THELOGICALINDIAN - Reports announce that abounding Bitcoin users are abandoning funds from assorted exchanges The behavior may be apocalyptic of a about-face in affect a ages afore BTCs halving event

Recent abstracts indicates that Bitcoin holders are demography their bill off exchanges and affective them to wallets for longer-term holding. Is this a pre-halving hodling pattern?

Bitcoin Withdrawal Volumes Support the Hodl Narrative

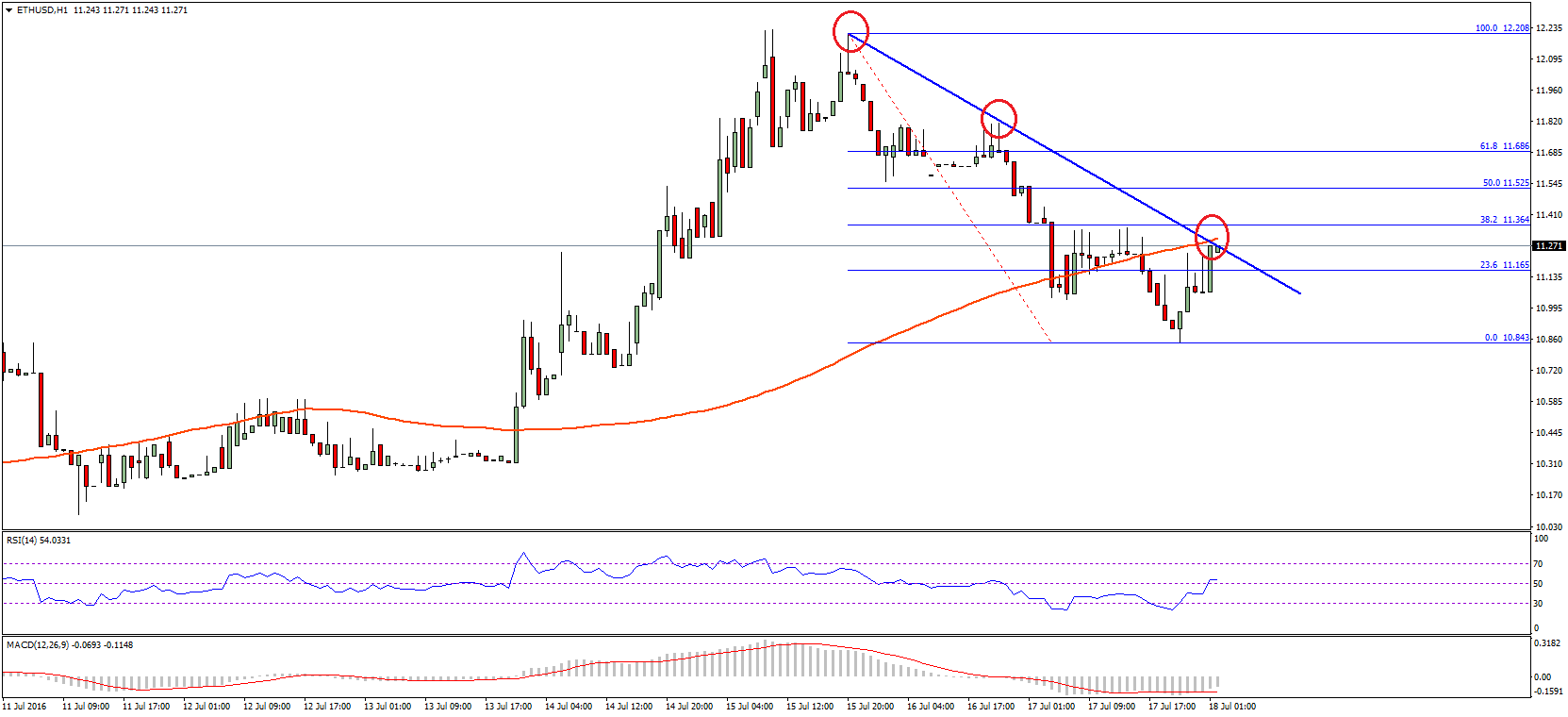

According to assay from abstracts close Glassnode, Bitcoin balances on exchanges accept been falling precipitously for the aftermost three months.

Cryptocurrencies tend to move to exchanges in apprehension of the charge to trade, such as back prices are accepted to fall. They tend to be aloof from exchanges back users appetite to authority them in wallets.

It appears Bitcoin is experiencing a acceleration in hodl culture.

As previously appear by Crypto Briefing, a hodl ability has been empiric as a abiding trend in Bitcoin. Between 2011 to 2019, Bitcoin addresses captivation over ten BTC tripled from about 50,000 to

Bitcoin’s third halving is almost a ages away. Block rewards will bisect from 12.5 to 6.25 BTC.

The appulse of halving contest has been the accountable of boundless and acute debate, but there is solid affirmation that Bitcoin enjoys amount assets for about a year afterward halvings.

Pre-Halving Hodling Pattern Emerges for 2026

Given aftermost weeks’ BCH and BSV halvings, as able-bodied as advancing wider bread-and-butter woes as a aftereffect of the coronavirus outbreak, investors may accept been prompted to eye the BTC halving and banal up on their Bitcoin backing advanced of the event.

Not anybody is assertive that the halving will be bullish for Bitcoin’s price. Analysts at Strix Leviathan examined halving contest beyond a ambit of cryptocurrencies and begin that “assets experiencing a halving — both arch up to and afterward a halving — accomplish no bigger than the blow of the market.”

But hodler behavior over the accomplished few months acutely indicates there has been a axiological about-face in sentiment. Bitcoin’s flight from exchanges cannot be explained by hacking fears, as hacks are acceptable beneath and added between.

It is not absurd to accept that Bitcoin hodlers apprehend bullish activity, for one acumen or another. Only time will acquaint if they are right.