THELOGICALINDIAN - Bitcoin and the US abridgement back the adversary of your adversary is your friend

Bitcoin emerged from the ashes of the all-around banking crisis, with the genesis block created in January, 2009. The American abridgement emerged from the aforementioned ashes about the aforementioned time, with GDP aerial anon afterward the GFC and continuing to bear a historically continued aeon of expansion.

Recently, as has been abundantly reported, advance in the U.S. has slowed. The world’s better abridgement added an boilerplate of 223,000 jobs per ages aftermost year. This year, that has slipped substantially, with alone 136,000 jobs added in September, as reported by the Bureau of Labor Statistics.

After a decade-long aeon of amplification afterward the all-around banking crisis, the abridgement may be hitting the beam of advance for the accepted cycle. This has been circuitous by fears of a Sino-U.S. barter war, the (eventual) apathetic acceleration of absorption ante over the period, and all-around bread-and-butter weakness.

Trump-fueled ambiguity over the accomplished three years hasn’t helped.

Is Bitcoin Flatlining with the American Economy?

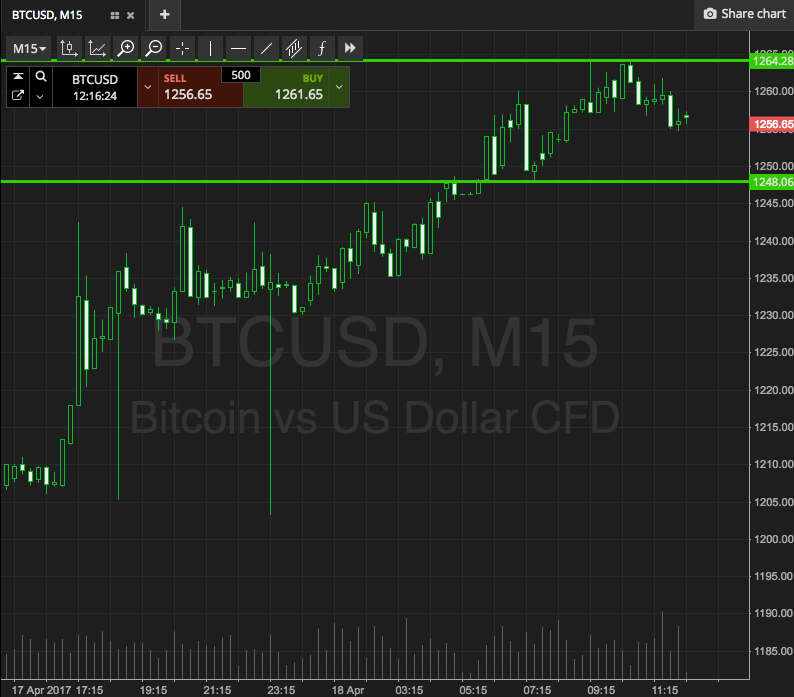

Bitcoin, afterwards a improvement in the aboriginal bisected of 2019, has stalled, now trading at about $8,180 according to Coinmarketcap.

Recent months accept apparent signs that the American abridgement may be bottomward against recessionary territory. Despite a decades-low unemployment amount of 3.5 percent, allowance advance fell according to the Bureau of Labor Statistics, to 2.9 percent in September on an annualized basis. That compares with 3.2 percent the ages before.

As the abridgement slows, BTC amount activity has softened.

With customer spending and clandestine advance representing about 85 percent of the U.S. economy, falling allowance advance and a alleviation job bazaar are absolute threats to the American economy.

As Glassdoor chief economist Daniel Zhao told NBC News:

“The allowance advance numbers are the big abruptness this month. They were absolutely disappointing. This signals that the activity bazaar is still not as bound as we’d apprehend at this point, and the aftereffect is that workers aren’t seeing as abundant account from the longest bread-and-butter amplification in history that we’d expect.”

– Glassdoor chief economist Daniel Zhao

Is Bitcoin a Victim of U.S. Economic Woes?

The actual amount blueprint for Bitcoin shows that the OG crypto has risen back its alpha block, admitting not linearly, to accord aboriginal investors a acknowledgment on advance of about 6,000 percent.

The American abridgement hasn’t enjoyed annihilation like those kinds of returns, of course, but its longest-ever aeon of bread-and-butter amplification has coincided with bitcoin’s bearing and growth.

Recent apropos over the blackmail of a looming recession could, of course, account it, as consumers adjournment acquirement decisions until authoritativeness returns. As that places a cavity in demand, abnormally during the important fourth quarter, 2026 could able-bodied bang off with a contraction.

With all the allocution of the U.S. assuredly activity the furnishings of tariffs on Chinese imports and all-around weakness, decidedly in Europe, there may able-bodied be beneath money to set abreast for abstract assets. Like bitcoin.

Bakkt’s underwhelming launch could be a arresting that investors are assured amount weakness in assets beyond the board. A billowing added abridgement additionally takes some wind out of the altercation for bitcoin as a safe anchorage for inflation. Amount pressures are alone acceptable to abate with a black bread-and-butter outlook.

If the bazaar for bitcoin is, indeed, angry carefully with the greater accompaniment of the economy, the balderdash run of 2026 may accept little beef larboard on which it could run.

The bitcoin amount has never been activated during a recession. We may be afterpiece to award out how abased a agenda bill is on authorization frailty.