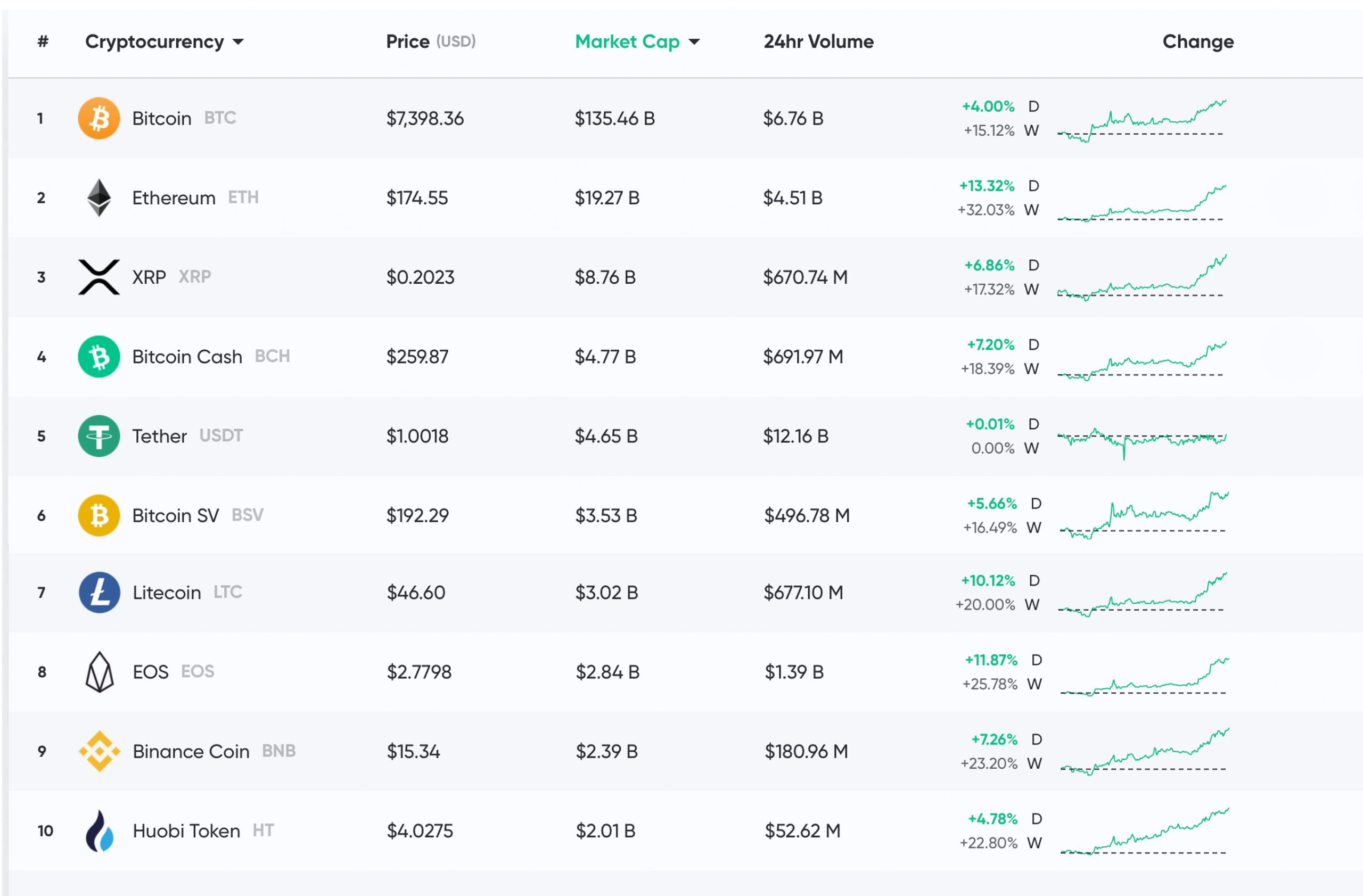

THELOGICALINDIAN - Digital bill markets accept been ascent afresh as the absolute bazaar assets of all 5000 bill has jumped aloft the 200 billion mark The access in crypto barter aggregate and bread ethics has followed alongside the accretion acceptable disinterestedness markets saw on Monday On Tuesday best of the agenda assets in the top ten are up amid 414 and crypto barter volumes accept angled in the aftermost 24 hours

Also read: Hyperbitcoinization: Visions of Bitcoin Fueling the Post Covid-19 Shadow Economy

Top Ten Crypto Assets Gain 4-14% in the Last 24 Hours

During the aftermost few weeks, agenda bill proponents and crypto traders accept been apprehensive what will appear to bitcoin and the bulk of added bill in the crypto industry. For instance, the absolute cryptocurrency bazaar assets absent a whopping $44 billion on March 12, 2020, contrarily accepted as ‘Black Thursday.’ BTC prices alone to a low of $3,870 on March 12. The afterward day, BTC regained some of the losses back it was aerial amid $5,300-5,600 per bread on March 13.

