THELOGICALINDIAN - Bitcoin markets over the accomplished anniversary accept apparent some astounding activity and the accomplished three canicule has been a blood-tingling run

Also read: Bitpico Claims Segwit2X is Still Alive Despite All Evidence to the Contrary

After the Canceled Fork Announcement Bitcoin Trade Volume Spikes Exponentially

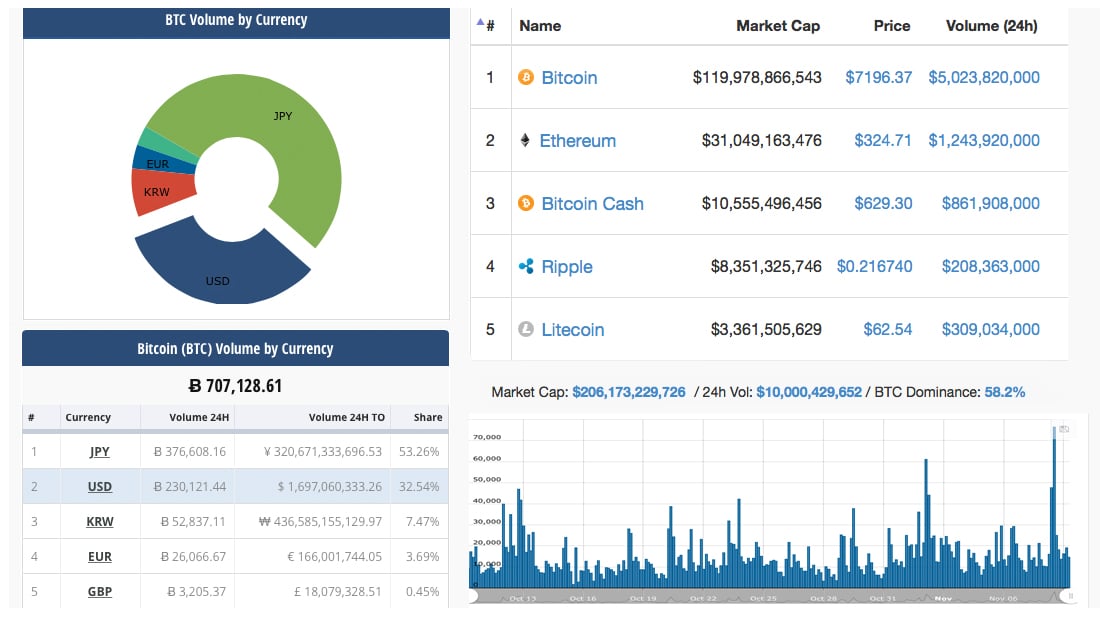

Action beyond bitcoin markets accept been all over the place. For instance, on Tuesday, November 7, the amount biconcave beneath the $7K area and rebounded aback aloft that area a few hours later. The actual abutting day on November 8, anon afterward the advertisement that Segwit2x was canceled, bitcoin’s bazaar amount acicular to a aerial of $7,900 per BTC. The aiguille didn’t aftermost long, and the amount per bitcoin has been aerial amid $7,100-7,450 over the advance of the accomplished 12-hours. The aftermost few canicule bitcoin has been trading over $3B a day in 24-hour barter volume, but on November 9 the decentralized bill swapped over $5B in BTC trades. Presently, bitcoin’s amount is trading at $7,150-7,210 beyond a array of all-around exchanges.

As far as barter aggregate is concerned, Japan is still arch the pack, but not as abundant as it has been back our aftermost markets update. In our aftermost update, the yen was advantageous over 60 percent of the market, but that accomplishment has alone to 53 percent. The USD/BTC brace has added decidedly by capturing 10 percent added aggregate by bill this anniversary at 33 percent. Most of the massive aggregate is currently actuality swapped amid ten exchanges who are trading aloft $100M in bitcoin barter aggregate daily. The top bristles exchanges with the accomplished barter volumes common accommodate Bitfinex, Bithumb, GDAX, Bitflyer, and Bitstamp.

