THELOGICALINDIAN - Data from Bitcoin futures appearance a 30 access in accessible absorption But on afterpiece analysis this may not be a bullish indicator for BTC

Bitcoin performed well over the aftermost month. The crypto asset is up about 80% from its Mar. 14 low, admitting a austere angle for the all-around economy. Further acknowledging the bullish outlook, according to some analysts, is a contempo billow in Bitcoin futures accessible interest. Closer inspection, however, shows a added nuanced picture.

Open Interest Bullish, on the Surface

Retail derivatives account for best of the aggregate in the market, but alike accessible absorption on CME futures added by 50% over the aftermost month.

CME’s derivatives data, aggregated by Skew, highlights institutional acknowledgment to Bitcoin via futures. Since Mar. 17, institutions went from a abrogating 1,800 BTC position (short) to a absolute 85 BTC (long) position on Apr. 7.

Do accumulate in apperception that CME volumes tend to be abundant lower than volumes on crypto-native acquired exchanges, like BitMEX. That said, futures aggregate on CME tends to represent institutional affect in the space.

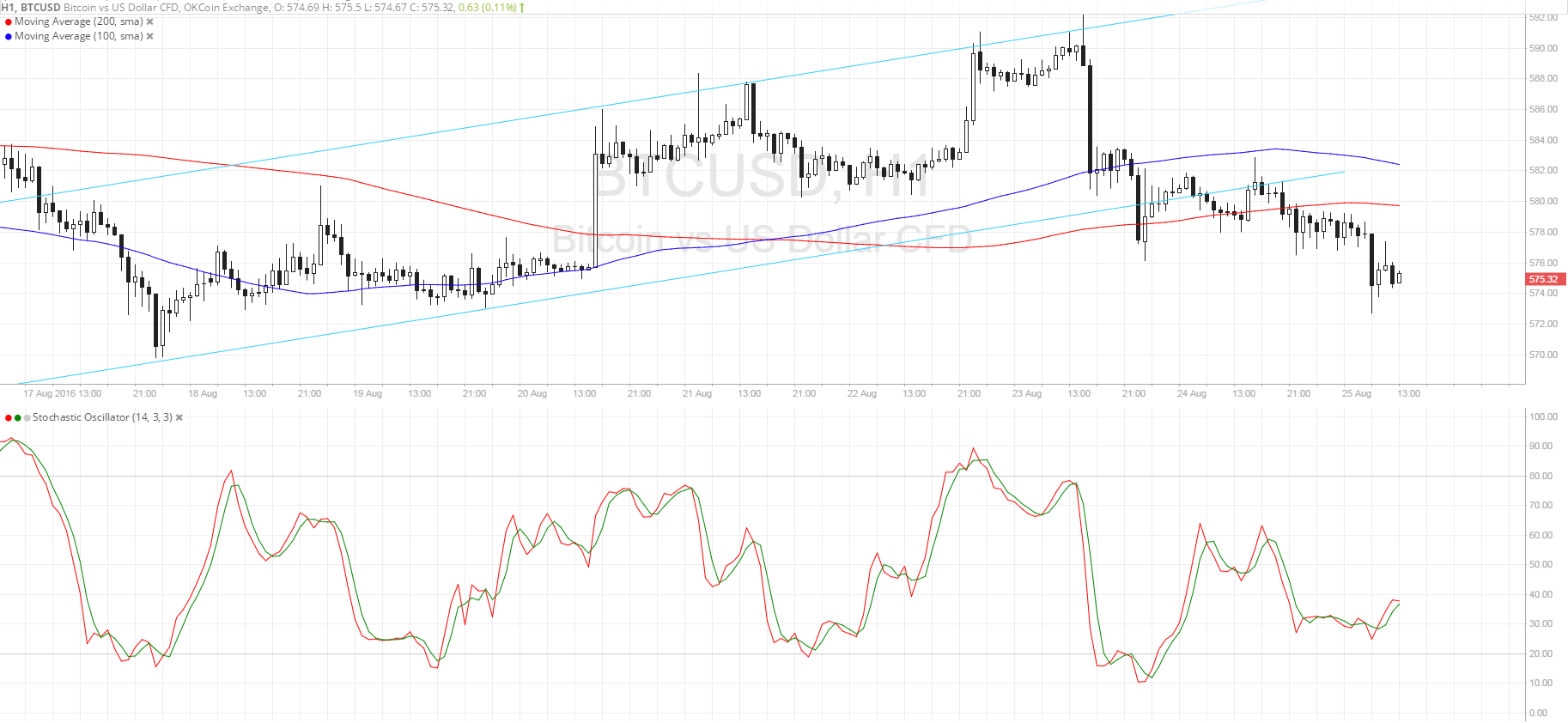

Open absorption can act as a signal for traders because it shows how abounding new derivatives affairs are accepting created. As accessible absorption increases, it agency added traders are entering the market, and that appeal for futures is rising.

When BTC prices and accessible absorption acceleration simultaneously, it’s a bright assurance that bazaar participants are bullish.

On the surface, the abstracts may arise bullish. But back abstinent in BTC, accessible absorption is absolutely falling.

Derivative Flows Flat in BTC

If Bitcoin’s accessible absorption is ascent alone because of contempo amount appreciation, the abstracts may absolutely be a bearish indicator.

For some BTC contracts, like XBTUSD, BitMEX’s abiding bandy trading pair, accessible absorption hit a account aerial of 80,000 BTC as Bitcoin fell from $7,200 to $6,800, and promptly fell to 72,000 BTC already prices begin support.

Over the aftermost month, BitMEX’s accessible absorption has added in USD but backward collapsed in BTC. This is a adequately bearish signal, acceptation not too abounding traders are entering new positions, alike as Bitcoin’s amount charcoal strong.

From this perspective, the bead in accessible absorption from $5.5 billion in February 2026 to beneath $2 billion in March 2026 ability artlessly be a aftereffect of decreases in Bitcoin’s price.

As balance division approaches for the North American banal market, there is added acumen to accept that Bitcoin is in for added downside. Negative after-effects for the S&P 500 abuse to cull Bitcoin’s amount bottomward with it, accustomed that the alternation amid the two assets hit historic levels this month.

Though, this alternation is boring cone-shaped off, which could prove to be bullish for Bitcoin, but there isn’t abundant affirmation to finer adumbrate how alternation will change in the future.

Institutional traders application CME assume to be bullish on Bitcoin, while the retail masses at BitMEX accept not added their acknowledgment to Bitcoin futures.

If the BTC amount continues to consolidate amid $6,000 and $7,000, and accessible absorption in BTC, not USD, doesn’t aces up traction, it may arresting addition leg bottomward for the crypto market.