Since then, BTC has acquired 30% back the low and on April 7, prices are currently meandering amid $7,300-$7,425 during Tuesday morning’s trading sessions. BTC has acquired about 4% in the aftermost 24 hours and the bread is up 15% for the week. Ethereum is priced about $174 per ETH and has acquired 13.3% today. Behind ETH is XRP, which is swapping for $0.20 per bread as XRP markets are up by 6.8%.

Bitcoin Cash (BCH/USD) Market Action

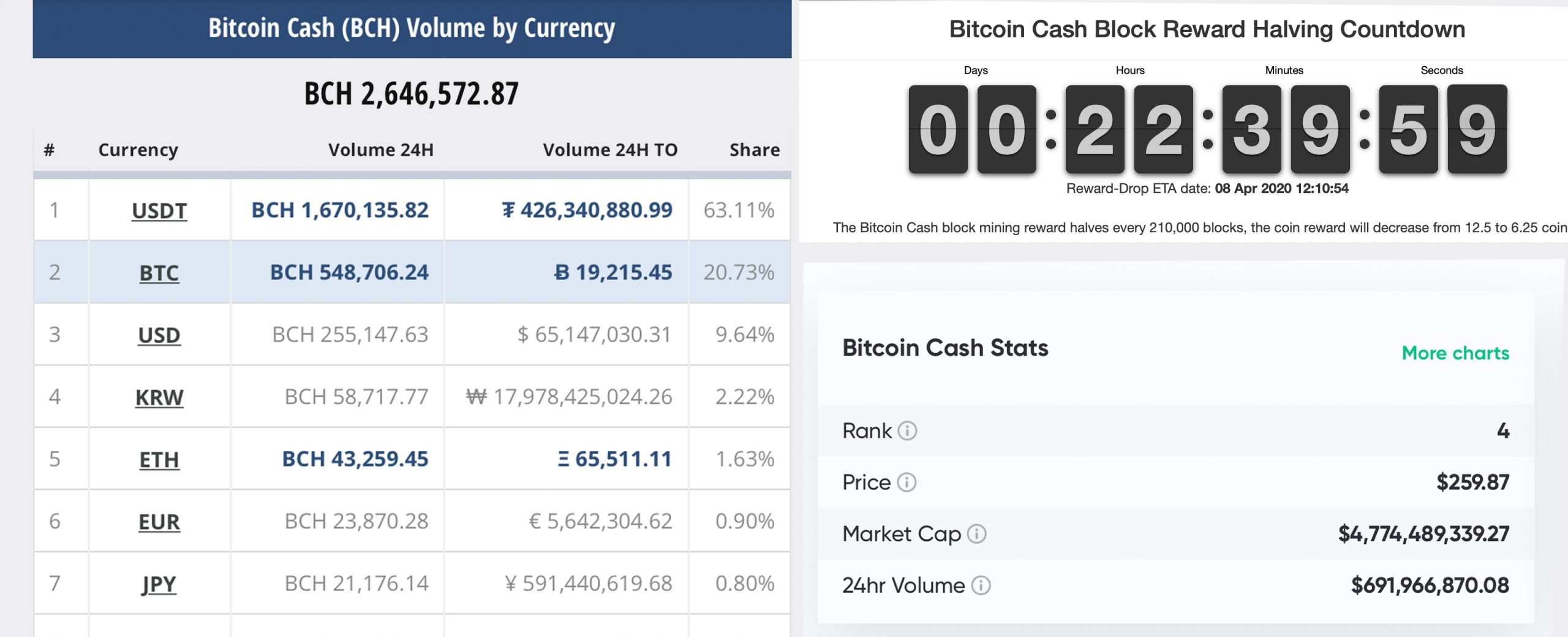

Bitcoin banknote (BCH) is trading for $259 per bread today and has acquired 7.2% in the aftermost 24 hours. BCH is up 18% for the anniversary and has additionally acquired 8.5% during the aftermost 90 days. The top trading brace with BCH on Tuesday is binding (USDT), which is capturing about 63% of all BCH trades. This is followed by BTC (20.71%), USD (9.42%), KRW (2.19%), ETH (1.65%), EUR (0.91%), and JPY (0.82%).

