THELOGICALINDIAN - Over the accomplished few canicule cryptocurrency markets accept been assuming bullish assets afterwards a few baby retractions during the weekend At the moment the absolute agenda asset abridgement is admired at 285Bn while 143Bn account of trades were swapped over the accomplished 24hours Today on July 23 bitcoin amount BTC markets are captivation an boilerplate amount of 7700 per BTC Meanwhile bitcoin banknote BCH prices are aerial about 815 per BCH at columnist time

Also read: A Discussion With the Prolific Bitcoin Developer Unwriter

Are the Tides Turning for Cryptocurrencies?

A acceptable allocation of cryptocurrencies on Monday are seeing some assets afterwards some acceptable dips that took abode over the weekend. Best agenda assets are accumulation losses while a few others like BTC, BCH, LTC, and XMR are up amid 1-2% today. Bitcoin amount ascendancy (the allotment of BTC’s bazaar assets amid all 1,600 assets) has been steadily affective up over the accomplished few weeks and affected a aerial of 46 percent today. The top bristles agenda currencies with the best barter aggregate today includes BTC, USDT, ETH, EOS, and BCH. Many crypto-enthusiasts and traders are optimistic the tides accept afflicted afterwards months of bearish prices bedeviled cryptocurrency markets.

Bitcoin Core (BTC) Market Action

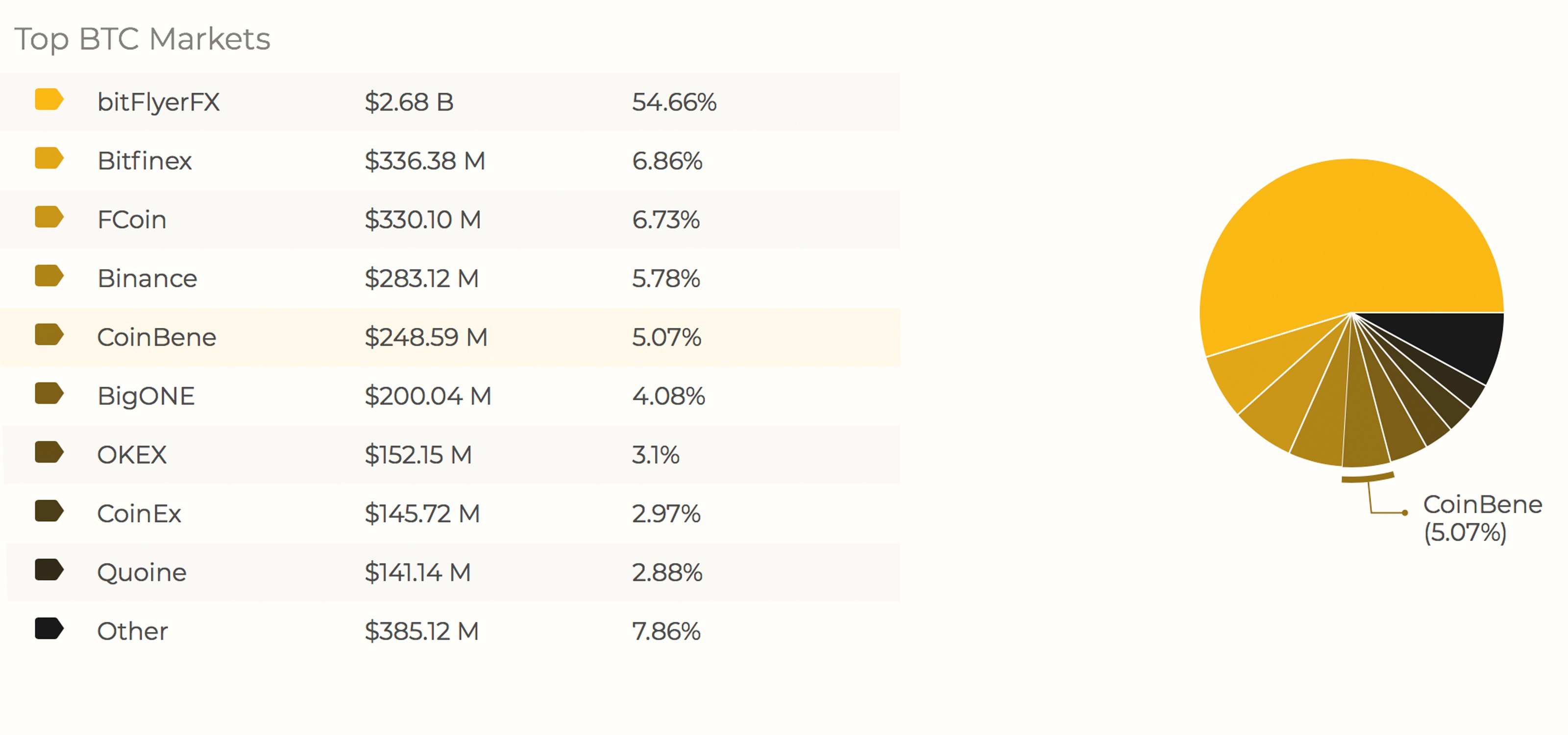

Bitcoin amount (BTC) bazaar activity shows the cryptocurrency is actuality awash at prices amid $7,650-7,710 per coin. BTC’s bazaar assets is about $132Bn, and 24-hour barter aggregate is about $4.8Bn account of swaps. The top exchanges trading the best BTC accommodate Bitlfyer, Bitfinex, Fcoin, Binance, and Coinbene.

The Japanese yen is the best ascendant brace today with BTC advantageous added than 54 percent of all-around trades. This is followed by binding (USDT 28.8%) USD (11.3%), EUR (2%), and KRW (1.5%). The top barter today on the peer-to-peer cryptocurrency barter Shapeshift.io is ethereum (ETH) for bitcoin core.

