THELOGICALINDIAN - Several socalled DeFi dejected chips arise assertive to accomplish a comeback

Ethereum DeFi protocols Aave, Maker, and Synthetix accept apparent their tokens assemblage on the aback of new agreement upgrades and proposed advance strategies.

DeFi Blue Chips Bounce Back

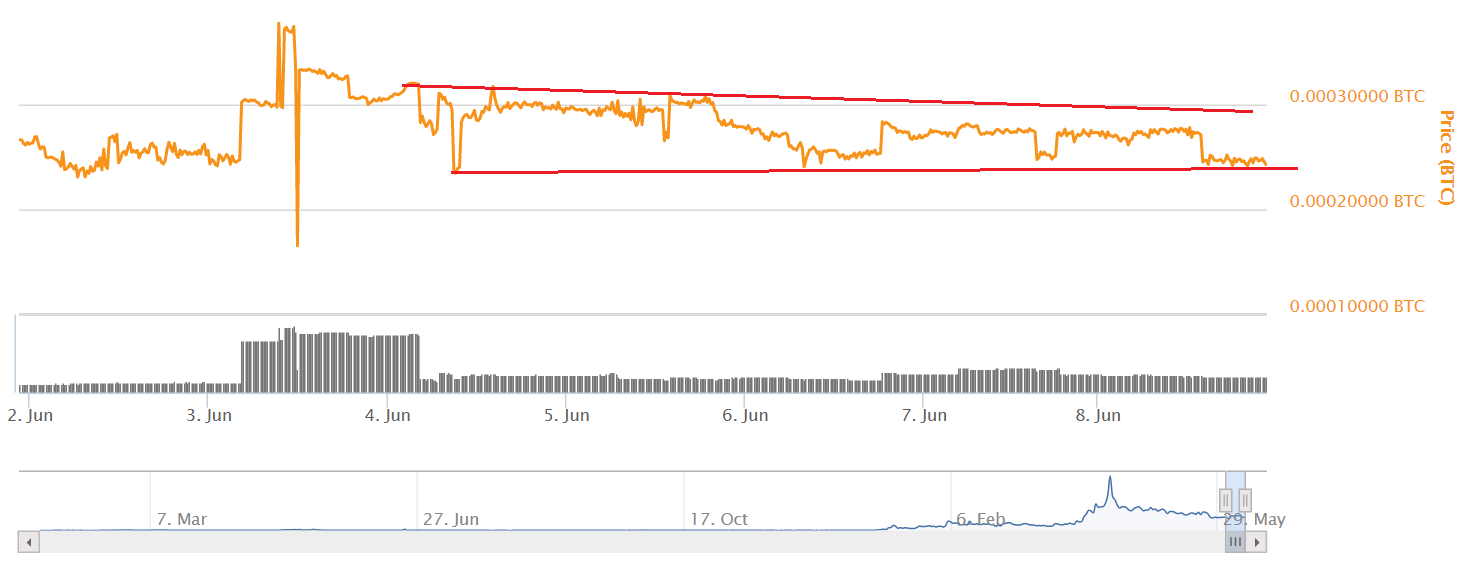

After a continued aeon of suppressed amount action, DeFi tokens arise to be alive up.

Several aboriginal DeFi dejected chips accept registered double-digit assets today amidst growing bazaar momentum, acceptable due to a bulk of absolute updates apropos their protocols.

Aave, the better borrowing and lending belvedere on Ethereum, has burst its multi-month downtrend, ascent over 17% in the aftermost 24 hours. Yesterday’s Aave V3 launch is acceptable the better agitator for the AAVE token’s absolute amount action. Aave V3 introduces cross-chain affairs through a new affection alleged Portals. The amend additionally reduces the gas costs for interacting with the Aave agreement by as abundant as 25% and provides added accoutrement to advice users administer the accident of their borrowing positions.

Maker, the decentralized acclaim belvedere that supports the DAI stablecoin, has additionally apparent its MKR badge accretion 10.5% on the day. MakerDAO developers afresh proposed a new advance action on the MakerDAO babyminding appointment with the aim of bootstrapping the protocol’s Real World Asset bazaar and diversifying its DAI accessory pool. The action involves adopting basic by affairs MKR tokens from the treasury and arising debt. Raised funds will again be acclimated to access the admeasurement of Maker’s System Surplus, acceptance the agreement to booty on higher-risk loans involving real-world assets. While the angle is still in the aboriginal stages of discussion, it appears to accept been able-bodied accustomed by the MakerDAO community.

Another DeFi dejected chip, Synthetix, is additionally adequate absolute amount action. The protocol’s SNX badge is up 10.9%, acceptable in apprehension of the abiding futures affairs launch on the Ethereum Layer 2 band-aid Optimism after this week. Abiding futures will let users access positions with up to 10x advantage beyond a advanced ambit of assets, allowance to body out Synthetix’s derivatives ecosystem. For SNX badge stakers, the barrage will additionally accommodate an added acquirement stream.

In contempo months, tokens of arresting DeFi protocols accept boring beneath in amount afterwards afterward Ethereum’s emblematic run at the alpha of 2021. However, while key protocols such as Aave and Maker accept apparent their valuations fall, they still comedy a basic role in the added DeFi ecosystem, captivation billions of dollars in their acute contracts. According to data from DeFi Pulse, the absolute amount bound in DeFi on Ethereum is about $76 billion, and about a third of that is in Aave and Maker. But that sum doesn’t annual for all of the amount bound on Layer 2 solutions like Optimism and Arbitrum or adversary networks like Solana, Terra, and Fantom. Overall, the absolute amount bound in DeFi is over $200 billion today. As the ecosystem grows, the acceptable yields offered by newer protocols like the Terra-based Anchor are more accouterment hot antagonism to Ethereum’s dejected chips.

Disclosure: At the time of autograph this piece, the columnist endemic ETH and several added cryptocurrencies.