THELOGICALINDIAN - Deutsche Bank has conducted a analysis about banking bubbles Eightynine percent of respondents see some bubbles in banking markets with bitcoin abreast the acute balloon area However added respondents apprehend the cryptocurrency to bifold than they do Teslas stock

Deutsche Bank’s Bubble Survey

A analysis appear Tuesday by Deutsche Coffer asked 627 bazaar professionals to amount on a calibration of aught to 10 how they see banking bubbles in a ambit of assets. According to CNBC, the analysis was conducted amid Jan. 13 and Jan. 15. The coffer begin that 89% of analysis respondents currently see some bubbles in banking markets.

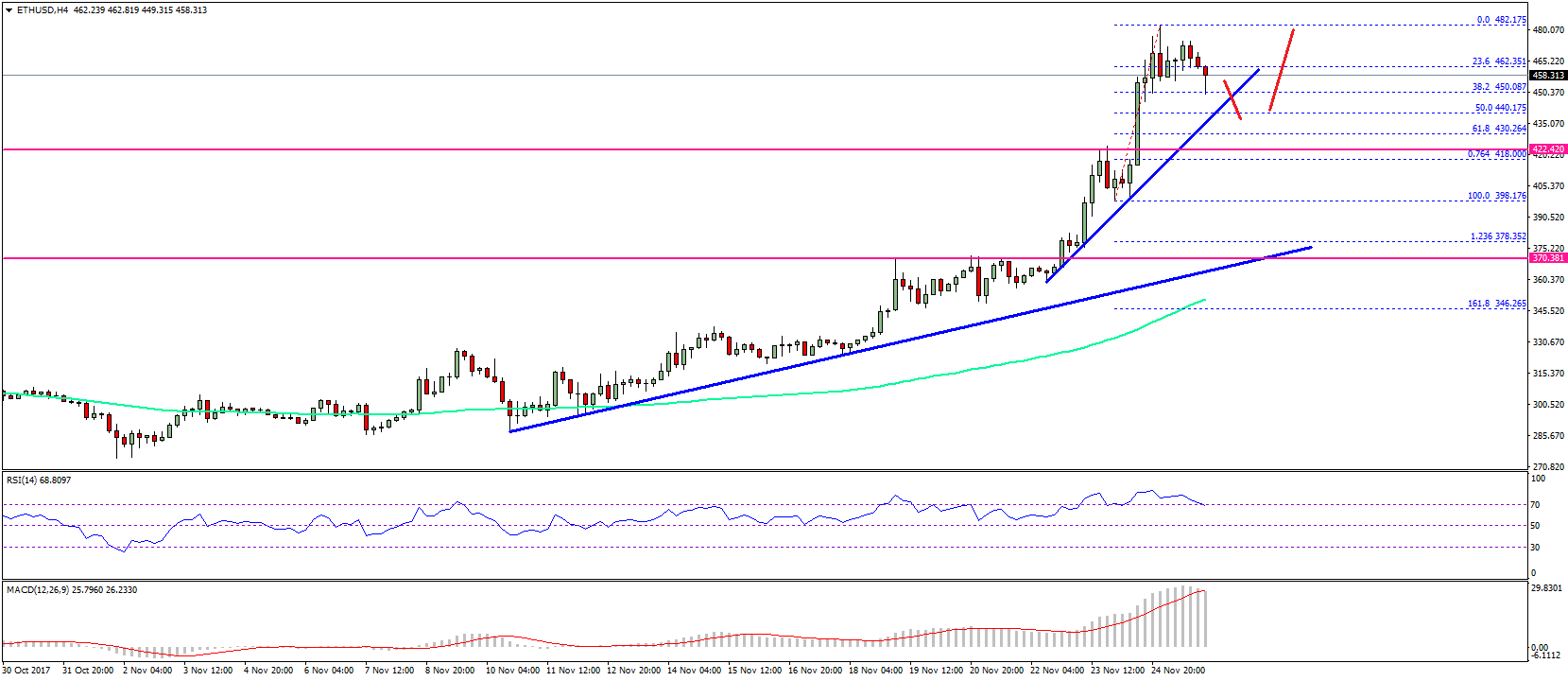

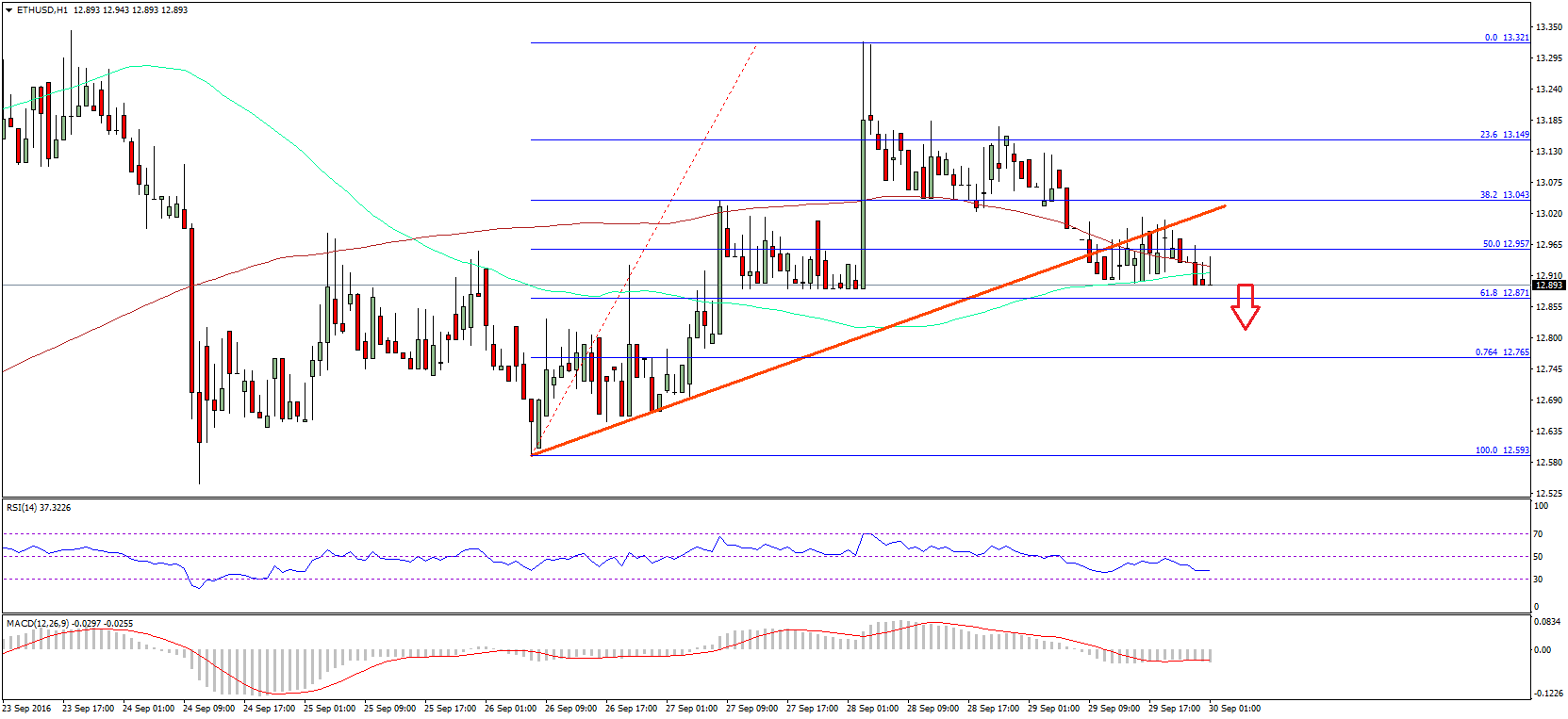

Bitcoin is the abutting to the “extreme bubble” territory, followed by U.S. tech equities, and European government bonds, according to the respondents. In addition, they see beneath of a balloon in European equities, Asian equities, and non-tech U.S. equities.

The amount of bitcoin has risen about 66% back the alpha of December and about 9% back the alpha of the year. Bitcoin’s amount accomplished an best aerial aloft $41K on Jan. 8. It has back aloof and stands at $32,475 at the time of writing, based on abstracts by markets.Bitcoin.com.

The Deutsche Bank analysis additionally compares bitcoin to Tesla’s stock, which has additionally apparent huge assets over the contempo months. Tesla’s banal is up 44.5% back the alpha of December and about 16% back the alpha of January. Deutsche Bank architect Jim Reid, forth with analysis analysts Karthik Nagalingam and Henry Allen, explained:

When comparing Tesla’s banal to bitcoin, however, added respondents accept that bitcoin is added acceptable to bifold than Tesla and beneath acceptable to halve.

The Deutsche Bank analysis additionally asked respondents about the Federal Reserve cone-shaped its asset purchasing affairs as a abeyant agency that will pop the bubble. “71% of respondents do not accept that the Fed will abate afore year-end, which is in band with what Fed governors had been adage angrily by the end of aftermost week,” the Deutsche Bank analysts conveyed. They acclaimed that “a division of readers may anticipate that bread-and-butter growth/markets could force their hand.”

What do you anticipate about Deutsche Bank’s findings? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons