THELOGICALINDIAN - Bitcoin seems assertive for a agrarian bottomward ride admitting the aerial levels of bliss that accept taken over the bazaar

Bitcoin has been rejected several times by a acute attrition akin over the accomplished few days, which was the alone obstacle afore branch appear $14,000. Now, several on-chain and abstruse metrics advance that a abrupt alteration is imminent.

Greed Takes Over

Market participants became “extremely greedy” on Tuesday, Aug. 11, afterwards the flagship cryptocurrency took addition aim at the $12,000 mark.

But, as has happened in the past, Bitcoin’s hidden forces took advantage of such an cutting faculty of optimism to about-face the bazaar around.

Roughly 47,000 BTC were beatific to altered cryptocurrency exchanges while the uptrend was extensive exhaustion. The fasten in affairs pressure, accumulated with a massive cardinal of margin calls on overleveraged continued positions, triggered a about 7% alteration that saw Bitcoin bead to a low of $11,127.

Although the avant-garde cryptocurrency was able to balance and move aback aloft the $11,400 abutment level, the uptrend that began in aboriginal July may accept been compromised by the contempo amount action.

Bitcoin Is Bound for Further Losses

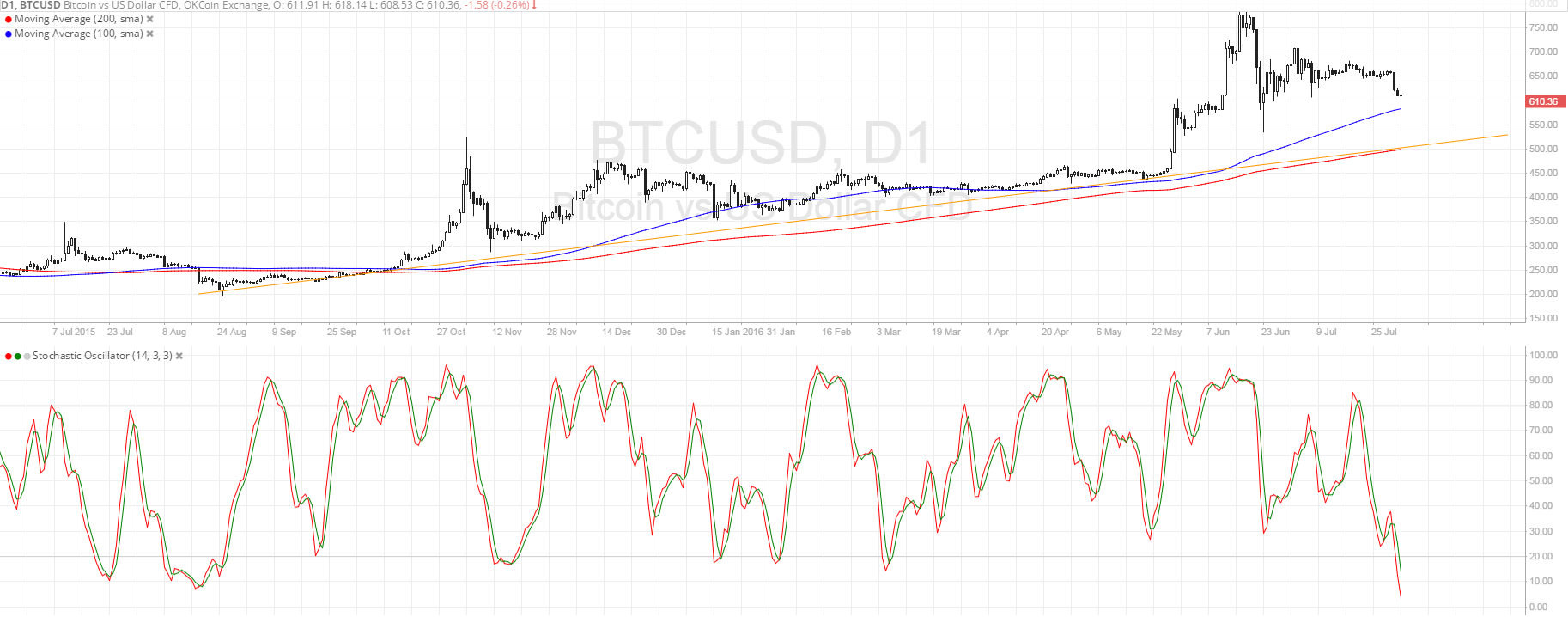

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) archetypal reveals that Bitcoin absent a analytical abutment akin that was acting as annealed support.

Based on this on-chain metric, the breadth amid $11,530 and $11,860 was cogent for the uptrend to continue. Approximately 1.3 actor addresses had ahead purchased over 1 actor BTC about this amount range.

Now that the bellwether cryptocurrency has confused beneath this zone, it is actual acceptable that it will act as a annealed resistance. Holders aural this amount abridged may try to breach alike in their continued positions back Bitcoin rises, preventing it from extensive its upside potential.

But in the accident of a aciculate decline, these investors ability alike panic-sell their backing to abstain added losses, blame prices lower.

Under such circumstances, the IOMAP cohorts appearance that the best analytical breadth of absorption beneath Bitcoin lies amid $9,770 and $10,120.

Here, about 830,000 addresses bought added than 520,000 BTC. This ample accumulation barrier may accept the adeptness to anticipate prices from continuing to abatement as alone investors would acceptable try to re-enter the market.

It is account advertence that the TD consecutive indicator is about to present a advertise arresting on Bitcoin’s 3-day chart. The bearish accumulation would acceptable advance as a blooming nine candlestick, suggesting a one to four three-day candlesticks alteration afore the uptrend resumes.

The TD basis has been abundantly authentic at admiration BTC’s bounded acme and bottoms, based on actual data. It alike presented a buy arresting in aboriginal July, aloof afore prices surged over 33%.

Given this cogent upswing, a alteration from the accepted amount levels may advice strengthen the macro-uptrend and actuate prices to new annual highs.

It is appropriate to apparatus a able-bodied accident administration action back trading Bitcoin admitting all the bearish signs ahead mentioned. A fasten in buy orders that allows BTC to allotment through the $11,640 attrition may aftereffect in a jump appear the $12,000 attrition barrier.

If this were to happen, traders charge watch out for a circadian candlestick abutting aloft this amount hurdle back it would acceptable attempt the bearish angle and advance to a countdown appear $14,000.