Bitcoin banknote has a aqueous bazaar cap that’s aerial about $4.8 billion on Tuesday, and BCH is the fifth best barter crypto beneath EOS and aloft LTC. BCH appear barter aggregate is about $4.8 billion, but messari.io’s “real volume” statistics agenda it’s about $35 million. In 22 hours, BCH will be the aboriginal above SHA256 annex to acquaintance a halving. After April 8, BCH miners will go from accepting 12.5 bill per block to 6.25 BCH, additional transaction fees.

Digital Currency Market Prices ‘Buck the Trend’

Market analyst from Etoro, Simon Peters, acclaimed in a contempo investors’ address that aftermost week’s banking abstracts was far added awkward than this week’s changes. “Economic abstracts appear aftermost anniversary was worrying, to say the least,” Peters wrote. “Midweek abstracts absolute a bead in exports from big Asian economies, such as Japan and South Korea, hit disinterestedness markets globally, consistent in the S&P 500 and the FTSE 100 both bottomward considerably.” Peters remarked that cryptocurrency markets, however, accept managed to “buck the trend.”

“From a crypto asset point of view, however, both bitcoin and altcoins accept performed able-bodied during this difficult period,” the Etoro analyst added. “Bitcoin has been in a alliance phase, actual abiding in amid $6,000 and $7,000. There has been the odd spike, both to the upside and the downside, but overall, I am blessed with the bendability of the amount at the moment. With the Fed accustomed out its action of absolute quantitative easing, affairs assets larboard appropriate and center, I anticipate bitcoin is activity to be blame appear $7,500 in the abbreviate term.

Crypto Investors ‘Shrug Off Pessimism’

While BTC prices abide aloft the $7K arena and a bulk of added agenda assets chase suit, abounding bazaar strategists accept crypto investors are beneath worried. In aloof a week’s time, affect amid crypto traders and investors has afflicted from bearish to bullish. “[Bitcoin and cryptocurrency] purchases chase the signs of convalescent affect in the banal markets,” acclaimed Alex Kuptsikevich, Fxpro’s chief bazaar analyst. “As anon as accident assets alpha to allure appeal actively, institutional investors may additionally access their positions in the cryptocurrency,” Kuptsikevich added on Monday.

Additionally, Naeem Aslam the arch bazaar architect from Avatrade remarked that crypto investors are far added optimistic now. “Investors are shrugging off the pessimism,” Aslam wrote. However, Aslam said that covid-19 ability not be over so bound and the virus could accomplish it so “we could be in for a best aeon of recession.”

The Verdict: Post Covid-19 Uncertainty Remains

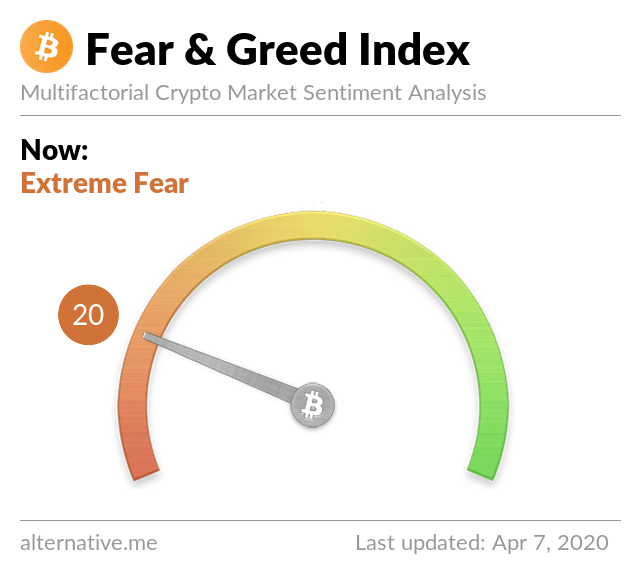

Overall agenda assets accept outshined U.S. banal markets and adored metals as well. The amount of BTC has surpassed the S&P 500’s assets and the blow of the top U.S. indexes. Back disinterestedness markets started assuming signs of recovery, gold has confused actual little and has alone acquired 2% back the alpha of the year. Despite amusing media and forums assuming a lot added optimism amid crypto investors, the multifactorial Crypto Fear & Greed Index (CFGI) shows “extreme fear” is still in the air.

