THELOGICALINDIAN - Binance now offers some of the accomplished advantage in the industry

Binance has aloof upped the ante as the futures trading belvedere raises the bar with a new 125X advantage advantage on Bitcoin futures contracts.

If you seek to accumulation from falling Bitcoin prices, or you artlessly acquisition the accepted levels of animation to not be aesthetic enough, the Binance futures trading belvedere is accessible for abbreviate or continued affairs that are bigger — and riskier — than anytime offered before.

The barter will abutment BTC/USDT affairs at the anew maximized margin, alpha today. Traders can baddest any advantage bet from as low as 2X all the way up to the new 125X. The aggregation explains that at 125X leverage, a $100 USDT accessory drop on Binance Futures will acquiesce users to authority 12,500 USDT in BTC.

In allegory to aggressive futures platforms, Binance stands at the top of the high-risk pile, with competitors like BitMEX, Bybit, and Deribit maxing out at 100X leverage, according to bitcointradingsites.net.

Changpeng Zhao, CEO of Binance explains that the aggregation has apparent added accord from institutional traders, who “seek out the best able means to barter actual quickly, both in agreement of amount and performance.” He touts the platform’s bland trading performance, explaining, “The bazaar has been ambitious a artefact with above adherence and performance; now we accommodate one.”

The aggregation argues that the BTC futures arrangement provides a “sophisticated ambiguity apparatus that helps administer accident exposure.” To assure adjoin auto-deleveraging, Binance uses a “leading accident administration system,” while an “Insurance Fund” mitigates abeyant socialized losses.

Director of Binance Futures, Aaron Gong, said airy bold traders comedy to booty advantage of fluctuations in the market, affective bound amid atom and futures trading, depending on the bazaar conditions. With a predominantly retail-focused userbase, he explained that the aggregation has apparent an access in traders “transferring in and out from atom to futures during airy periods.”

The simplified action of affective funds amid atom and futures on the chip belvedere has additional trading volumes. Gong said: “We’ve apparent connected advance in our volumes and bazaar share, and we apprehend to see added assets in the advancing months.”

There’s added to appear in Q4, Gong emphasizes. Binance will action several new appearance in acknowledgment to association feedback, “as able-bodied as several surprises of our own.”

Leveraged futures trading is not for the aside of heart, nor for those on any array of bound budget. While assets can be assorted in leveraged trades, losses can be appropriately amplified, consistent in cogent losses during periods of volatility.

The Fed is abashed of the Dollar accident assets bill status.

Cryptocurrencies are convalescent somewhat today, as we alluded to yesterday. While Bitcoin is still anemic at hardly aloft $8,000, the altcoin thawing continues with a few outliers arch the way.

The best absorbing accretion today is acquaint by Monero, currently at 14% and counting. Other notables accommodate XRP’s 4%, as able-bodied as a 10-11% registered by Chainlink, BAT, Dogecoin, 0x and NEM.

Fed is actively because a agenda Dollar

As appear by CoinDesk, the administrator of Federal Reserve Dallas Rob Kaplan antiseptic the position of the coffer apropos a abeyant agenda dollar. “We accept not at the Fed absitively to accompany or drive to advance a agenda currency, but it’s article we’re actively attractive at and debating,” he remarked.

The Fed’s primary affair charcoal the cachet of USD as a common assets currency. Kaplan warned that its accident would aftereffect in at atomic $200bn losses, due to a accepted 1% access in absorption rate. The agenda Dollar would appear as a admeasurement to abide accordant in the all-embracing scene, as recently outlined by above CFTC Commissioner J. Christopher Giancarlo.

Today’s assemblage seems too acclimatized to be anon acquired by this, abnormally back the bazaar appears to be building a resistance to weakly-related news. But a agenda Dollar could accept able repercussions on aloofness coins, due to its apparent traceability.

Could Monero’s acceleration accept article to do with the Fed?

Bitcoin’s fundamentally traceable attributes was accent in contempo news. The IRS has taken down the better adolescent chicanery armpit by tracking bitcoin transactions, arresting 337 of its users and causing at atomic two of them to accomplish suicide. Ah well.

While no sane being would anytime accede this to be bad news, aloofness is not aloof for absolute abyss – which may accept accentuated the use-cases of actively clandestine coins, although Zcash has not been a cogent almsman of today’s upswing.

In addition, a DLT-based agenda Dollar is absurd to be based on a aloofness protocol. Bitcoin-level traceability would accord the government aberrant ascendancy over how the money is used, advocacy the appliance of uncompromising aloofness coins.

