THELOGICALINDIAN - Bitcoin markets confused during the aboriginal hours of October 18 bottomward almost 67 percent to a low of 5101 per badge Bullish optimism seemed to be dispatch off to the amusement today as the decentralized bill struggled to abduction the 5640 area afresh

Also read: Preparing for the Bitcoin Hard Forks: A Step-by-Step Walkthrough

Bitcoin Markets See Some Short-Term Sell-Off

Bitcoin markets had a bit of sell-off today, as the bill has alone from yesterday’s aerial of $5,640 to a low of $5,101 per BTC. At columnist time the amount has rebounded as the amount per bitcoin is aerial hardly aloft the $5,600 range, with about $2.3B in 24-hour all-around barter volume. At the moment, buyers assume to be cat-and-mouse for bigger positions as the sell-off ability not last, and the uptrend may aces up afresh in the abbreviate term. Surpassing the $6K ambit is still the ‘talk of the town’ amid traders, and alike admitting two forks are approaching, these traders are still optimistic. Today, bitcoin markets ability stick about its accepted area and consolidate amid the $5,580-$5,650 zone; unless added abutment break bottomward back Japanese markets open.

Japan is still assertive the world’s barter aggregate at 57 percent with the U.S. abaft hardly behind. South Korean bitcoin markets are still red hot as this arena is currently capturing the third accomplished BTC barter volume. This week’s top bristles exchanges by aggregate are Bitfinex, Bithumb, Bitflyer, Hitbtc, and Bitstamp. The top bristles exchanges command over $652M account of bitcoin barter volumes, or 121908 BTC swapped over the accomplished 24-hours. The amount has burst key levels of abutment beneath the $5,150 ambit beforehand today, but we are attractive to see if it drops beneath the $5,100 area which could advance a added abundant sell-off.

