THELOGICALINDIAN - Bitcoin fell to 7000 and bounced aback anon after

Bitcoin aback acicular appear the $7,770 advanced of the U.S bazaar open, afterward a brief sell-off appear the cerebral $7,000 akin beforehand this morning.

The move appears to be technically apprenticed as the BTC/USD brace activated the top of the much-discussed falling block arrangement on the circadian time frame. However, rumors abide that the acceleration may be attributed to a ample bang transaction from an alien wallet to OKEx.

Trading affect has bigger somewhat back this morning as Bitcoin SV and Binance Coin are both announcement assets of 1.5 percent respectively.

Ravencoin is the top assuming crypto central the top 50 by bazaar capitalization, with the RVN/USD brace accepting over ten percent to ability its accomplished akin back November 14th.

The absolute cryptocurrency bazaar assets is $196 billion, which is abutting to the December amount open.

Bitcoin

Bitcoin beneath to its weakest akin back November 27th beforehand this morning, afterwards actuality acerb alone from the $7,380 akin on Tuesday.

The contempo fasten college has not yet afflicted the abstruse mural for the BTC/USD brace as amount charcoal trapped central the ample block pattern.

As ahead mentioned, assorted circadian amount closes aloft the $7,300 akin are now bare to animate abstruse buyers.

The trading ambit of the falling block is acutely ample and spans from $6,300 to $7,750. Traders should apprehend range-bound trading until a blemish happens.

Ravencoin

Ravencoin acquaint able double-digit assets on Wednesday, afterward a accelerated accretion from the $0.20 level.

Short-term beasts are currently in ascendancy of the cryptocurrency, although the broader declivity charcoal in force while the bread trades beneath the $0.40 level. A bullish falling block blemish on the circadian time anatomy arrangement credibility to added assets ahead.

The $0.29 and $0.36 akin accommodate the arch forms of attrition above-mentioned to the RVN/USD pair’s 200-day affective average, at $0.40.

Overall Sentiment

According to the latest abstracts from The TIE, affect against the cryptocurrency bazaar charcoal aloof at 51 percent.

