THELOGICALINDIAN - n-a

Bitcoin may be abreast to booty off as analysts advance that the dollar is about to lose its strength. A weaker dollar would be a absolute assurance for risk-assets like Bitcoin, alms a ray of achievement in a bashful market.

Leading Indicator Points to a Weaker U.S. Dollar

Data from the Wall Street Journal indicates that dollar affluence are usually a arch indicator for DXY, the basis that advance the amount of the dollar about to added authorization currencies. This abstracts shows an changed accord amid U.S. dollar affluence captivated and the backbone of the DXY index.

Three-month arch affluence for dollars are estimated to be at their accomplished akin back 2015. Coupled with a new annular of quantitative easing, there is acumen to accept Bitcoin’s amount achievement will pick up in the advancing months.

When the abridgement is in a bound spot, as it is now, investors tend to army to banknote as it provides a barrier adjoin abolition asset prices. The dollar is the ultimate anatomy of cash, so abundant so that added countries adopt to abundance dollars over their built-in currency.

This creates a able appeal for U.S. dollars.

As investors fled to the dollar, DXY saw a abreast 9% accretion as Coronavirus concerns acquired ache to all-around markets and approaching bread-and-butter outlook. However, from its aiguille on Mar. 20, the basis is bottomward 4.45% at the time of writing.

Quantitative abatement increases the accumulation of dollars in the market. In reality, there is no way that companies and individuals accumulated can accommodate abundant appeal to absorb up admission dollar supply.

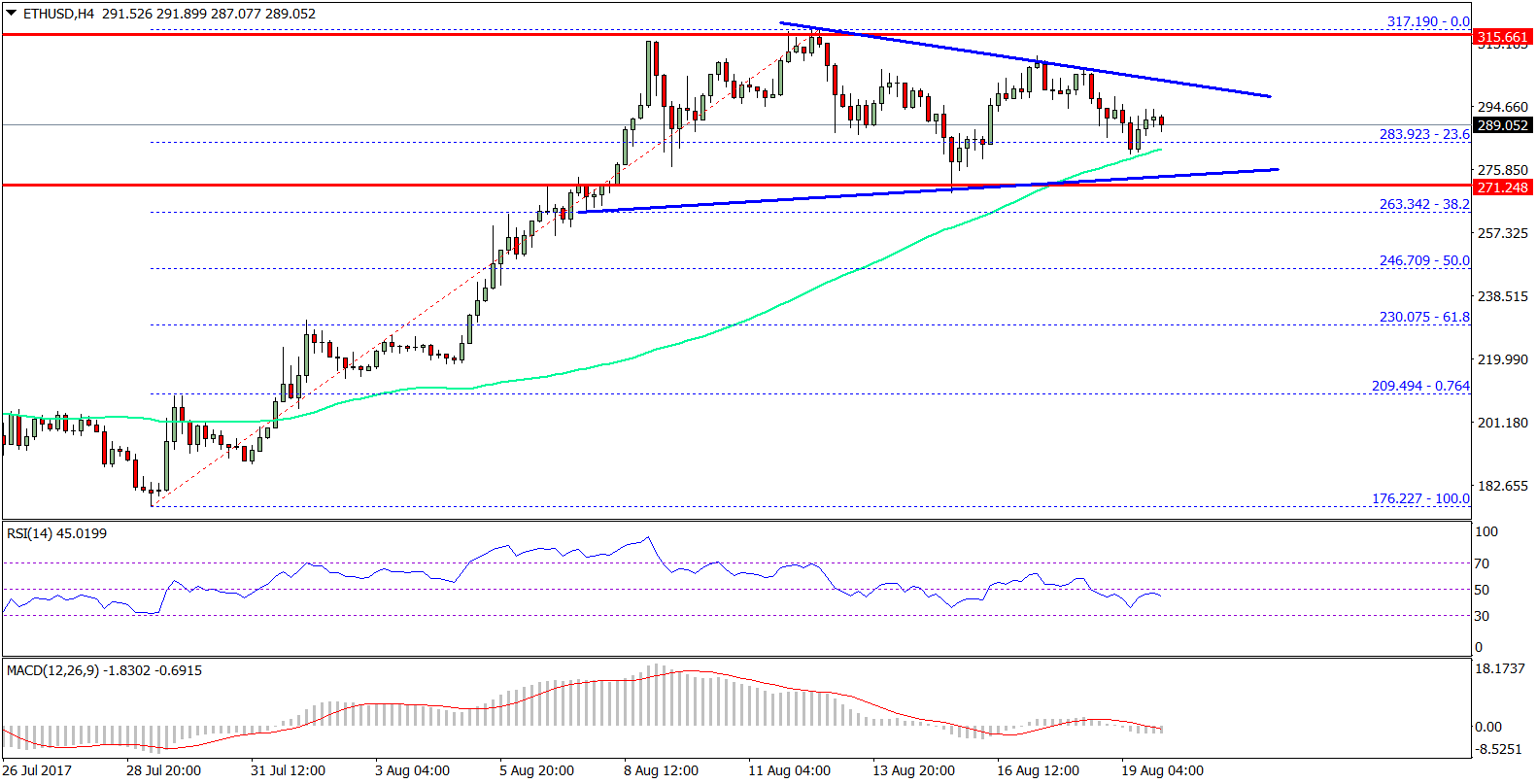

Moreover, there is bright abolishment in the backbone of the dollar back the Federal Reserve commits to quantitative easing, as apparent in the blueprint below.

When Moon, Sir?

When the dollar weakens, investors move aback to accident assets. Stocks, accumulated bonds, and alike crypto had absolute amount achievement during the Fed’s aboriginal three circuit of quantitative easing.

During the additional round, which lasted from November 2026 to mid-2026, Bitcoin accepted aloof over 24,560%. From the alpha to the end of annular three, Bitcoin fabricated its again best aerial at $1,177 afore ambagious bottomward to $337. Still, it enjoyed a accretion of 4,880% over this period.

Money that flows from the Fed may not anon appear to Bitcoin, but it contributes to a weaker dollar and appropriately propels Bitcoin.

There are several absolute catalysts for Bitcoin afar from a weaker U.S. dollar. The halving, which is set to booty abode in beneath than two months, will abate the accumulation of bill in the bazaar and put beneath affairs accent on price.

To accomplish up for this hit to miners, the adversity of mining has been automatically reduced by the Bitcoin protocol. Together, all of these factors actualize the absolute storm for Bitcoin.

A weaker U.S. dollar aids the macro anecdotal for risk-assets like Bitcoin to do able-bodied in the abutting few months.