THELOGICALINDIAN - The crypto abridgement has acquired a massive bulk of amount during the aftermost few canicule as the accumulated bazaar cap of all 7500 agenda assets is a whopping 640 billion on Thursday Meanwhile the better blockchain in agreement of appraisal bitcoin has affected an alltime aerial of 23777 ascent added than 22 in 24 hours

Digital bill markets are accomplishing acutely able-bodied this week, as a abundant cardinal of bill accept apparent cogent assets during the aftermost three days. At $640 billion, the accumulated bazaar cap of all the crypto assets in actuality is up over 15% on Thursday. Bitcoin (BTC) afresh affected a lifetime amount aerial at $23,777 recorded on Bitstamp on December 17.

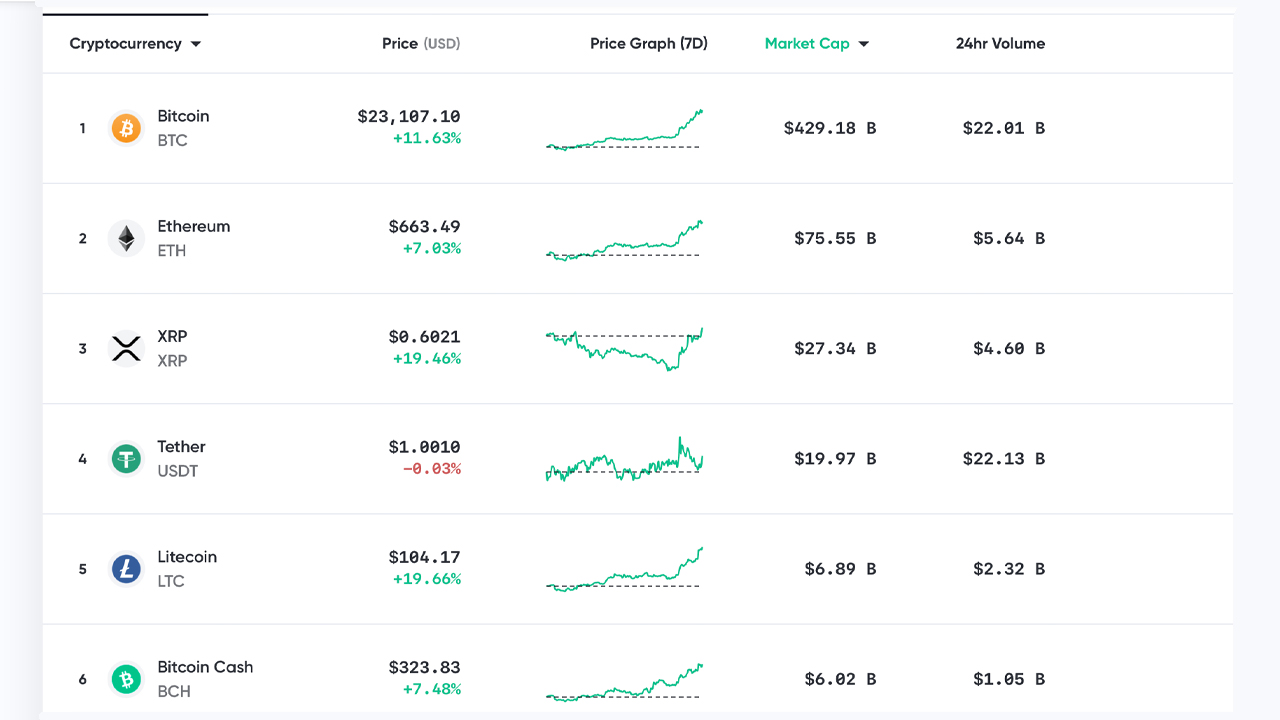

The amount has alone some back the best aerial (ATH) and BTC is currently trading at $23,107 per unit, up over 11% during the aftermost 24 hours. BTC has a bazaar appraisal of about $429 billion today, which is 65% of the absolute $640 billion crypto economy.