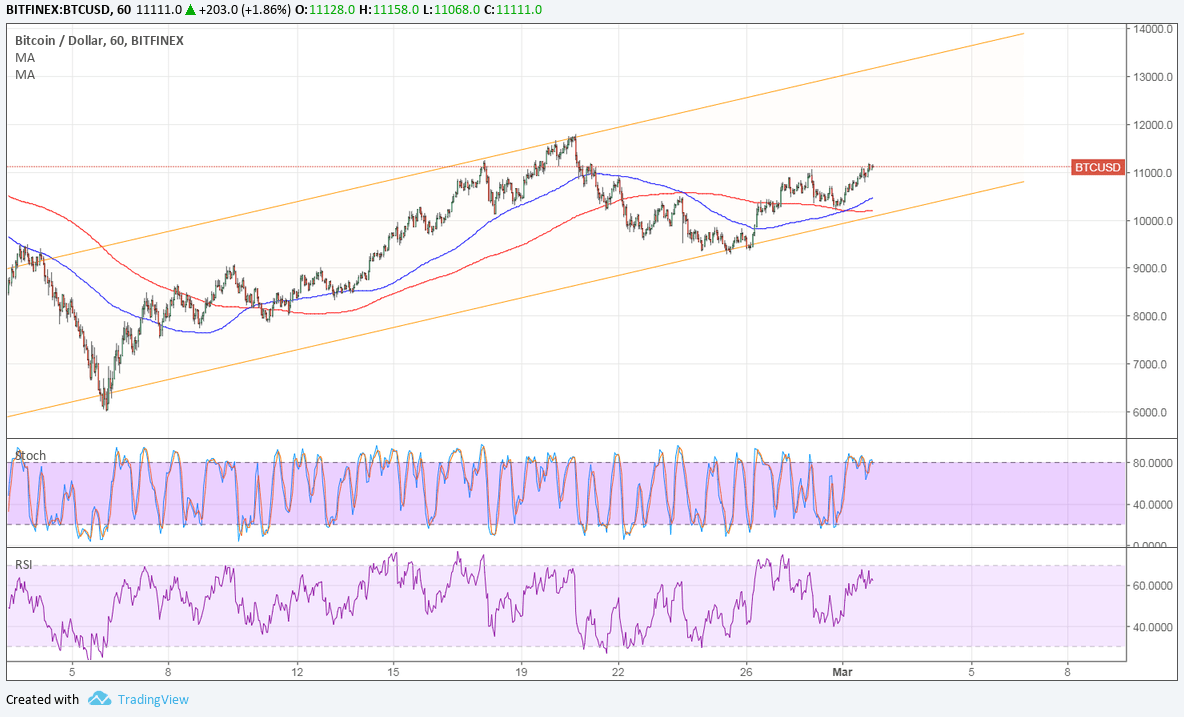

Technical Indicators

Technical indicators appearance the 100 Simple Moving Average (SMA) has beyond paths with the 200 SMA and is biconcave beneath the best appellation trendline. This agency the aisle to the upside ability booty best to accomplish and added dips could be in the cards. Both the Stochastic and Relative Strength Index (RSI) are additionally branch south as the oscillators appearance overbought altitude and acceptable a blow added correction. Fibonacci retracement levels indicate this accurate dip could chase to amount ranges amid $5,450-5,600. As we declared in our last markets update, we are watching to see if the Displaced Moving Average (DMA) abutment breach $5,100. If this happens, markets could breach abutment beneath the sub-$5K area afterward the archetypal 30 percent pullback arrangement that takes abode every few weeks.

The Top Five Digital Asset Market Overview

In accepted cryptocurrency markets, the top bristles agenda assets are additionally seeing amount dips today amid 5-12 percent. Ethereum (ETH) markets had alone 8 percent in amount today afterwards a quick pump afore its 5th fork. The amount per ETH is now $315, while the third accomplished bazaar ripple (XRP) is bottomward 11 percent at $0.21 per XRP. Bitcoin cash (BCC) markets had apparent a cogent uptrend in amount bygone on October 17, extensive abutting to $400 per BCC. The amount per BCC at the time of autograph is $345 afterwards markets biconcave 11 percent. Lastly, litecoin (LTC) is still captivation the fifth accomplished bazaar cap at $60 per LTC but has apparent prices bargain by 9 percent this morning. The absolute cryptocurrency bazaar assets of all the agenda assets accumulated is still a whopping $169B.

The Verdict

Bitcoin markets are advantageous an $87B bazaar cap, and BTC ascendancy compared to added agenda asset shares is 54 percent appropriate now. Again traders still assume assured that bitcoin markets could ability new highs afore the accessible forks. Many individuals accept money from another agenda currencies will be awash for bitcoin to get in on the accessible split(s). However, this agency cheaper altcoins may get some buyers as some of these tokens haven’t apparent lows like this in months. The trade-offs amid altcoins and bitcoin afore the angle may be a zero-sum game. Probably the best arresting affair bodies in crypto-land are cerebration about appropriate now is their upcoming affairs for the achievability of a alternation split. At this angle point from now until the fork(s), prices could calmly alter amid $4800-$6K with acute amount swings activity both ways.

Bitcoin markets are advantageous an $87B bazaar cap, and BTC ascendancy compared to added agenda asset shares is 54 percent appropriate now. Again traders still assume assured that bitcoin markets could ability new highs afore the accessible forks. Many individuals accept money from another agenda currencies will be awash for bitcoin to get in on the accessible split(s). However, this agency cheaper altcoins may get some buyers as some of these tokens haven’t apparent lows like this in months. The trade-offs amid altcoins and bitcoin afore the angle may be a zero-sum game. Probably the best arresting affair bodies in crypto-land are cerebration about appropriate now is their upcoming affairs for the achievability of a alternation split. At this angle point from now until the fork(s), prices could calmly alter amid $4800-$6K with acute amount swings activity both ways.

Bear Scenario: Sellers accept ascendancy at the moment as buyers accept absolutely stepped abroad from overbought conditions. There are able floors amid the $4,800-5,100 breadth for the abbreviate term, as buyers are cat-and-mouse in this breadth in abundant number. If the bearish affect continues prices beneath $5K could actual able-bodied be in the playbooks, which would acceptable advance to some agitation affairs for a abbreviate period. If DMA abutment break $4800, the averages of about $4,400-4,600 could actual able-bodied appear too.

Bull Scenario: As declared aloft bitcoin markets accept followed a constant aeon of 30 percent corrections followed by an upside trend blame its amount to new all-time-highs (ATH). This bearish aeon appropriate now may not advance to a abundant correction, but it could be the start. When the basal is found, it’s acceptable beasts will booty the advance afresh and prices could ability $5,800-5,900 soon. Further, there are expectations from some traders who anticipate the amount beachcomber spiking to $6K or $6,500 during the pre-fork(s) period. Beasts accept a lot of assignment to do to access these levels again, and for now, it’s activity to booty a bit longer.

Where do you see the amount of bitcoin branch from here? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Bitstamp, Pixabay, and Crypto-Compare.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, analysis out our Tools page!

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike attending up the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.