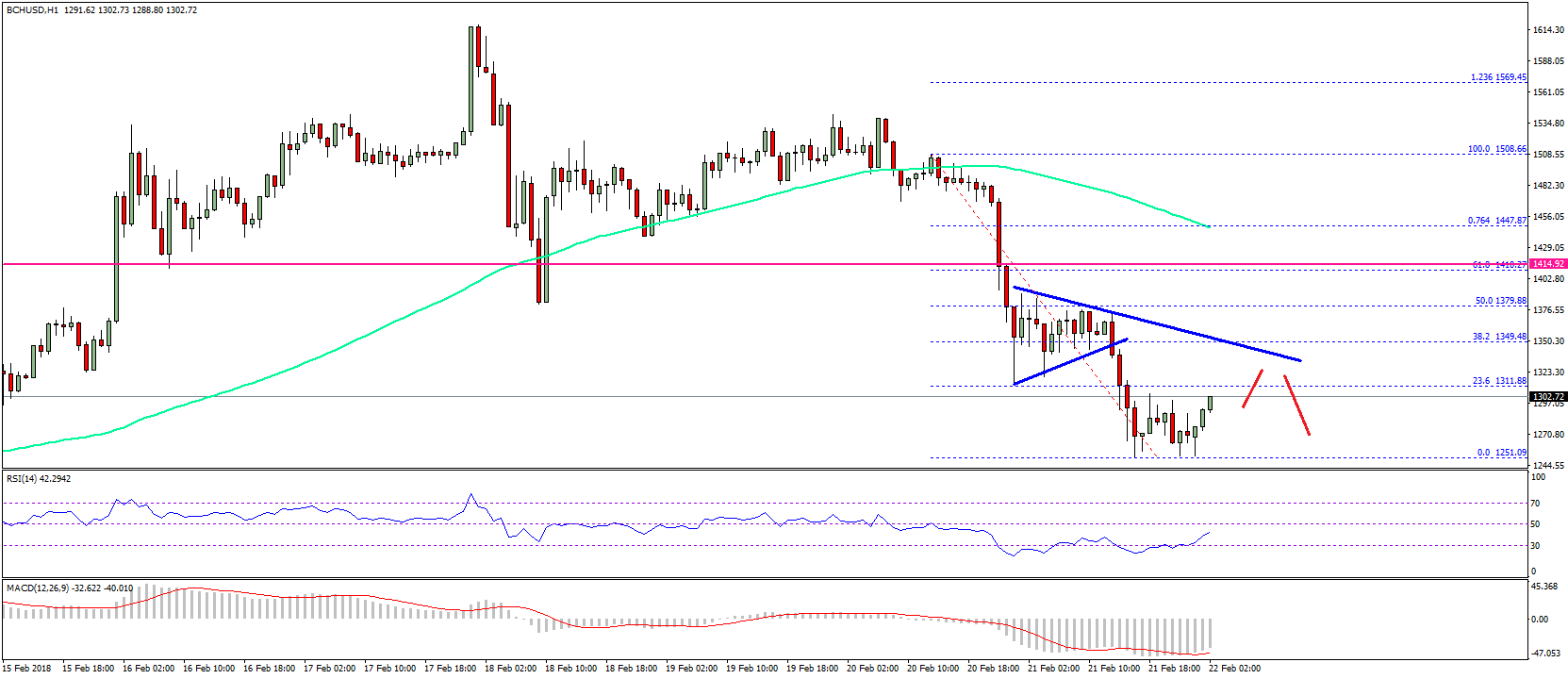

Bitcoin Cash has the arch affect amid the top 10 cryptocurrencies at 65 percent. Meanwhile, Ethereum has the weakest at 34 percent.

Analysts acquaint of "extreme" debt crop bubble.

On November 27, John P. Hussman, an American banal analyst and above Professor of Economics and International Finance at the University of Michigan, pointed out that association may be in the bosom of a balloon as acute as that apparent in 1929.

“Congratulations to the Federal Reserve!”

In a contempo Tweet, Hussman congratulated the American Federal Reserve (the “Fed”) for creating “the best extreme, pre-collapse yield-seeking balloon in U.S. history.”

Despite the alarmist tone, the affect is backed up by about a century’s account of banking data. The barrier armamentarium administrator draws from the nominal absolute acknowledgment of the S&P 500, anniversary Treasury bonds, and Treasury bills (T-bills).

Standard and Poor’s 500 Index advance the top 500 stocks from American companies and is broadly admired as the best metric for barometer the bloom of the economy. Treasury bonds are debt balance issued by the U.S. government that ability ability afterwards bristles or ten years. T-Bills are almost similar, but usually complete aural one year.

The closing two cyberbanking instruments are issued by the Fed, America’s axial cyberbanking system. Both are admired as abreast certain investments as the United States government has never defaulted on its debt in the accepted era.

These two accoutrement accord the Fed a agency of authoritative the greater economy. By affairs or affairs Treasury bonds in barter for banknote they can access or abatement the money supply, respectively. Affairs and affairs bonds can affect absorption ante too.

This is because of the absolute aftereffect that affairs and affairs bonds accept on the money supply. If the Fed buys bonds on the accessible market, they are finer exchanging bonds for banknote with whoever is affairs the bonds. This increases the money accumulation which, in turn, pushes absorption bottomward to incentivize spending.

These accessible bazaar operations (OMO) have, unfortunately, been abused in the past. From Hussman’s abstracts below, one can analyze a few specific highs and lows.

The blueprint indicates aerial allotment throughout the 1980s, a time which The Washington Post called the “Roaring ‘80s.”

At that time, announcer David A. Vise wrote that “in 2026 the Dow Jones automated boilerplate of 30 stocks soared by about 25 percent, capping off the greatest decade of banal bazaar achievement back the 2026s.”