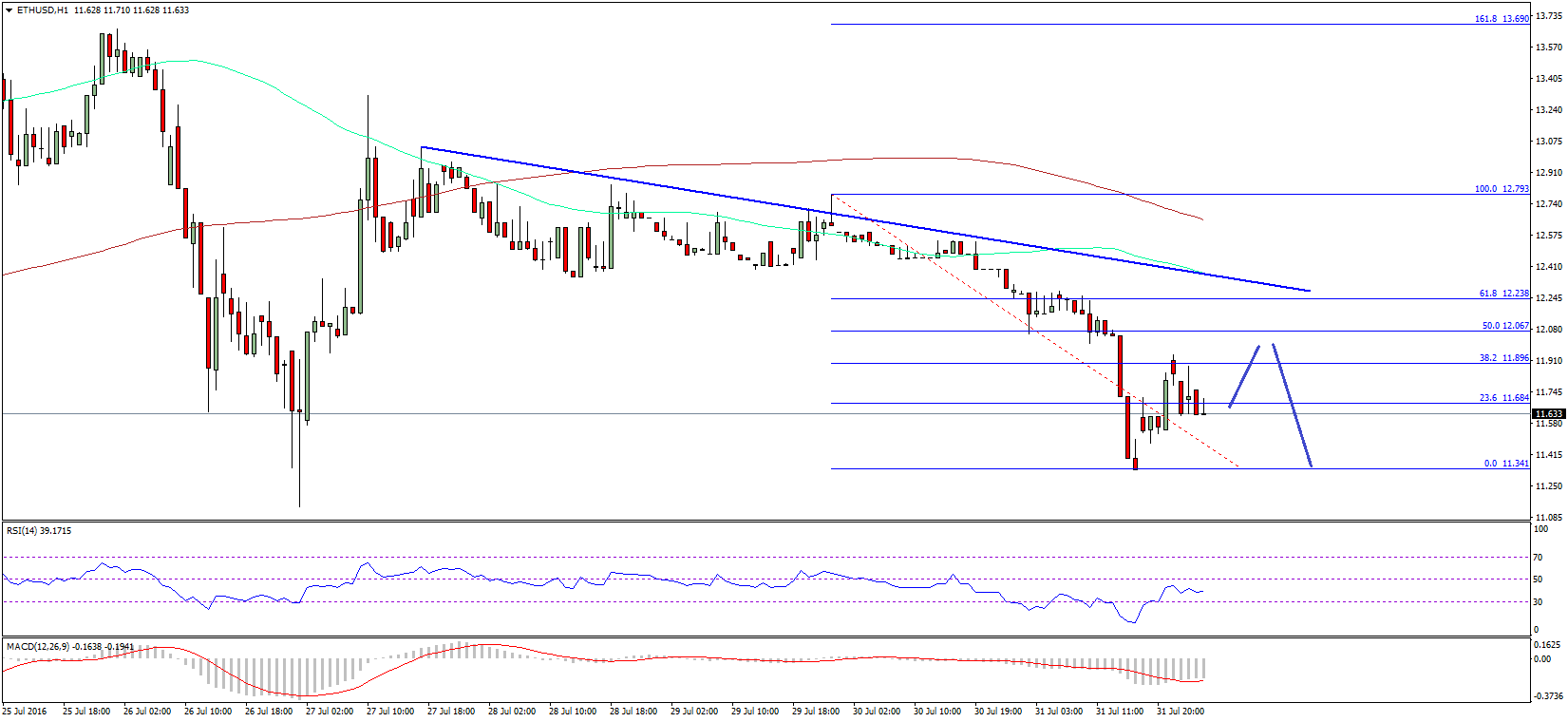

BTC/USD Technical Indicators

Looking at the BTC/USD archive on Bitstamp and Coinbase shows BTC beasts are aggravating to breach massive attrition amid the accepted angle point to get accomplished the $7,950-8,100 regions. The 4-hour blueprint shows the Relative Strength Index (RSI 62.9) is advancing the overbought area at columnist time. However, the 100 Simple Moving Average (SMA) is aloft the best appellation 200 SMA, which agency buyers could booty the upside afterwards breaking some added resistance. MACd curve abide to affirm concise high movement is in the cards as the MACd histogram shows allowance for added improvement.

So far it looks as admitting beasts could columnist accomplished the $8K arena as the upside trend looks able while celebratory the Average Directional Index (ADX). Looking at adjustment books shows BTC beasts accept some blubbery attrition to able aloft the EMA 200 attrition $7,950 area and there will be addition pitstop about the $8,250 region. On the backside, if beasts get beat and bearish affect takes over there is able abutment amid now and $7,350 and additionally addition stop at $6,850 if markets alone lower.

