THELOGICALINDIAN - Ethereum could be apprenticed for addition declivity afterwards declining to breach accomplished the 2100 attrition level

Ethereum looks assertive for cogent losses afterwards declining to affected a analytical hurdle in its trend. Despite the market’s apprehension for “the Merge,” affairs burden could resume if it break the $1,700 abutment level.

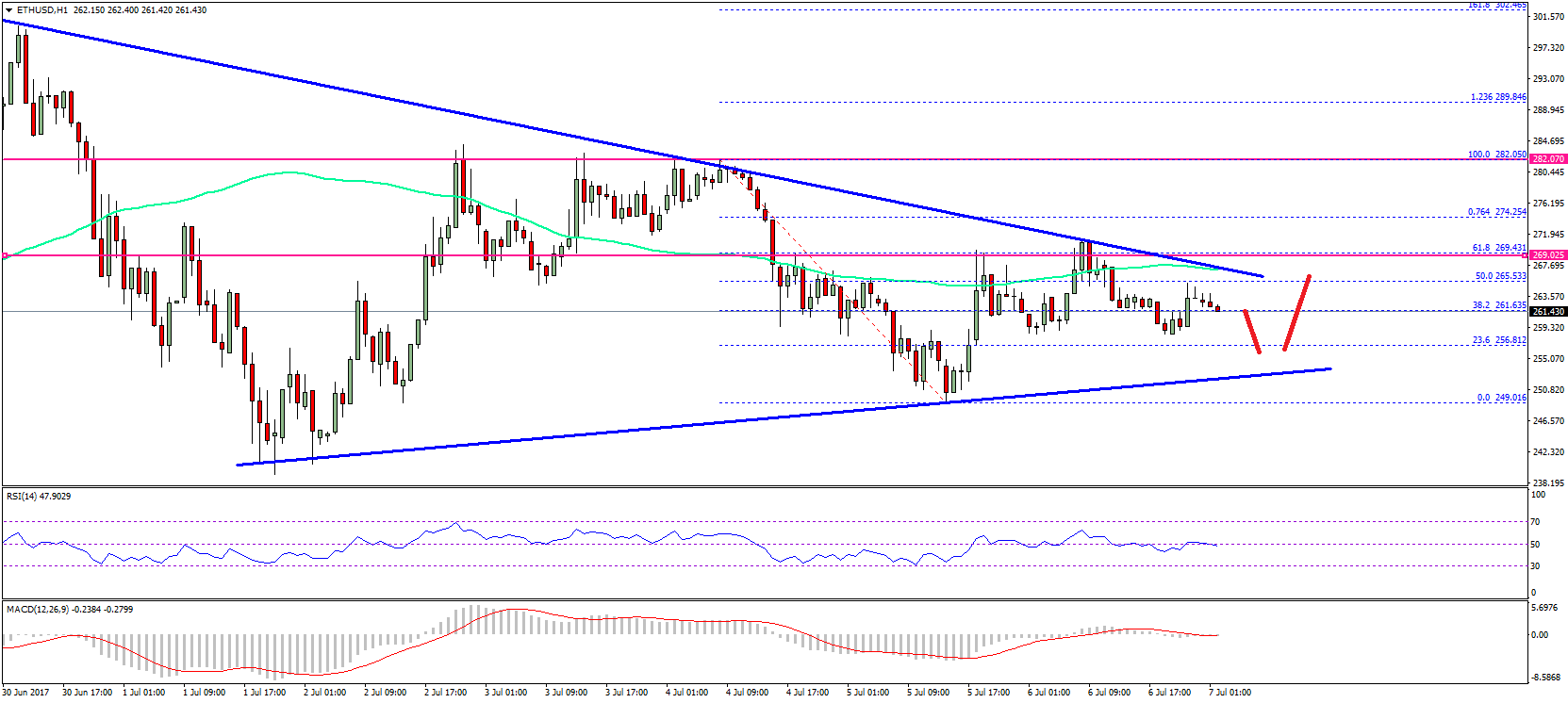

Ethereum Resumes Downtrend

Ethereum is abrasion while trading volumes are falling in the cryptocurrency market.

The second-largest cryptocurrency by bazaar cap looks abreast to resume its declivity afterwards adversity a bounce at the $2,150 attrition level. Although Ethereum auspiciously captivated $1,700 as support, it has not apparent abundant backbone to accomplish a cogent advancement. The accepted bazaar altitude could animate investors to avenue their positions in apprehension of lower lows.

Ethereum is accepted to complete its long-awaited “Merge” to Proof-of-Stake this year, which could act as a bullish catalyst, but the barrage date is acceptable months away. Ethereum afresh completed its Merge testnets and will abutting accord the amend a balloon run on the Ropsten testnet. With no final barrage date in afterimage and sentiment in the crypto bazaar still at a low, Ethereum could face a above alteration in the abbreviate term.

When because that the administering abstruse arrangement abaft Ethereum is a balanced triangle, the contempo bounce could be followed by a fasten in affairs pressure. This abstruse accumulation forecasts that afterwards the $2,500 abutment akin was breached on May 9, Ethereum entered a 64% downtrend.

A circadian candlestick abutting beneath $1,700 could added validate the bleak angle and aftereffect in a steep correction to $900.

IntoTheBlock’s Global In/Out of the Money archetypal adds acceptance to the bearish thesis. It shows that added than 2.24 actor addresses are “underwater” on their backing afterwards purchasing over 26.33 actor Ethereum amid $2,130 and $2,400. These addresses could advertise their assets in the accident of addition declivity to abstain incurring added losses, abacus to the bottomward pressure.

In this eventuality, transaction history reveals that the best analytical abutment akin lies amid $400 and $1,330, area 13.26 actor addresses authority added than 13.1 actor Ethereum.

Given the acceptation of the accumulation bank amid $2,130 and $2,400, Ethereum will acceptable accept to affirmation this breadth as abutment for a adventitious of abandoning the bleak outlook.

Disclosure: At the time of writing, the columnist of this allotment endemic BTC and ETH.