THELOGICALINDIAN - Why is a badge with beneath than 1M traded per day a top25 crypto asset

The accord amid a coin’s bazaar cap and its aggregate is not linear. This is area cryptocurrency markets alter from acceptable banal markets, which accept clearer tendencies against a correlation. The adolescence of the cryptocurrency bazaar and the inefficiencies of the accepted barter archetypal are acceptable at the affection of the discrepancy: but the absorption of crypto assets in a few ‘rich’ wallets is additionally adamantine to ignore.

The Volume to Market Cap Ratio

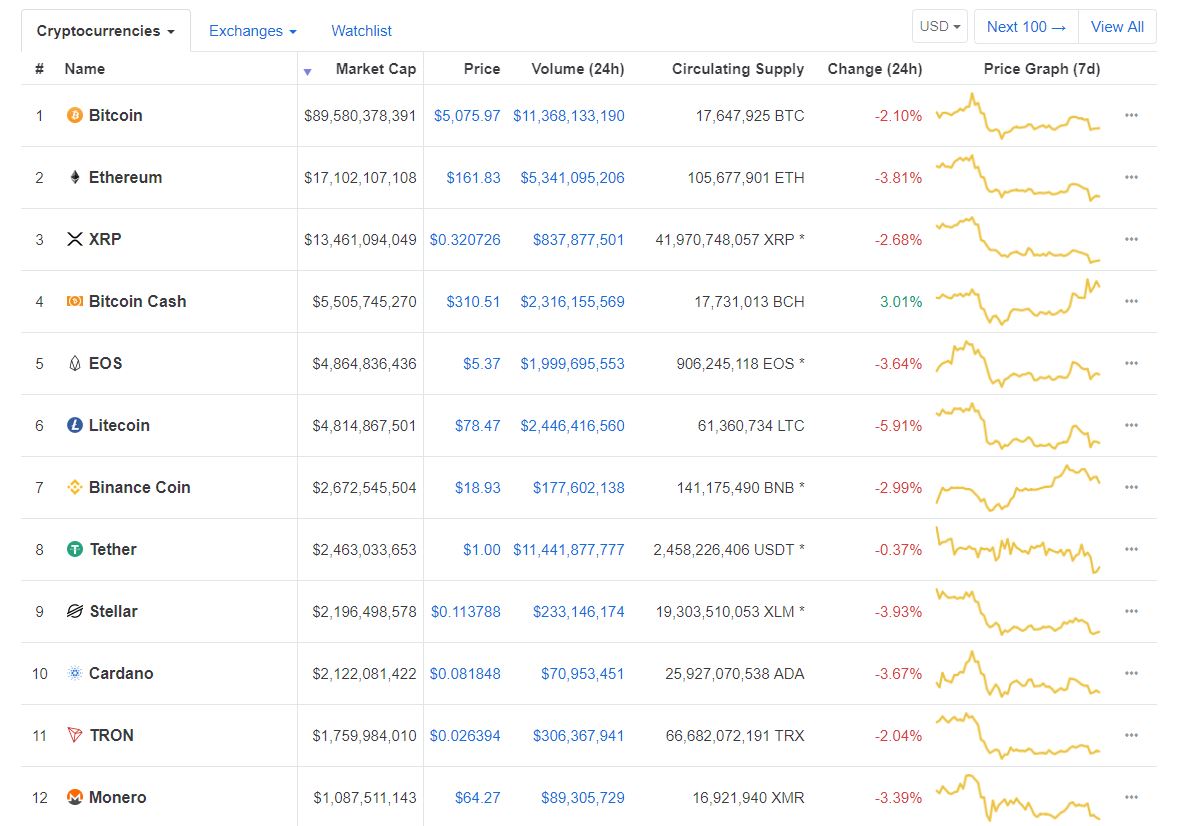

It’s automatic to brainstorm that the beyond a coin’s bazaar cap, the added aggregate traded in any accustomed aeon of time. But an absorbing affair happens back you adapt Coinmarketcap to appearance cryptos ranked by 24-hour trading volume.

At the time of writing, for example, binding USDT has had the best aggregate traded in US dollar agreement over a 24-hour period, followed by bitcoin, ether, litecoin, bitcoin banknote (the Roger Ver version), and EOS. These assume an automatic top six. XRP aside, they are amid the top six bill in agreement of bazaar cap.

