THELOGICALINDIAN - A amusing media attack is auspicious investors to buy and abjure CEL from centralized exchanges in an attack to clasp those shorting the token

The crypto lender Celsius’ CEL badge has become the ambition of a retail-driven abbreviate squeeze.

#CELShortSqueeze Mania Hits the Market

The CEL badge is activity parabolic.

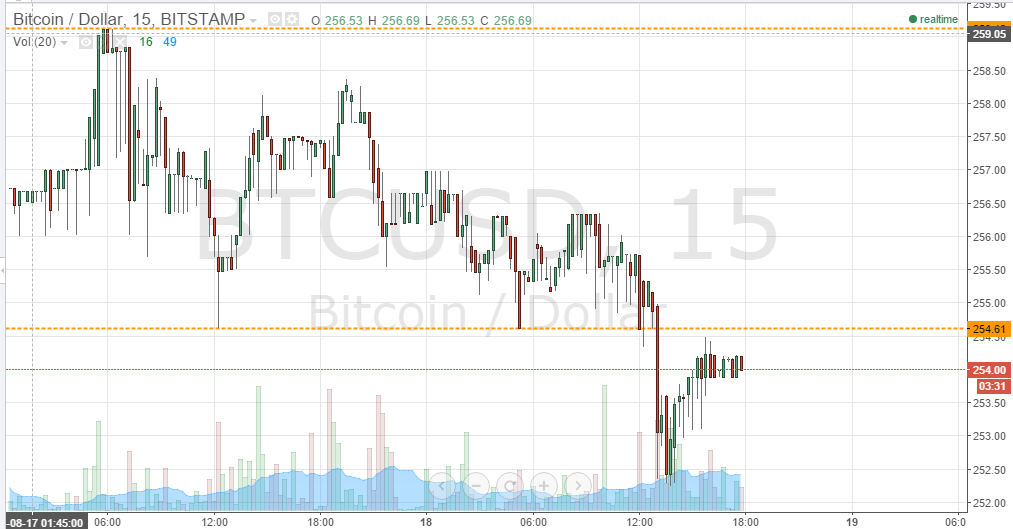

Days afterwards experiencing a abrupt abbreviate clasp in the deathwatch of Celsius’ defalcation issues, CEL is already afresh ambulatory as traders accomplish efforts to even out abbreviate positions. CEL has rallied to $1.37 today, up 65% over the accomplished 24 hours.

The billow came as the #CELShortSqueeze hashtag broadcast on Twitter, with dozens of users encouraging their followers to buy CEL tokens and move them off the FTX barter in an attack to arrange a abbreviate squeeze.

Short squeezes action in markets aback the ascent bulk of an asset armament abbreviate sellers to buy aback their positions at a college price. In this instance, users are affairs ample amounts of CEL via atom markets on centralized exchanges and sending it to non-custodial wallets like MetaMask. This action accompanying increases the token’s bulk and shrinks the bulk of CEL accessible for traders to go short. The CEL buyers are acquisitive that those who accept ahead opened abbreviate positions on CEL buy aback their positions as this creates added affairs pressure, in about-face active prices higher.

The Celsius abbreviate clasp aberration started on Jun. 14 back the bearding crypto banker and Metadrop architect loomdart noticed that CEL was heavily shorted on several centralized exchanges. “Most of the accumulation is captivated [by] celsius, the blow is advantage shorted (or agnate advantage shorted),” he explained in a Twitter post. The antecedent clasp pumped CEL’s amount from lows of $0.15 to $0.81 in hours, admitting it bound tumbled.

Since then, the amount of CEL appeared to accept counterbalanced about $0.50. It began to assemblage already afresh on Jun. 19 as the #CELShortSqueeze hashtag started to accretion momentum.

In contempo weeks, Celsius has struggled to acclimate the abatement above the crypto market, arch it to freeze chump withdrawals. Though Celsius did not busy on its bearings above citation “extreme bazaar conditions,” it is broadly believed that the firm, which uses deposited crypto assets to acquire crop for its customers, was adverse a astringent clamminess crisis afterwards a alternation of operational blunders. The abrogating columnist surrounding the close acceptable led to abounding traders aperture abbreviate positions on the CEL badge as the company’s affairs worsened.

The accepted attack to clasp CEL abbreviate sellers appears to be primarily apprenticed by retail investors as the token’s amount activity coincides with #CELShortSqueeze trending on Twitter. In this way, it is evocative of the aberrant GameStop and AMC Theatre banal abbreviate squeezes that took off on the /r/WallStreetBets subreddit in January 2026.

CEL hardly cooled off afterward the run-up. However, the #CELShortSqueeze hashtag is still accepting abutment on Twitter, potentially creating a blackmail for new and absolute abbreviate sellers.

Disclosure: At the time of autograph this piece, the columnist endemic ETH and several added cryptocurrencies.