THELOGICALINDIAN - CEL acicular again plummeted today during whats been an active few canicule for Celsius

The afflicted crypto lender Celsius saw its CEL badge surge—then crash—today in an credible abbreviate clasp event. The move may accept been triggered by signs of solvency on a wallet accounted to accord to Celsius.

Celsius Shorters Suffer

Celsius’ CEL badge briefly acicular afore abolition today as the close faces rumors of accessible insolvency.

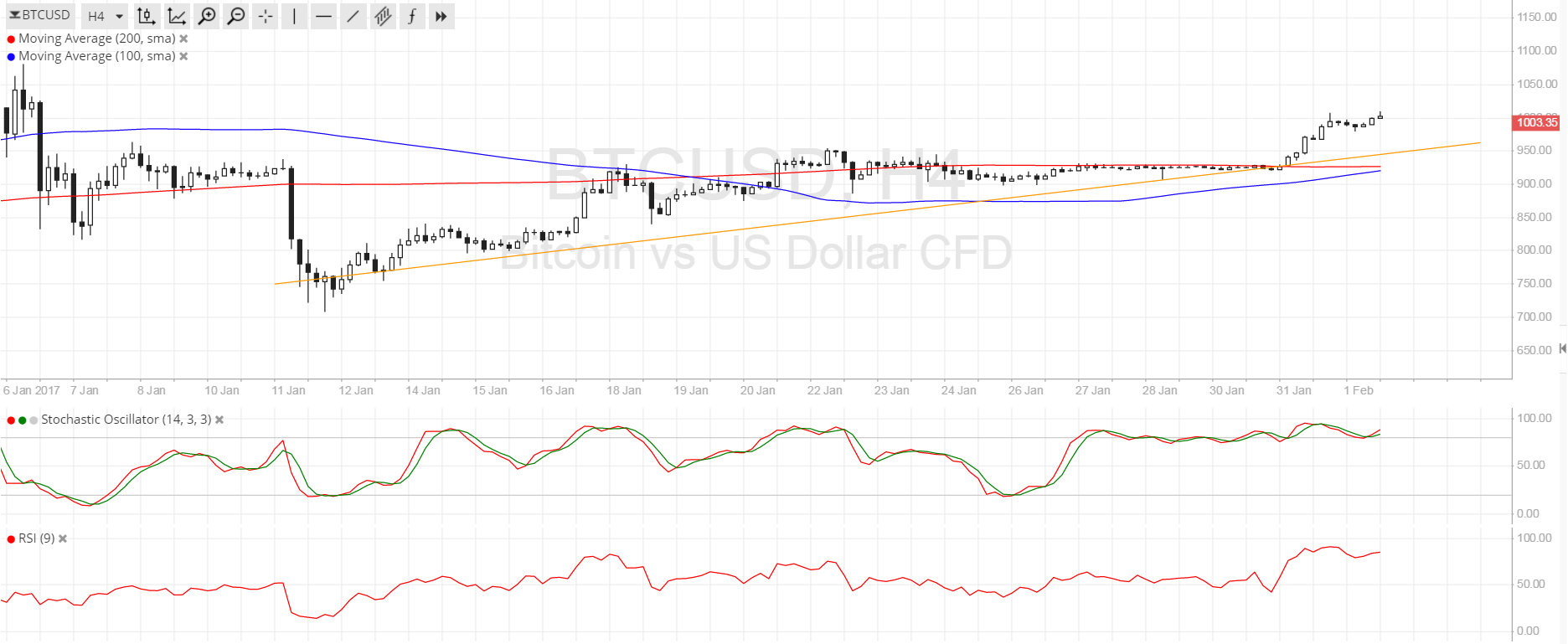

CEL comatose with the broader crypto bazaar Monday on the account that Celsius had paused chump withdrawals. It briefly traded as low as $0.095 afore convalescent to about $0.33 today. It again jumped over 300%, topping $1.42 on assorted exchanges. It hit $1.65 in the CEL/wETH clamminess basin on Uniswap V3, while FTX registered a aerial of $2.57. However, the badge comatose as bound as it jumped and started to collapse account later. It’s trading at about $0.57 at columnist time.

The move looks to be what’s accepted as a “short squeeze,” area a abrupt fasten armament bazaar participants who are abbreviate on an asset to buy aback their position at a college price. When abbreviate squeezes occur, a domino aftereffect ensues, blame prices higher. In this instance, CEL jumped again bound plummeted.

Celsius is a crypto lending belvedere best accepted for alms barter yields on assets like Bitcoin and Ethereum. CEL offers barter allowances such as rewards and discounts on Celsius loans.

The close has been adverse clamminess issues as the bazaar trends down, which is why froze chump withdrawal, swaps, and transfers Monday citation “extreme bazaar conditions.” Rumors of the firm’s accessible defalcation had broadcast the crypto amplitude for weeks, but the firm’s CEO Alex Mashinsky has again denied the claims.

Today’s abbreviate clasp may accept been triggered by contempo action on a MakerDAO basement rumored to accord to Celsius. MakerDAO is an Ethereum-based DeFi agreement that lets users excellent DAI back they drop collateral. The wallet associated with the basement was facing defalcation of its captivated Bitcoin collateral, but on-chain data shows that it deposited $28.1 actor account of DAI into the basement at 14:58:32 UTC.

Market participants may accept interpreted the DAI drop as affidavit of the firm’s solvency alike admitting it has not been accepted whether the wallet belongs to Celsius or not. After the spike, CEL is up from Monday’s low. Nonetheless, it’s still 92.9% abbreviate of its peak, and Celsius withdrawals are still paused.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.