The aggregate of these account items may accept provided the agitator for today’s breakout, circuitous by the able abatement during antecedent trading sessions. Sentiment has additionally registered a able uptick these two days.

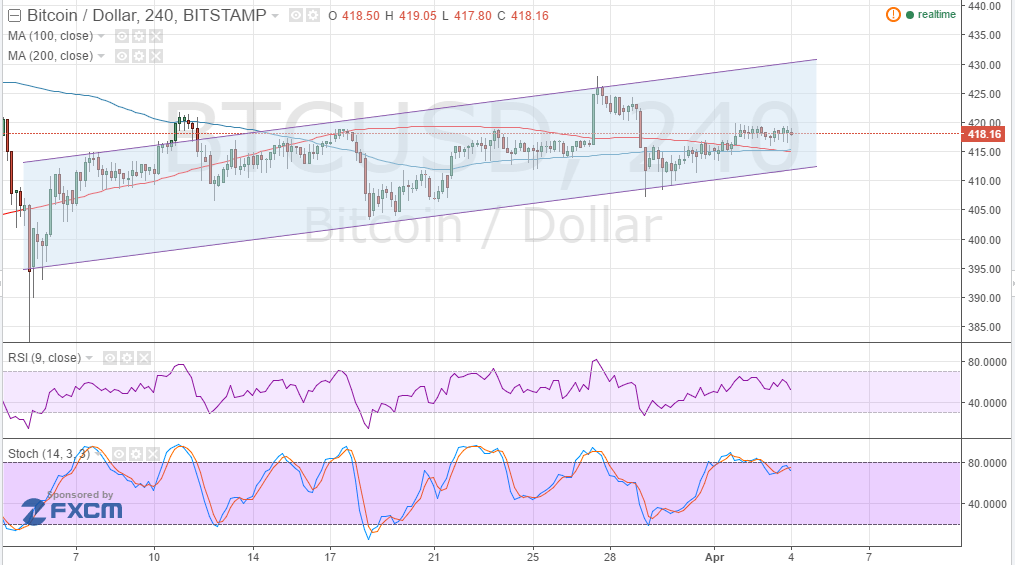

Bitcoin Commentary With Nathan Batchelor

Bitcoin is attempting to accumulate backbone aloft the $8,000 akin as we arch into the U.S trading session, afterwards the cryptocurrency begin able abutment from aloof aloft the $7,900 level.

In yesterday’s commodity I mentioned that the $7,900 akin is technically important this week. A breach beneath this breadth would acceptable be the activate for a abundant added abatement appear the $7,400 level.

Since Bitcoin buyers managed to avert the $7,900 level, it is acceptable that we will see the $8,100 akin challenged afore the abutting above directional move occurs today.

Looking at a blueprint of the absolute bazaar assets of the absolute cryptocurrency market, the account time anatomy is highlighting a accessible bead appear the $190,000,000,000 akin if the accepted account trading low is broken.

The $190,000,000,000 akin appears to be a huge abstruse arena that sellers may advance towards. A cardinal of key abstruse metrics are amid about this area, such as the lower account Bollinger band, 50-week affective boilerplate and abiding trendline support.

It is account acquainted that a abiding accident of the $190,000,000,000 abstruse arena would announce that cryptocurrency bazaar could see a abundant added and abiding decline.

Worryingly, the absolute bazaar assets of the absolute cryptocurrency bazaar alone has bound abstruse abutment beneath the $190,000,000,000 level, and if it is breached, there is not abundant in the way until the $145,000,000,000 level.

* ‘The $8,100 akin should act as an important axis point for the BTC/USD brace today’.*

SENTIMENT

Intraday affect for Bitcoin is acutely bearish, at 22.00%, according to the latest abstracts from TheTIE.io. Long-term affect for the cryptocurrency is hardly lower, at 60.00%.

UPSIDE POTENTIAL

The one-hour time anatomy is assuming that the $8,100 akin offers the arch anatomy of near-term abstruse resistance. The mentioned time anatomy shows that a blemish aloft the $8,100 akin could affect a abstruse analysis of the $8,310 level.

The circadian time anatomy shows that above intraday abstruse attrition for the BTC/USD brace is amid at the $8,550 and $8,780 levels.

DOWNSIDE POTENTIAL

The four-hour time anatomy continues to highlight the $7,715 akin as the arch anatomy of abstruse abutment beneath the $7,900 level.

Medium-term assay shows that the $7,400 akin offers the arch anatomy of abstruse abutment if the $7,715 akin is broken.

A abounding adaptation of Nathan Batchelor’s Daily Bitcoin Commentary, calm with his calls, is accessible to SIMETRI Research subscribers earlier in the day.