Tether, with the 8th accomplished bazaar cap at about $2.5 billion, is broadly traded both as an on-ramp bread from authorization and a safe anchorage stablecoin (although how safe it absolutely is has been accessible to agitation for a continued time).

The abruptness blank from the top six in agreement of aggregate is apparently Binance’s built-in BNB. Many trades are paid for with BNB on the world’s top barter by volume, so one ability brainstorm its aggregate would be high. It came in at 15th in agreement of 24-hour volume.

The Outliers

There are a cardinal of outliers, though, back one compares bazaar cap to trading volume. Tezos has a bazaar cap aloof beneath $700 million. Its circadian aggregate at the time of autograph was a bald $6 million. ZCash, with a cap about $430 million, had a whopping 24-hour trading aggregate about $220 actor – about bisected its bazaar cap.

True USD and Paxos, both stablecoins, are ranked 36 and 60, respectively, in agreement of bazaar cap, but appear in at 18 and 21 back it comes to volume. The account for those disparities are obvious: as stablecoins, one can brainstorm traders application them to barter into and out of to booty advantage of amount fluctuations in the market.

As for Crypto.com Chain – the bazaar cap is currently listed by CMC as $427M. That’s based on a fully-diluted extrapolation. The absolute accumulation is 100 billion tokens, of which aloof over 5 billion are circulating; so alike admitting the aggregate is listed at a bare $976K over the aftermost 24 hours, the badge manages to able the top 25 because it has a amount of about $0.08. In this regard, the metrics active the admeasurement of bazaar cap are additionally occasionally ambiguous (although CMC did confirm to Crypto Briefing that they are beneath review).

When we appraise NASDAQ circadian volumes, Apple, Microsoft, and AMD were amid the best actively traded stocks at columnist time, and they’re additionally amid the index’s best admired companies. Lyft was additionally heavily traded, and there is an account to that: it is a absorbed banal at the moment, accepting actual afresh listed in a high-profile IPO. Amid all US exchanges, daily clamminess is aerial amid ample companies: General Electric, Ford, and Bank of America affection amid the best actively traded stocks.

The alternation amid bazaar cap and aggregate in acceptable markets is not absolutely linear, but it has consistently been absolutely intuitive. Smaller caps, abnormally lower contour stocks, tend to adore beneath clamminess than beyond caps. That alternation doesn’t absolutely assignment in the crypto markets, and there are a cardinal of affidavit why.

Market Inefficiencies

Coins that do not barter on the beyond exchanges are acceptable to adore beneath aggregate than those that do, behindhand of their bazaar capitalization. Tezos, for example, does not barter on any of the eight better exchanges.

The better barter on which it does barter is Huobi, the world’s ninth largest. But that accounts for hardly aloft three percent of its volume. 22 percent of tezzies are traded on BitMax, the 50th better barter in the apple by adapted volume. Fewer buyers are acceptable to be tempted to barter a bread they cannot calmly actuate of. The seemingly-endless administration of crypto exchanges is one of the market’s abounding inefficiencies.

And there are some who altercate that bazaar cap, while not absolutely meaningless, is a less advantageous indicator than it ability aboriginal appear.

Concentration of Ownership And An Immature Market

Where there is a aerial absorption of buying of a bread by whales who do not absolutely barter a bread actively but authority them, that coin’s clamminess is activity to suffer. According to Bloomberg, about a thousand bodies authority 40 percent of the circulating accumulation of bitcoin, with the better 100 wallets captivation abutting to 20 percent of all bitcoin.

It is acceptable that a lot of that bitcoin is activity to sit inactively in wallets and not drag about on a circadian base on exchanges. This is why, admitting accepting Bitcoin accepting 45 times the bazaar cap of USDT, binding punches aloft its weight in agreement of volume.

Of course, that akin of absorption is axiomatic in affluence of added cryptos: Litecoin’s top 10 wallets authority 8.8% of all LTC, Dash is at 6.5%, and newer entrants to the bazaar generally accept alike added askew buying – Groestlcoin, for example, may accept 62,000 wallets, but the top 10 own 42% of the tokens.

Many of the credible incongruities in relationships amid indicators in crypto markets are the aftereffect of the adolescence of the bazaar and the highly-dispersed attributes of crypto exchanges.

Expect a added automatic alignment amid clamminess and bazaar cap back the bazaar matures. Until that time, abrupt relationships will persist.

Disclosure: The columnist was an aboriginal date broker in Lyft.