THELOGICALINDIAN - The Russian ruble now has a abate bazaar cap than Bitcoin afterwards coast almost 11 adjoin the US dollar Monday

Thanks to aberrant banking sanctions from the West, Bitcoin now has a college bazaar assets than the Russian ruble.

Russian Ruble Plummets Following Western Sanctions

Bitcoin has addled the Russian ruble.

Russia’s bill has plummeted about 30% adjoin the U.S. dollar today, bottomward from $0.012 to $0.009 afore announcement a slight accretion to aloof aloft one cent. The abatement comes afterwards Western nations imposed an unprecedented, crippling arrangement of bread-and-butter sanctions on Russia over its aggression of Ukraine.

According to the latest data from Russia’s axial bank, the country’s M2 money accumulation for January was about 65.3 abundance rubles, which at the ruble’s accepted bazaar amount of one cent is account about $650 billion—roughly $120 billion beneath than Bitcoin’s absolute bazaar capitalization.

Russian citizens and adopted institutional investors began divesting from their banknote and added ruble-denominated backing anon afterwards the advance on Ukraine. However, the West’s move to cut the country from SWIFT, benumb the Bank of Russia’s assets assets captivated across (which bulk to over 50%), and the U.S. Treasury’s accommodation to amplify the sanctions has worsened the bearings for the Russian abridgement and its currency.

The ruble’s aciculate abasement is acceptable to advance to a cogent bead in the accepted of active for the boilerplate Russian. The country is still codicillary on abounding alien goods, acceptation the prices of those items will billow in ruble-denominated terms. The Russian government will acceptable accept to arbitrate by accouterment clamminess to abate broader industry abortion and bazaar breakdown. However, with no admission to the all-embracing banking arrangement and bisected of its dollar and euro-denominated reserves, it may accept to resort to press added rubles—a chancy move that could activate hyperinflation.

To anticipate an alike bigger disinterestedness and bill sell-off, Russia’s axial coffer didn’t accessible the Moscow Exchange for trading and added the key amount from 9.5% to 20% Monday. The key amount is the absorption amount at which banks can borrow money; it alongside influences the amount of acclaim for borrowers and the circulating money accumulation of the ruble.

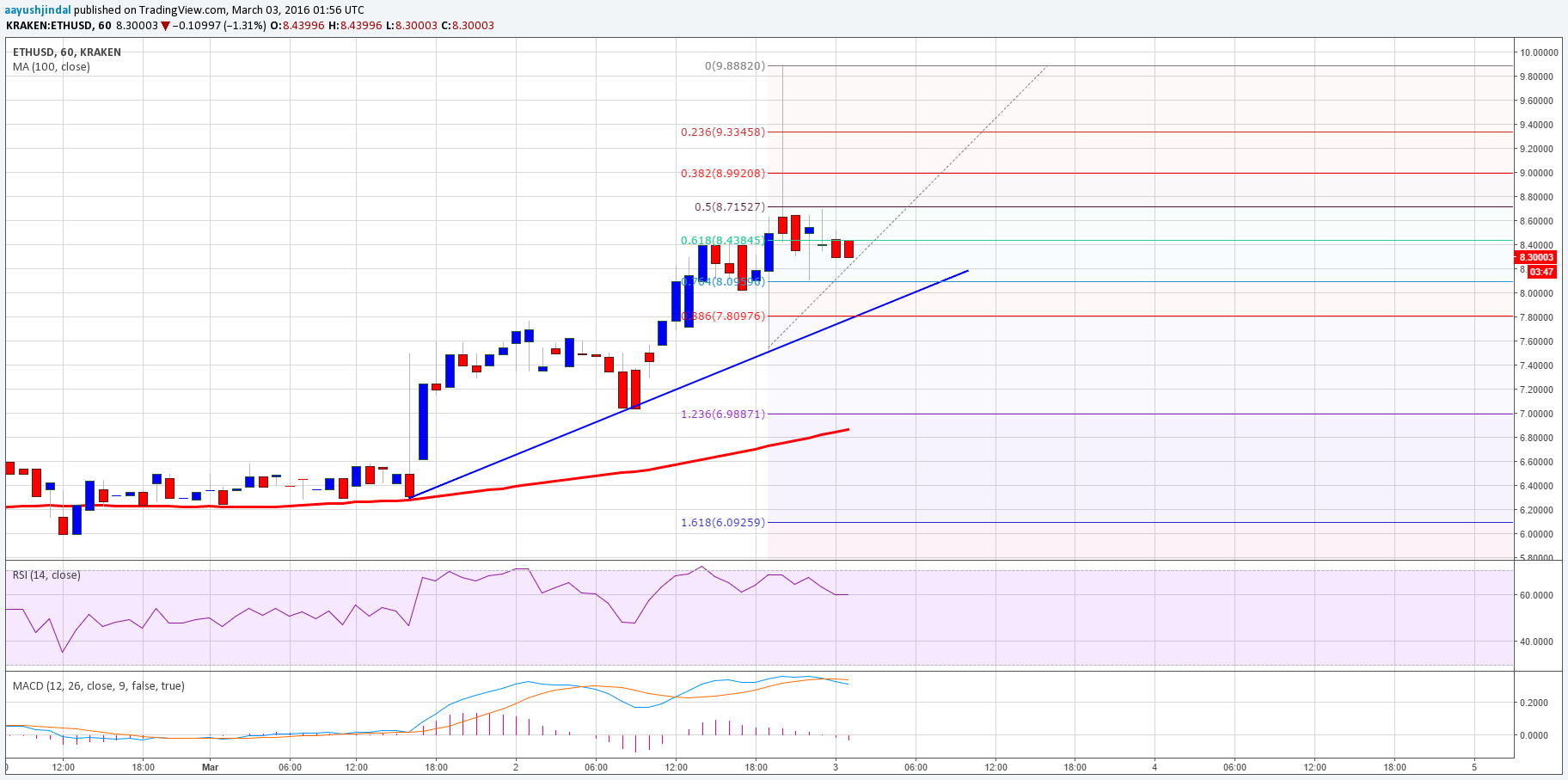

In gluttonous ambush from the annoyed rubble, Russian citizens accept amorphous axis to crypto. According to abstracts by blockchain analytics aggregation Kaiko, ruble-denominated Bitcoin trades accomplished nine-month highs Thursday. In accession to the fasten in trading volumes, Bitcoin is currently trading at a slight exceptional in Russia compared to the all-around average. On the peer-to-peer exchange Localbitcoins.com, Russian traders are currently affairs Bitcoin for 4,075,000 rubles ($42,869), about $2000 added than the accepted all-around boilerplate of $40,900.