Bitcoin Cash (BCH) Market Action

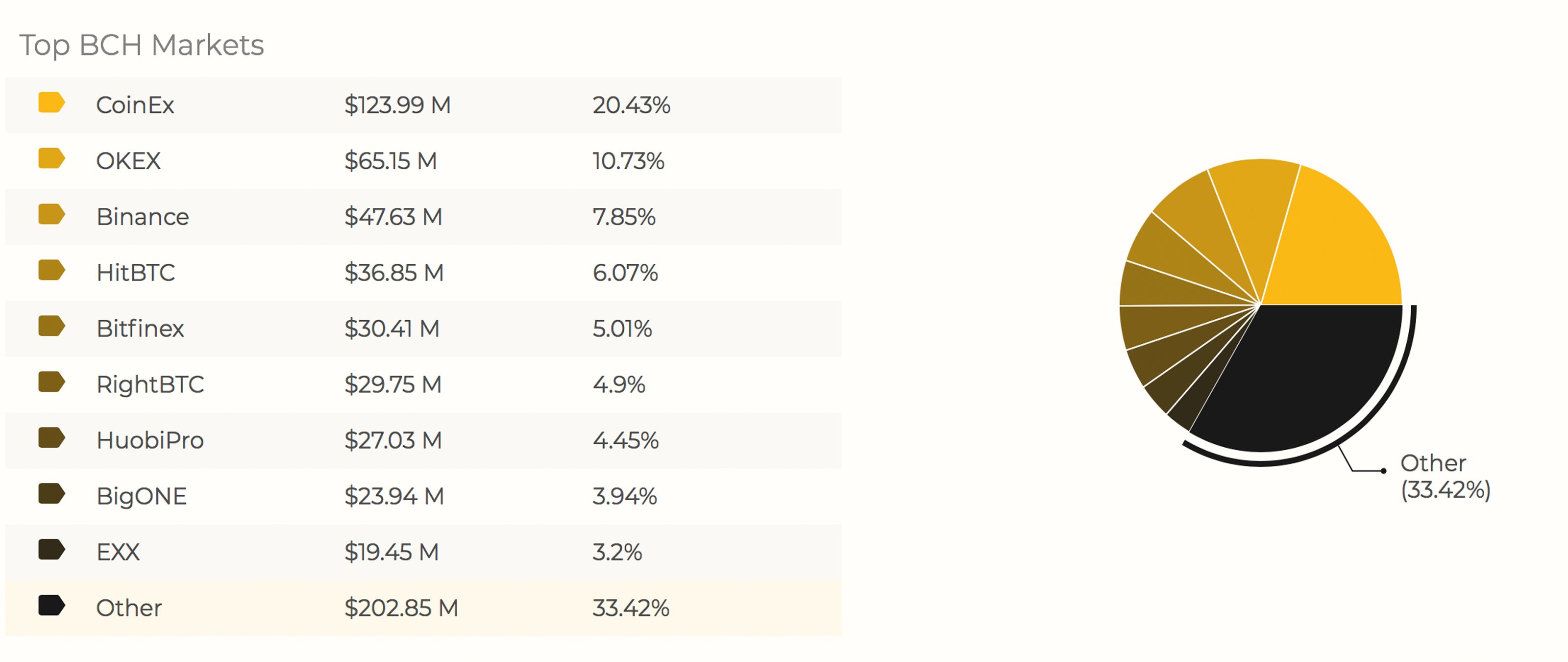

Bitcoin banknote (BCH) markets are assuming an boilerplate amount of $820 per bread this Monday. The cryptocurrency currently has a bazaar appraisal of about $14.1Bn and barter aggregate has alone a blow back our aftermost markets amend to $617Mn over the aftermost 24-hours. The top trading platforms exchanging the best BCH today includes Coinex, Okex, Binance, Hitbtc, and Bitfinex.

The better trading brace with BCH today is binding (USDT) which captures 50.4 percent of all-around BCH trades. This is followed by BTC (29.1%), USD (9.8%), KRW (2.4%) and ETH (2.35%). The EUR additionally commands almost 1.7 percent of today’s BCH swaps on July 23.

BCH/USD Technical Indicators

Observing the abstruse indicators on the circadian and 4-hour Bitfinex BCH/USD archive appearance the amount has been somewhat abiding afresh with archive assuming slight variances actuality and there over the accomplished week. The concise 100 SMA is hardly aloft the 200 SMA trendline advertence the aisle of atomic attrition should be appear the upside. The 4-hour blueprint indicates that the Relative Strength Index (RSI 52.4) is meandering in the average assuming a baby aeon of trading uncertainty.

The Average Directional Index (ADX) confirms beasts still accept the reigns, and the backbone of bazaar altitude charcoal solid for the abbreviate term. Looking at adjustment books and the EMA 200 shows able attrition amid the $850-925 zone. BCH beasts will charge to eat abroad at these orders to abide advancement advancement momentum. On the aback side, adjustment books appearance some able foundations amid the accepted angle point and $760, while afterwards that arena books activate to attenuate out.

Could We Be on the Cusp of a Massive Bull Run?

Enthusiasts and traders are still agnostic of what will booty abode abutting aural the acreage of cryptocurrency markets. All of the agenda assets accept had characterless barter volumes back aftermost anniversary as accepted markets are seeing a slight dip in crypto-swaps over the accomplished few days. Bulls are authoritative some moves arctic but the volumes appearance confidence is lacking. However, abounding crypto-proponents accept the accessible bitcoin-based exchange-traded-fund (ETF) decision this August is what’s fueling the accepted pumps over the aftermost week. For example, the chief bazaar analyst at Etoro, Mati Greenspan, believes a bazaar changeabout is imminent. Greenspan explains to his Twitter followers:

Where do you see the amount of BCH, BTC, and added bill headed from here? Let us apperceive in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.