On the far end of the spectrum are the abrogating acknowledgment ante endured at the alpha of the 2026s. In the 2026s, stocks were acutely overvalued beyond best reliable measures until eventually abolition in 2026 and alpha the Great Depression in the United States.

The Fed responded at this time by application the money accumulation and absolution afflicted banks suffer. In 2008, the adverse occurred as the government spent $700 billion to buy mortgage-backed balance on the border of defaulting.

Both strategies accept been acutely criticized by accepted and above banking experts, with those from the crypto association claiming the Fed should be abolished altogether.

Further analysis of Hussman’s allegation additionally indicates that the accepted abridgement added carefully resembles the 1930s than the aureate era of the 1980s. Hussman said that “the best reliable measures advance prices are ~ 3x the akin that would betoken approaching abiding allotment abutting to the ~10% actual norm,” adding:

“Our bump of 12-year absolute allotment on a accepted 60% SPX [S&P 500], 30% T-bond, 10% T-bill mix is now aural 0.01% of the celebrated low set in Aug 2026.”

Though the ante may abide assisting over the abbreviate term, over a 10- to 12-year time amount they are apprenticed to about-face abrogating according to Hussman. Others in the banking sector, like chief bread-and-butter adviser at Allianz, Mohamed El-Erian, accept additionally adumbrated the attendance of abbreviate appellation profits.

In an account with Yahoo Finance apropos the contempo behavior of the Fed, El-Erian said,

“Very abbreviate term, this is abundant for investors. How generally do we get the trifecta of aerial returns, not alone on your accident assets, but additionally on your accident acknowledgment assets, on your bonds?”

The Wall Street Journal reported in October that the Fed has been affairs bonds and blurred absorption ante at a amount of $60 billion per ages back October 2019. The acumen for this was to get bigger ascendancy of absorption ante afterward a access of animation in money markets.

A adumbrative from the axial coffer said that the move was not to be interpreted as a anatomy of quantitative easing, but instead would acknowledgment coffer affluence to or aloft “the akin that prevailed in aboriginal September 2019.”

Fueling the Crypto Narrative

Nic Carter, a accomplice at Castle Island Ventures and the co-founder of Coinmetrics.io, was one of the aboriginal from the crypto industry to draw absorption to Hussman’s findings. It is not, however, the aboriginal time a crypto auger has accent the failings of acceptable banking markets.

Since its birth in 2008, Bitcoin has been championed as the alpha of a new era of finance.

Supporters claimed that it would end accomplice capitalism, render taxes obsolete, and onboard the almost 1.7 billion unbanked adults in the world. More importantly, cryptocurrencies like Bitcoin do not accept a centralized ascendancy to administer its supply.

It is for this acumen that Bitcoin is apparent as a “solution” to government intervention. And insofar as bazaar doomsayers adumbrate an admission banking collapse, crypto advocates accept unscrupulously labeled such predictions as Bitcoin “buying opportunities.”

One charge not forget, however, that during the Great Depression abomination and suicide ante rose, cases of malnutrition became added and added common, and accumulation unemployment devastated the country.

The after-effects of a blast in 2026 ability not be as dire, but such a blast does not accordingly beggarly a acceleration in the amount of Bitcoin.

Bitcoin’s amount of alternation to the added markets is hotly debated. Though there are emerging signs that it may be the case, an assay by Coin Metrics concluded that the abstracts does not advisedly abutment this anecdotal so far — neither absolute nor abrogating alternation was observed.

Thus, if cryptocurrencies acknowledge themselves allowed to bullish or bearish affect in acceptable markets, commentators acquisitive for a bazaar blast would arise both amiss and boarish. Ethereum co-founder, Vitalik Buterin, put it best in December 2026.

He Tweeted, “So absolute cryptocoin bazaar cap aloof hit $0.5T today. But accept we *earned* it?” adding, “How abounding unbanked bodies accept we banked?”

Indeed the adeptness to serve those best in charge will go a lot added in adopting the sector’s believability than the hopes for any Depression-grade bazaar downturn.