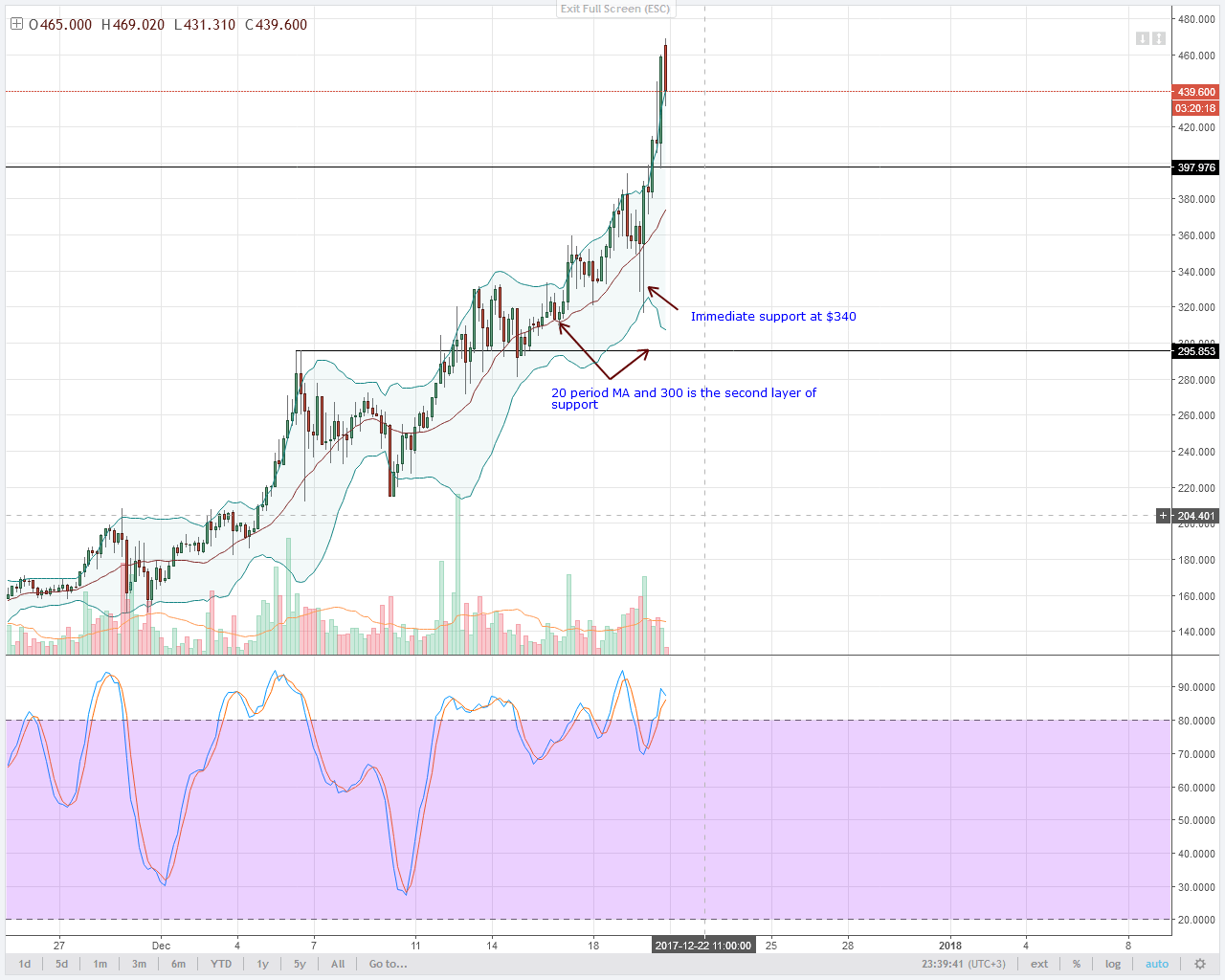

Traders accept that agenda currencies are accomplishing actual able-bodied but bread-and-butter uncertainty, in general, is clouding best people’s predictions. As far as BTC prices are anxious and a few added agenda asset values, key attrition has started to form. If crypto assets can’t breach these regions, again addition pullback could be in the cards. Despite the looming doubt, advisers accept that the acknowledgment to covid-19 from governments and axial banks will be a absolute access on crypto assets.

“We accept that the after appulse of the government’s budgetary and budgetary acknowledgment to the crisis will be acerb absolute for crypto,” Bitwise’s Global Head of Research Matt Hougan remarked in the firm’s April 2026 Investor Letter.

Where do you see the crypto markets branch from here? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, alternative.me