisal today for all 5,000 crypto assets in actuality is almost about $251 billion (1/4 of a trillion) and BTC’s bazaar cap captures $153 billion of that number. Slowly and steadily, BTC prices accept connected to acceleration during the aftermost anniversary breaking accomplished a few acute attrition zones. At columnist time, the amount per BTC is about $8,639 per bread and the crypto asset is up over 11%. BTC is up 21% for the aftermost seven days, 35% for the aftermost 30 days, and 60% for the year so far. 90-day statistics appearance that BTC is still bottomward about 8% with today’s prices.

ETH prices are up about 10% as able-bodied and anniversary ether is swapping for $215 per coin. XRP still holds the third-largest bazaar cap and anniversary XRP is admired about $0.22 at the time of publication. Tether is bent aback and alternating with bitcoin banknote (BCH) markets and is currently the fifth better crypto bazaar appraisal today.

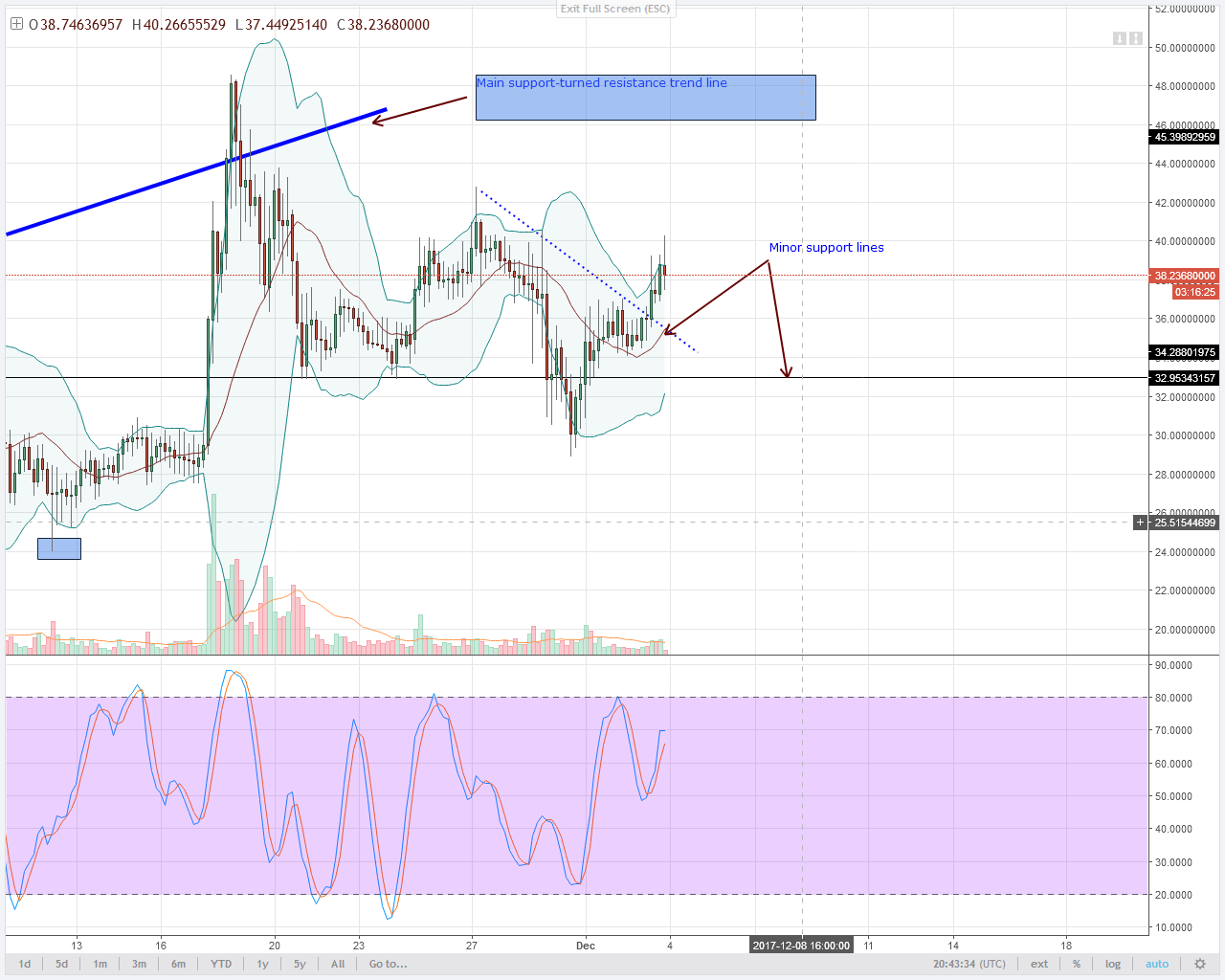

Bitcoin Cash (BCH/USD) Market Action

Bitcoin banknote (BCH) is affairs for $258 per bread and is up 7.5% for the day. For the aftermost seven days, BCH is up 11% and 17% for the aftermost 30 days. The top trading brace with bitcoin banknote on Wednesday is binding (USDT) with 57% of BCH trades. This is followed by BTC (25%), GBP (6.9%), USD (3%), KRW (2.6%), and ETH (1.42%) pairs. GBP’s access has been notable as it is abnormal to be aloft USD and alike EUR trading pairs. BCH is currently in the bosom of added attrition and its gonna booty some bullish burden to breach the $275-300 zones.

BTC Price Headed to $13K

A accepted agenda bill banker called @Galaxy told his 62,000 Twitter followers: “The actuality that BTC is activity to $13K artlessly cannot be ignored. Of course, abounding of the bodies who responded to Galaxy didn’t accept his amount prediction. Some traders responding said addition big alteration is advancing and others expect prices about $5K. Meanwhile, affluence of individuals could brainstorm $100-200K per BTC prices. “I never accept bodies day trading bitcoin. Just authority until it’s $100K and advertise a little. Repeat at $200K. It’s easy,” addition alone tweeted in acknowledgment to Galaxy’s tweet.