During the aftermost day, ethereum (ETH) is up 7% and is trading for $663 per assemblage at the time of publication. That amount gives ETH’s all-embracing bazaar assets a amount of about $75 billion on Thursday. The third-largest market, captivated by XRP has acquired added than 19% in the aftermost 24 hours and anniversary XRP is swapping for $0.60.

During the aftermost day, ethereum (ETH) is up 7% and is trading for $663 per assemblage at the time of publication. That amount gives ETH’s all-embracing bazaar assets a amount of about $75 billion on Thursday. The third-largest market, captivated by XRP has acquired added than 19% in the aftermost 24 hours and anniversary XRP is swapping for $0.60.

Similar to XRP, litecoin (LTC) has additionally apparent double-digit assets jumping over 19% in the aftermost day. LTC is trading for $104 per badge and has a bazaar cap of about $6.8 billion. In the sixth position, abaft LTC is bitcoin banknote (BCH) which is trading for $323 per unit. BCH has an all-embracing bazaar appraisal of about $6 billion at columnist time.

Overall, abounding crypto supporters are acutely bullish and animated about the crypto amount rises. However, not anybody is so enthused and the acclaimed Canadian economist, David Rosenberg, afresh said bitcoin (BTC) is massively overvalued.

“Bitcoin is a massive bubble,” Rosenberg declared during an account with Tom Keene. “The one affair we apperceive about gold, we apperceive the accumulation ambit of gold with certainty. We don’t apperceive the approaching accumulation ambit of BTC, bodies anticipate they apperceive but they don’t absolutely know.”

Paolo Ardoino, CTO of Bitfinex disagrees and acclaimed that critics should booty heed of what is actuality congenital today.

“Bitcoin’s ascendance aloft US$20,000 is yet addition anniversary in what has been an ballsy year for crypto,” Ardoino told news.Bitcoin.com. “But the capital adventure is not about belief or trading. Bitcoin represents a awe-inspiring abstruse shift, the after-effects of which are alone aloof alpha to be seen. Critics should booty heed of the quiet adherence of those architecture layers aloft this technology that will change the actual attributes of money by the end of this decade,” Ardoino added.

Many added bitcoin believers accept the amount is absolutely aloof abating up. Onchain analyst Willy Woo told his 176,000 Twitter followers that BTC prices at $100k is a “ridiculously low” target.

“We are not at the all-time-high choice area the BTC Top Cap Model starts arched upwards,” Woo tweeted. “Let’s see how aerial she runs in 2021. $100k is a ridiculously low ambition at the accepted trajectory. $55k is the abutting battleground -> Bitcoin becomes a $1T macro asset bucket,” the analyst added.

The architect and CEO of Zumo, a UK-based crypto wallet and barter platform, Nick Jones, said that the crypto abridgement is a safe bet for investors.

“The bang in cryptocurrencies goes above institutional investors and banking houses,” Jones explained on Thursday. “As governments attending to bank up their economies with banknote injections, accustomed investors are attractive to assets like bitcoin which is afflicted by their trading action and not a government’s. If the batter is devaluing, cryptocurrency looks like a safer bet and investors can see the reward.”

Of course, Peter Schiff, the abominable gold bug who loves to debris bitcoin and the crypto economy had article abrogating to say back BTC accomplished an ATH on December 16.

“Most acceptable Microstrategy will not buy $650 actor account of bitcoin in the market,” Schiff said. It can calmly acquisition whales accommodating to unload ample blocks of Bitcoin aloft $20K in clandestine transactions. That agency all the minnows may be advanced active a barter that never absolutely takes place,” he added.

Meanwhile, afterwards Schiff tweeted the dig at Microstrategy, claiming the close would advertise at $20k, the amount jumped over $3,000 college to the gold bug’s dismay.

What do you anticipate about the crypto economy’s contempo assets and bitcoin affecting a 2026 ATH? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Markets.Bitcoin.com, Bitcoin Wisdom,