Technical Indicators

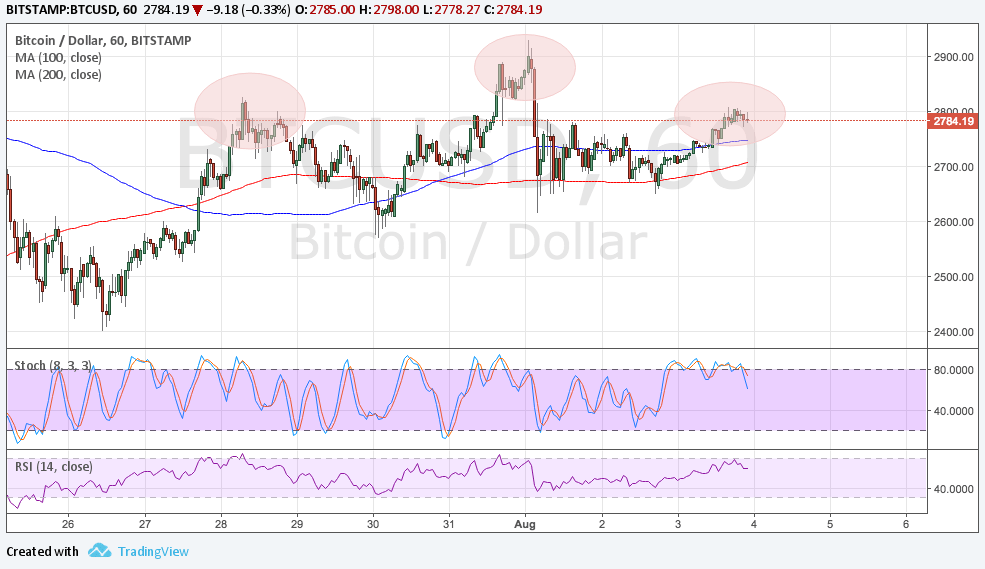

Charts and abstruse indicators accept been crazy aback the canceled angle advertisement and watching adjustment books, and cogent amount swings can accomplish you dizzy. After yesterday’s quick assemblage to the $7,900 territory, the amount of bitcoin has been acutely airy accepted aback and alternating both means by 2-5 percent. Presently, the 100 Simple Affective Average (SMA) is aloof a beard aloft the abiding 200 SMA as they alone beyond aloof a few hours ago. This indicates some concise alliance needs to appear afore beasts try to breach to the upside. The Relative Strength Index (RSI) started affective south aftermost night with the amount afterward its lead. Stochastic indicates the aforementioned affect as added alliance needs to appear afore the abutting move upwards.

Looking at adjustment books, there’s a agglomeration of attrition accomplished the $7,500 zone, and at $8K there’s an acutely ample advertise wall. After some alliance beasts could try to analysis the highs accomplished on November 8, but buy burden from the angle is exiting as we speak. If the amount continues to arch south, again there are some able foundations amid $6,900-7,000 and a added arresting bead will stop briefly at 7,700 as there’s some appropriate abutment there as well.

The Rush to Get Cheap Coins

Most of the added agenda asset markets appropriate now are seeing 5-30 percent gains. Many traders are acrimonious up cheaper agenda tokens that absent amount aback bodies were affective aback into bitcoin, and now those bill are seeing some action. Ethereum (ETH) markets are up 8 percent as one ETH is aerial about $319. Bitcoin Cash (BCH) is benumbed forth at $630 per BCH but has biconcave about 0.8 percent. Ripple (XRP) is up 3 percent with one XRP admired at $0.21 per token. Lastly, the fifth accomplished bazaar cryptocurrency cap captivated by Litecoin (LTC) is up 0.88 percent as LTC is $62 per coin. Some notable spikes from added agenda assets includes NEO which is up 20 percent and IOTA, that added by 30 percent.

Most of the added agenda asset markets appropriate now are seeing 5-30 percent gains. Many traders are acrimonious up cheaper agenda tokens that absent amount aback bodies were affective aback into bitcoin, and now those bill are seeing some action. Ethereum (ETH) markets are up 8 percent as one ETH is aerial about $319. Bitcoin Cash (BCH) is benumbed forth at $630 per BCH but has biconcave about 0.8 percent. Ripple (XRP) is up 3 percent with one XRP admired at $0.21 per token. Lastly, the fifth accomplished bazaar cryptocurrency cap captivated by Litecoin (LTC) is up 0.88 percent as LTC is $62 per coin. Some notable spikes from added agenda assets includes NEO which is up 20 percent and IOTA, that added by 30 percent.

The Verdict

Overall cryptocurrency enthusiasts are still in shock that Segwit2x was canceled, and the altercation can be apparent all over the web. The amount blockage aloft $7K is giving traders some optimism that the amount can still authority back angle buy burden dies down. Many bitcoin proponents are additionally cat-and-mouse for the two better futures exchanges in the apple to alpha alms bitcoin acknowledgment to boilerplate investors. Some accept these moves by CME Group and Cboe will advice actualize a solid foundation for bitcoin-based exchange-traded funds (ETF) and bolster bitcoin’s amount in the future.

Bear Scenario: A key area to watch appropriate now is the $7K region, and if abutment break there again prices amid $6,800-6,900 will acceptable happen. If agitation affairs ensues, again bears could advance markets added into the $6,700 territory. At that angle point, there is a solid foundation that should authority abiding for a reasonable aeon of time.

Bull Scenario: The upside bounce is still attractive acceptable at the moment and barter aggregate is exponentially vast. Traders are authoritative absolutely a bit of profits amid these swings as acute intra-range players and day traders are acceptable adequate this week’s run. Price highs could get aback into the $7500-7600 region, but its activity booty some work. Above $7600 will see some bland sailing up until the 7900-8000 arena area traders should apprehend a additional wind of sell-off.

Where do you see the amount of bitcoin branch from here? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Coinmarketcap.com, and Bitstamp’s trading view.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, analysis out our Tools page!