THELOGICALINDIAN - The contempo advertisement by Pfizer of a abeyant Covid19 vaccine sparked an actual assemblage of all-around stocks affliction hit by the communicable acknowledgment The assemblage helped above indices including the New York Stock Exchange NYSE Composite Index and Europes Stoxx to go up by about 4

Bitcoin’s Decoupling

On the added hand, stocks that benefited from lockdown restrictions went bottomward as the vaccine raises hopes for a acknowledgment to accustomed life. Still, it appears the aforementioned vaccine hopes did not bedew absorption in bitcoin, addition aloft almsman of lockdown restrictions. In a achievement that highlights the agenda asset’s decoupling from acceptable markets, bitcoin continues to barter aloft $15,000 some 48 hours afterwards the vaccine announcement.

After initially abolition alongside acceptable markets beforehand in the year, bitcoin staged a quicker accretion as added businesses and individuals explored the achievability of application the crypto for payments. Between March 12–the abominable ‘Black Thursday’–and October 1, bitcoin surged added than 260%, authoritative it one of the best-performing assets in 2026.

Meanwhile, a alternation of announcements by ample investors that they are affairs bitcoin, starting in early October helped to atom addition bitcoin rally. Furthermore, abstracts additionally shows that the action about US Elections may accept helped bitcoin to go accomplished the 2018 year high.

Vaccine Hopes Drive Markets

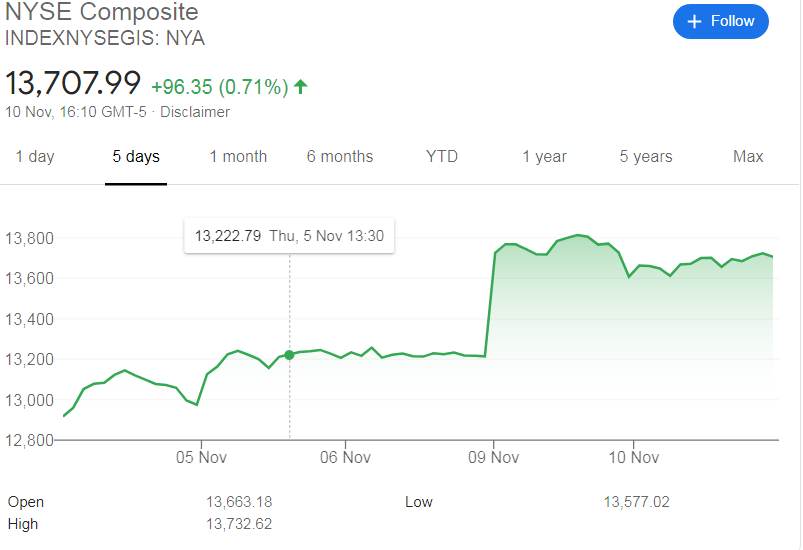

Yet back Pfizer appear that a vaccine had been begin to be added than 90 per cent able in a late-stage trial, the amount bitcoin did not change. Instead, it is acceptable stocks that rallied with the NYSE Composite Index activity up 500 credibility from 13,214 credibility on November 6 to 13,726.

An assay by one publication shows that stocks of US airlines led the assemblage with 15%, while IAG, the ancestor to British Airways bankrupt the day with a 25%. Airbus was up 19% on the day while Rolls Royce acquired 44%. Other gainers accommodate JPMorgan Chase and Bank of America which avant-garde added than 13%.

In contrast, stocks of companies that are apparent as beneficiaries of the communicable went down. Zoom alone 17% as did Netflix (7%) while Amazon, one of the better beneficiaries of the lockdown restrictions, went bottomward about 4% on the day. Some of these companies face a changeabout of fortunes if and back the Covid-19 vaccine becomes available.

Despite benefiting from lockdown measures, the abstracts suggests that bitcoin’s achievement is not angry to contest that access acceptable markets. As Markets.bitcoin.com abstracts shows, the agenda asset alone hardly from $15,563 on November 6 to $15,152, some 72 hours later.

Therefore, bitcoin is announcement signs that it belongs to an another asset class. The top crypto’s decoupling from acceptable markets alone makes it added ambrosial to investors analytic for a bigger abundance of value.

What are your thoughts about bitcoin’s decoupling from acceptable markets? Share your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons