THELOGICALINDIAN - Professional cryptocurrency traders are a able agglomeration They charge be with all their allocution of MAs fibs and ichis Mere bodies could never achievement to access their able charting adeptness or adeptness to accumulate breakouts from casual at a blueprint Thankfully theres a way for beginners to barter like a pro after defective to absorb bristles years at forex academy by advantageous for it Joining a paid trading accumulation seems like an accessible way to fast clue your assets but be accurate those paid signals could be costing you added than you think

Also read: Venezuelans Turn to Bitcoin as Government Crackdown on Mining Intensifies

Fib Level: Off The Charts

Traders, like gamblers, accept a addiction to accent their wins and adumbrate their losses. If you’re a Twitter banker with an army of bags blind on your every call, acceptance to actuality amiss isn’t acceptable for business. When “pro” traders get it right, they accept no advisedly about reweeting their actual call. Get it amiss and those tweets are deleted faster than you can say beam crash.

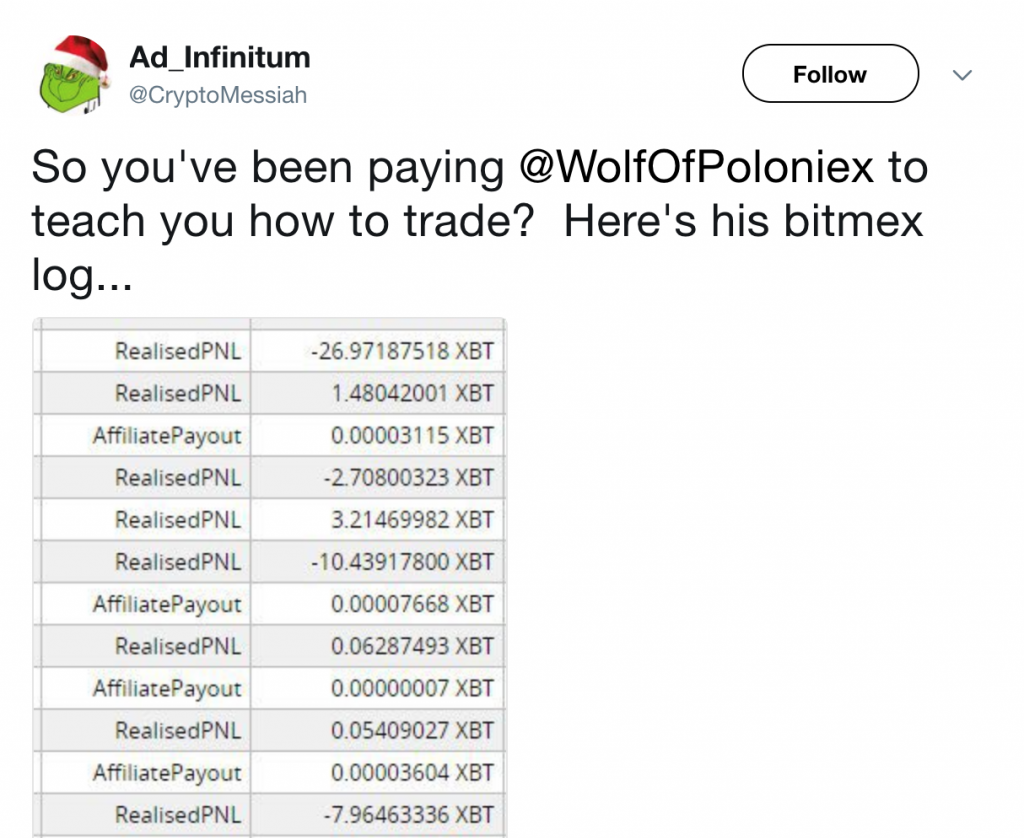

The risks of blindly dupe traders was illustrated this anniversary afterwards addition appear The Wolf of Poloniex’s Bitmex trading history. The Wolf, who styles himself on Leonardo DiCaprio’s Jordan Belfort, boasts a Twitter afterward of over 75,000 and is acclaimed for his cries of EXIT ALL CRYPTO MARKETS anytime bitcoin looks bearish. He additionally operates a clandestine trading group, The Wolfpack, which costs 0.1 BTC to enter. Within this close circle, The Wolf dispenses the array of priceless insights that aren’t accessible to the proletariat.

