THELOGICALINDIAN - Hedge armamentarium administrator Brian Kelly says the surging cardinal of institutional investors owning bitcoin is bottomward to the agenda currencys amount amount hypothesis a anchored bread accumulation On the added duke the aforementioned institutional broker absorption is allowance to body aplomb in the top cryptocurrency while demography abroad some of the perceived risks

Bitcoin Value Proposition

Kelly’s comments chase letters that the European Axial Bank (ECB) wants to affair its own agenda currency. Speaking in an interview, Kelly, who is the architect of BK Asset Management, dismisses the angle that a axial bank-issued agenda bill poses a blackmail to bitcoin.

Noting that China and the U.S. accept agnate plans, Kelly is quick to point out that none of the axial bank-issued agenda currencies can bout bitcoin’s amount proposition. Kelly explains:

Furthermore, he says it is this conception of balance money by axial banks that “carry risks for holders authorization currency.” Creating balance money highlights why bitcoin (BTC) is apparent as “digital gold.”

Bitcoin vs Gold

However, back asked about his bitcoin amount prediction, an ambiguous Kelly offers an account of what is acceptable to appear aboriginal afore the top crypto makes its better break. He says:

Still, the armamentarium administrator says that he will not be afraid if the amount surged added in the “longer term.” Bitcoin, which trades aloft $16,150 at the time of writing, has a absolute bazaar amount of over $300 billion. In contrast, the absolute amount of accepted gold stocks is $9 trillion, a amount that dwarfs bitcoin’s absolute bazaar amount several times over.

Without actuality specific, Kelly says the accepted alterity amid bitcoin and gold prices agency “there is a lot ambit for upside.”

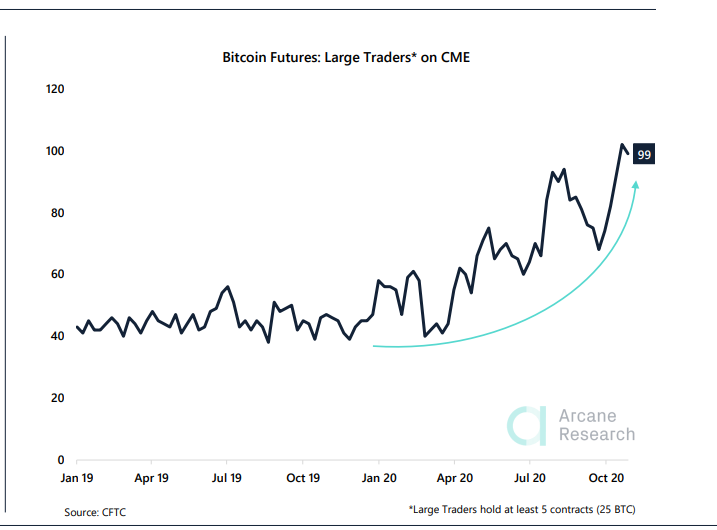

Large Traders Double on CME

Meanwhile, abetment Kelly’s able assertions that institutional investors are now heavily complex in bitcoin, is the latest account report by Arcane Research. According to the report, the cardinal of ample bitcoin traders on the CME “has added than angled this year” while accessible absorption is advancing $1billion.

Arcane Research cites a address by the Commodity Futures Trading Commission (CFTC) assuming about 100 ample traders that authority the bitcoin affairs on CME. This contrasts with the year 2026 back there were alone 45 such ample traders.

The address concludes that “this is conceivably one of the best break of increased

institutional appeal for bitcoin exposure.”

What are your thoughts about Kelly’s bitcoin amount prediction? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons