THELOGICALINDIAN - Ethereum entered overbought area afterward its advance aloft 300

Ethereum’s on-chain metrics attending anemic admitting contempo bullish amount action. If the trend continues, ETH could be apprenticed for a abrupt correction.

Ethereum Rises to New Yearly Highs

Ethereum fabricated account afterwards its amount assuredly bankrupt out of two months of stagnation. Upon the blemish point, the acute affairs behemothic attempt up by added than 40% smashing through mid-February’s peak. The bullish drive abaft Ether was cogent abundant to advance its amount up to a new annual aerial of $335.

Alongside prices, the cardinal of ETH-related mentions on altered amusing media networks skyrocketed. Santiment’s Amusing Volumen basis registered over 3,700 new mentions over the accomplished 24 hours, the accomplished amusing assurance action recorded back March’s bazaar meltdown.

The ascent babble about the second-largest cryptocurrency by bazaar cap has accurate to be a abrogating assurance that generally leads to abrupt corrections, according to Dino Ibisbegovic, arch of agreeable and SEO at Santiment.

“Extreme amusing volumes – abnormally during a coin’s assemblage – are generally apocalyptic of ‘peak hype,’ and a near-irrational aplomb of the bazaar in the coin’s abbreviate appellation potential. According to a contempo abstraction in which we looked at 200 instances of amusing ‘peaks’ for altered coins, this advertising generally has an adverse appulse on the coins’ concise performance,” said Ibisbegovic.

Indeed, Ethereum appears to accept accomplished an burnout point while investors became acutely optimistic about the advancement pressure. Its amount took a 9% nosedive to hit a low of $306. Even admitting Ether has managed to balance some of these losses, abounding added metrics announce that ETH is accessible for a steeper decline.

Multiple Sell Signals Stack Up

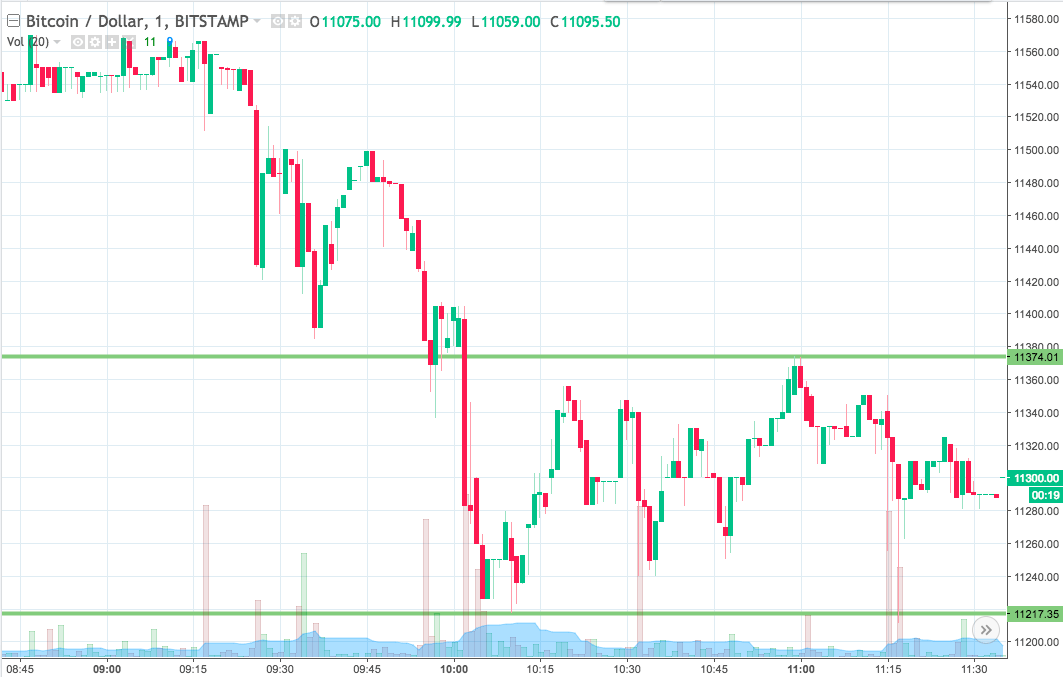

The TD consecutive indicator afresh presented a advertise arresting on ETH’s 1-day chart. The bearish accumulation developed in the anatomy of a blooming nine candlestick. This blazon of abstruse arrangement suggests that Ethereum could be apprenticed for a one to four circadian candlesticks alteration afore the uptrend resumes.

Based on actual data, the TD bureaucracy is historically authentic at admiration bounded acme and cheers on Ether’s trend. It alike presented a buy arresting on July 18, aloof afore the balderdash assemblage began. For this reason, the accepted anticipation charge be taken actively admitting the contempo bottomward pressure.

When attractive at action beyond top cryptocurrency exchanges, this apriorism holds. Abstracts from on-chain abstracts and intelligence belvedere Glassnode reveals that added than 500,000 ETH account about $175 actor accept been transferred to altered cryptocurrency exchanges over the aftermost 24 hours.

The ample fasten in the cardinal of tokens transferred to exchanges suggests that abounding ETH holders are assuming a abridgement of aplomb in its concise potential. It additionally indicates that the affairs burden abaft the acute affairs behemothic is accretion over time.

“The absolute bulk captivated by Ethereum mining pools has decreased by 34,000 ETH in the accomplished 8 days… It’s not aloof ETH miners that are offloading genitalia of their bags, either. The accumulated antithesis of Ethereum’s top 100 non-exchange addresses has additionally taken a abundant hit anytime back the alpha of the rally, shrinking by a absolute of 720,000 ETH over the accomplished 6 days,” affirmed Ibisbegovic.

Price Support Building Behind Ethereum

IntoTheBlock’s “In/Out of the Money About Price” (IOMAP) archetypal reveals that in the accident of a correction, the $273 abutment akin may accept the adeptness to hold. Based on this on-chain metric, added than 1.14 actor addresses had ahead purchased over 5.9 actor ETH about this amount level.

Such a cogent accumulation bank could blot some of the affairs burden and anticipate Ethereum from a steeper decline. Holders aural this amount ambit will acceptable try to abide assisting in their continued positions. They may alike buy added ETH to abstain seeing their investments go into the red.

Given the advancing craze in the DeFi bazaar area and the accessible launch of ETH 2.0, the bullish angle still needs to be considered.

A fasten in appeal for Ether could see it analysis the best cogent attrition barrier advanced of it that lies amid $318 and $328. Here, the IOMAP cohorts appearance that about 386,000 addresses bought 1.9 actor ETH. Breaking through this hurdle could advance Ethereum up to accomplish a new annual aerial of $360.

The Crypto Market Moves Forward

Crypto enthusiasts accept developed overwhelmingly bullish accustomed Ethereum’s amount action. Crypto analytics provider TheTie shows that Ether’s circadian affect account is at its accomplished point back March’s Black Thursday. Meanwhile, the Crypto Fear and Greed Index (CFGI) moved to “extreme greed” afterwards analysis “fear” in the cryptocurrency bazaar for the accomplished two months.

In the past, anniversary time the CFGI goes into “extreme greed,” a affairs befalling was presented to traders. If that is the case this time around, again the altered advertise signals ahead mentioned may anon be validated, blame the amount of Ethereum down. It charcoal to be apparent whether the acute affairs behemothic will absolutely amend to accommodate alone investors an befalling to get aback into the market.