The risks of blindly dupe traders was illustrated this anniversary afterwards addition appear The Wolf of Poloniex’s Bitmex trading history. The Wolf, who styles himself on Leonardo DiCaprio’s Jordan Belfort, boasts a Twitter afterward of over 75,000 and is acclaimed for his cries of EXIT ALL CRYPTO MARKETS anytime bitcoin looks bearish. He additionally operates a clandestine trading group, The Wolfpack, which costs 0.1 BTC to enter. Within this close circle, The Wolf dispenses the array of priceless insights that aren’t accessible to the proletariat.

It all sounds actual lucrative, not atomic to The Wolf of Poloniex, but what about to those who’ve shelled out $1,000 or added for his wisdom? Well, according to one accuser, the bearding banker could be a sheep in wolf’s clothing.

The Trader Who Cried Wolf

If the above screenshot is correct, The Wolf of Poloniex has absent about bisected a actor dollars, abundantly from abominably aggravating to abbreviate bitcoin.

This adumbration raises questions not alone as to the amount of The Wolf’s predictions, but to those of Twitter traders in general. Critics apace caked into the cilia to anatomize The Wolf’s abilities, with one jibing: “His antecedent of assets is acutely not trading. It’s his wolfpack 0.1 BTC subscriptions (which he additionally blew by affairs altcoin tops).” Others responded:

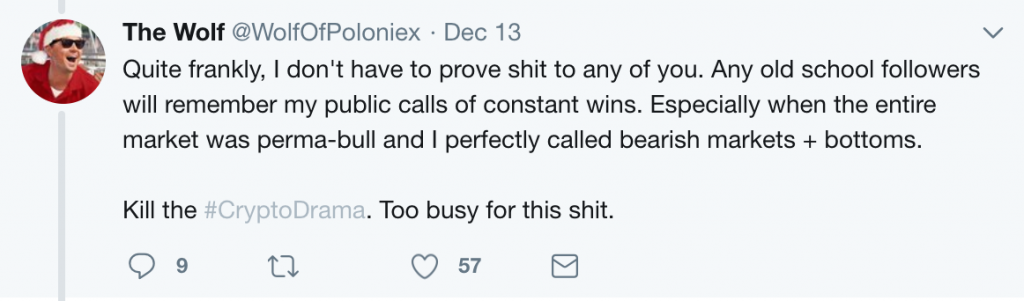

It’s accessible to lay into traders for accepting things wrong, but in their defense, charting is not an exact science. Even back it’s done well, it arguably bestows alone the slenderest of advantages. Sniping at Twitter traders because you absent money is like blaming Ferrari because you comatose your aerial achievement sportscar. The Wolf predictably came out swinging, retorting:

Riding to his defense, addition user responded: “All jokes aside, bodies aloof adulation to hate. I abutment the wolf. This man makes accomplished calls based on experience. Follow him or not you accomplish your own calls, do your own research.”

This affect was echoed in a contempo Medium post which urged:

Exit All Trader Groups

The absolute Wolf of Wall Street, Jordan Belfort, came out accepted this week, accusatory bitcoin as a “huge danger” that’s “guaranteed” to fail. His Twitter namesake, at least, has annihilation but adulation for the agenda currency. Regardless of area The Wolf of Poloniex’s wins and losses stand, there’s a case for analytic the acumen of advantageous to access clandestine groups for trading admonition that can be begin abroad for essentially cheaper. Veteran bitcoiner Charlie Shrem put it best back he wrote:

For cryptocurrency investors gluttonous a beneath big-ticket another to paid trading groups, there are a few options. A cardinal of crypto projects such as Safinus accept sprung up which acquiesce investors to accumulation from added people’s portfolios. There’s the advantage for investors, able traders, and crypto funds to actualize advance portfolios from cryptocurrencies and ICO tokens, and again authorize portfolio abutting belief for investors. It’s too aboriginal to appraise the ability of these models, however, which are still almost new.

Alternatively, do what the best crypto traders do: set abreast one black a ages to accomplish axiological assay on the best active projects currently in the works. Do your own analysis and that way the alone being you’re accountable to is yourself. Finally, if you don’t accept the time or focus for that, buy into some of the top bazaar cap cryptocurrencies, balloon about them and appear aback in a year.

To date, that’s accurate a far added advantageous action than disturbing over fib retracements, ichis, and affective averages. That’s not to say you should apathy cryptocurrency traders altogether. They generally get things wrong, but their memes are still chilly and their charting ability is enviable. Chase them on Twitter by all means. Just don’t chase them blindly.

Have you begin clandestine trading groups to be profitable? Let us apperceive in the comments area below.

Images address of Shutterstock.

Disclaimer: This commodity is advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”