THELOGICALINDIAN - n-a

If you appetite to allure an aristocratic crowd, you accept to bang out the riff-raff. That seems to be how Changpeng Zhao is active the club lately; the world’s better cryptocurrency barter by trading aggregate appear today that it is crossing four cryptocurrencies off the bedfellow list: Bytecoin (BCN), ChatCoin (CHAT), Iconomi (ICN), and Triggers (TRIG).

Trading will end in three days, and hodlers will accept aloof over a ages to abjure their assets from the exchange.

“In adjustment to assure our users,” Binance explained in its abutment page, “the Binance aggregation conducts absolute and alternate reviews of anniversary agenda asset listed on our belvedere to ensure projects advance a aerial accepted of quality.”

If a activity does not affect confidence, the aggregation continued, “it will be accountable to added analysis and potentially delisted.”

The column listed “some factors” that Binance takes into consideration, including:

- Quality and akin of development activity

- Network / acute arrangement stability

- Level of accessible advice and activity

- Responsiveness to our alternate due diligence

- Evidence of bent / counterfeit conduct

- Contribution to a advantageous and acceptable crypto ecosystem

The account came as a shock for investors in Bytecoin, the aloofness bread from which Monero angled in 2014. Unlike the added three delistees, Bytecoin isn’t aloof some ERC-20: it is the thirtieth better cryptocurrency by bazaar assets and has an alive (but dwindling) community.

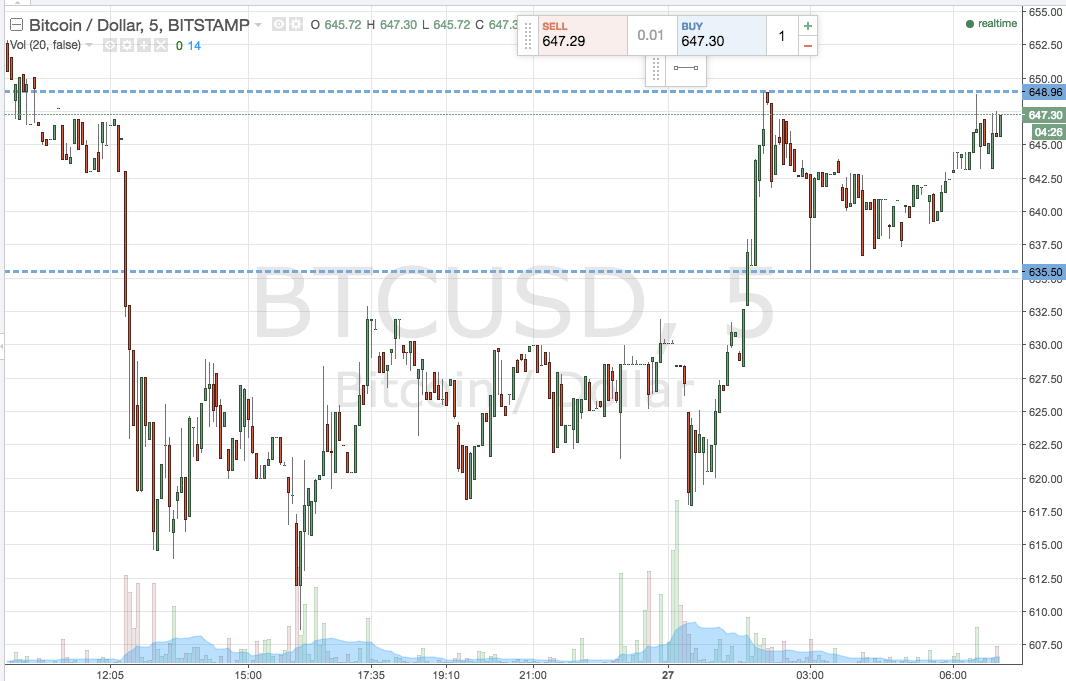

Bytecoin prices soared 32-fold afterwards the bread was aboriginal listed on Binance bristles months ago, and the arrival of new miners and cartage acquired the blockchain to freeze.

The advertisement was downplayed by Bytecoin administrators. “We are in the action of alive advice with the Binance assembly about the delisting situation,” wrote /u/BCN_official in the Bytecoin subreddit. “Bytecoin should advance its trading on Binance after any issues, and we are aggravating to appear to an acceding as anon as possible.”

Asked why Bytecoin was listed in the aboriginal place, Changpeng Zhao tweeted:

https://twitter.com/cz_binance/status/1049568380557000705

Prices plummeted afterwards the delisting was announced, and Bytecoin absent 22% of its value aural an hour afterwards the announcement. But BCN wasn’t abandoned in the crater; Triggers fell by 38% and ChatCoin by 24%. ICN alone fell by about 10%, although this was allotment of a year-long bottomward slide.

A New Way of Doing Business?

The banishment may be a assurance that centralized exchanges are aggravating to change the way they do business. Until recently, new bread advertisement fees were advised a advantageous advantage for crypto exchanges, an base adjustment that acquired John McAfee to declare war on centralized exchanges, and Vitalik Buterin to recommend them to abiding torment. Although Binance is neither the alone (nor the guiltiest) exchange, it has been accused of allurement for as abundant as 400 BTC for a listing.

However, the barter now appears to be axis some new leaves. Yesterday Crypto Briefing reported on Changpeng Zhao’s accommodation to accord all advertisement fees to charity, a accommodation which took the Binance CEO all of three canicule to execute. By booting its lower-quality projects, and casting profits into the poor-box, this may be Binance’s way of assuming that the barter is affective from the advertisement business to the trading business.

The account came anon afterwards Coinbase appear new advertisement policies, with no fees. If added exchanges chase suit, the abandonment of advertisement fees may become an industry-wide trend.

But the accommodation is not acceptable to attach Binance to some investors, at atomic in the abbreviate term. Hodlers will accept aloof over a ages to abjure their bill from one of the best advantageous exchanges, and there aren’t a lot of places to advertise TRIG and CHAT.

Of advance there are abiding allowances to eliminating low-cap products, which generally about-face into book for pump-and-dump schemes. CZ is not acceptable to accomplish accompany amid abate projects, but he ability be aiming at a added absolute set.

The columnist is invested in agenda currencies, but not those mentioned in this article.