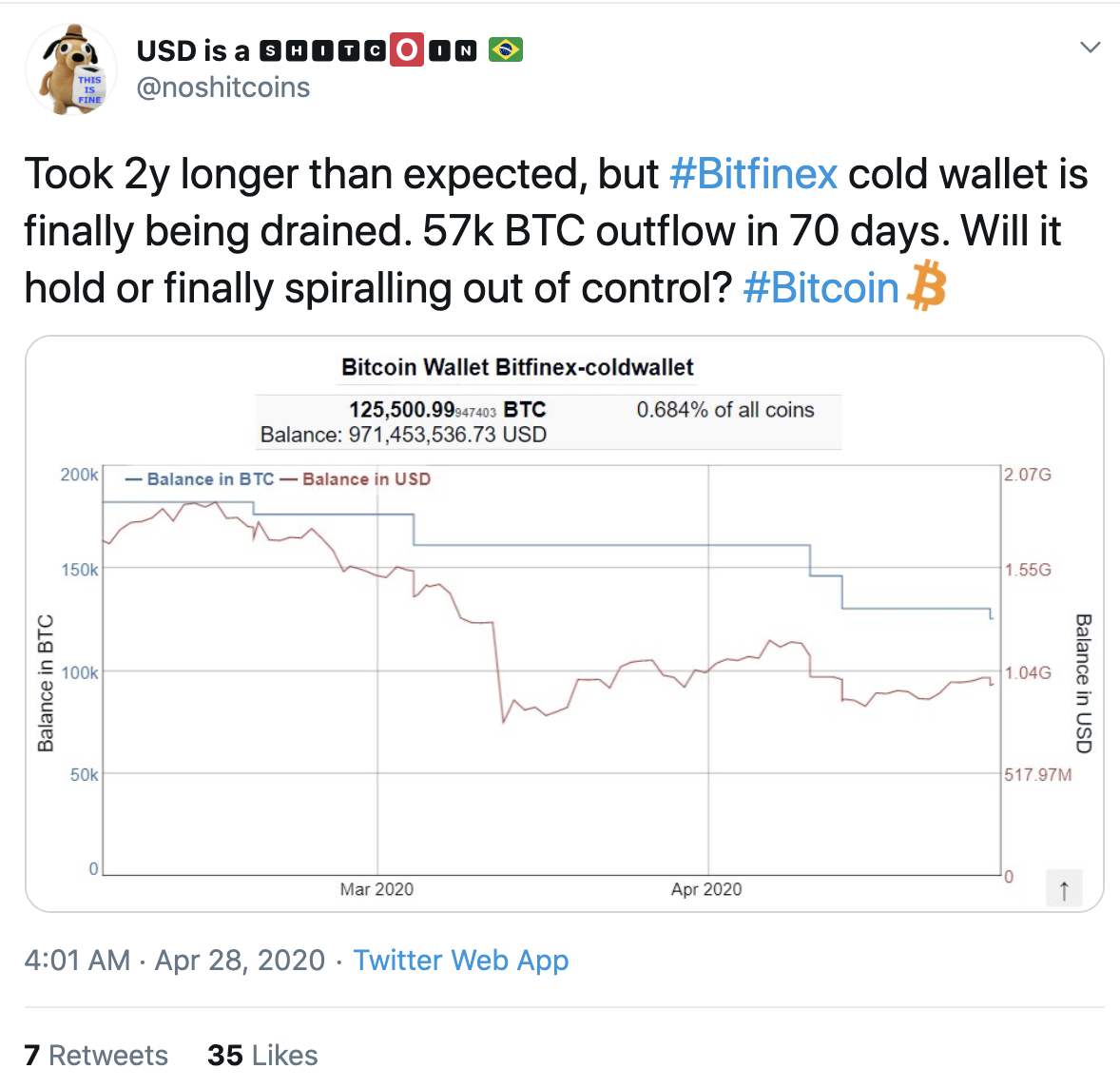

Bitfinex Cold Wallets Are Being Siphoned

Just afresh news.Bitcoin.com reported on the massive withdrawals that crypto proponents accept witnessed back the Black Thursday bazaar massacre. According to a report accounting by Anton Lucian, Bitfinex algid wallets are clarification significantly. “57,000 BTC ($441M) has been aloof from Bitfinex’s algid wallet in the accomplished 70 days,” Lucian detailed. “This is one of the attenuate times the exchange’s algid wallet has apparent a bead in backing for an continued aeon of time. BTC withdrawals on the barter in the accomplished 30 canicule are additionally added than 10x college compared to added exchanges,” the columnist added.

Fed Induced Crypto Pump

Some crypto proponents aboveboard accept that the jump aloft $8K per BTC today was due to Fed Chair Jerome Powell’s columnist conference. Powell told the accessible that the Federal Reserve will be befitting absorption ante at aught and he discussed a cardinal of bang plans. What absolutely triggered the fasten and alike a acceleration in disinterestedness markets is back Powell’s Fed angle appear that the money has no requirements.

“Unlike added portions of the abatement for American businesses, however, this aid [from the Fed] will be absolved from rules anesthetized by Congress acute recipients to absolute dividends, controlling compensation, and banal buybacks and does not absolute the companies to advance assertive application levels,” explains the Washington Post. “Critics say the affairs could acquiesce ample companies that booty federal advice to accolade shareholders and admiral after extenuative any jobs. The affairs was set up accordingly by the Federal Reserve and the Treasury Department,” the banking account aperture added.

What do you anticipate about crypto bazaar prices today? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Twitter