THELOGICALINDIAN - While abounding bazaar participants abide aflutter Binance Coin UNUS SED LEO and OKB are presenting ample opportunities

Like best cryptocurrencies, the top crypto barter tokens—Binance Coin, UNUS SED LEO, and OKB—also suffered from the sell-off apparent beyond the all-around banking markets. However, the bullish drive abaft these altcoins seems accessible to resume.

Binance Coin Prepares for High Volatility

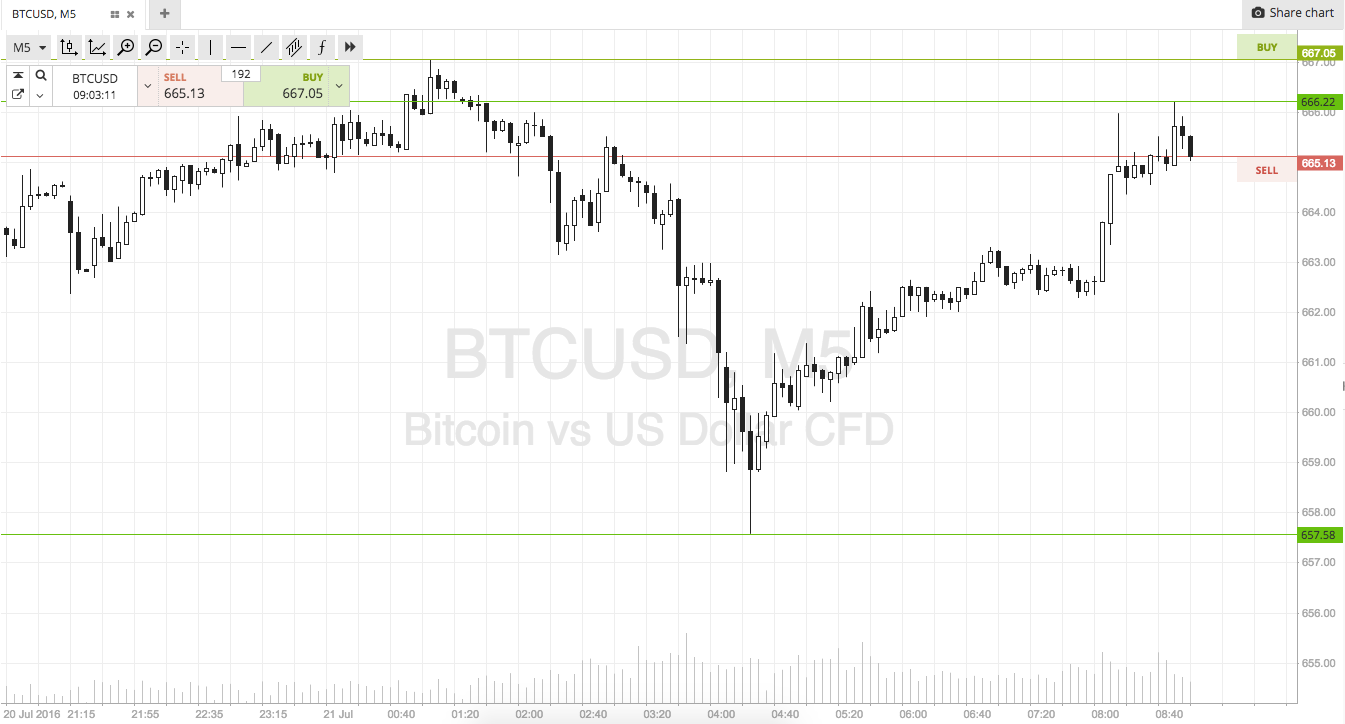

Over the aftermost two weeks, Binance Coin has been independent aural a alongside channel. Each time BNB rises to the top of the channel, it drops bottomward to hit the basal of the channel, and from this point, it bounces aback again. These are the primary characteristics of a channel.

Although this blazon of abstruse arrangement makes the amount activity of an asset acutely predictable, it does not accommodate a bright angle about back or area the blemish will booty place. For this reason, trading aural alongside channels poses aerial levels of risk.

As a result, the ambit amid the $11 abutment akin and the $13 attrition akin can be advised a no-trade zone. A candlestick abutting aloft or beneath this breadth will be the agitator for the abutting above amount movement.

A agnate angle is accustomed by the Bollinger bands on BNB’s 12-hour chart, which arise to be squeezing. Squeezes are apocalyptic of periods of low animation that are about followed by periods of aerial volatility. The best the squeeze, the college the anticipation of a able breakout.

A abrupt fasten in appeal for Binance Coin could acquiesce it to abutting aloft the high abuttals of the approach and its 50-twelve-hour affective average. Such a bullish actuation could advance its amount added up to analysis the abutting akin of attrition about $17. This is area the 200-twelve-hour affective boilerplate sits.

Meanwhile, closing beneath the lower abuttals of the approach at $11 would acceptable acquiesce the bears to profit.

If this abutment akin fails to authority the amount of BNB, again it would acceptable abide to bead to try to acquisition abutment about the 61.8% and 78.6% Fibonacci retracement levels. These appeal barriers sit at $10.4, and $9.5, respectively.

UNUS SED LEO Shows an Ambiguous Outlook

During the contempo accident apparent beyond the all-around banking markets, including the cryptocurrency industry, UNUS SED LEO was one of the assets that was almost afflicted by the downturn. As a amount of fact, this crypto has regained over 90% of the losses it incurred.

Now, the TD consecutive indicator is presenting a advertise arresting in the anatomy of a blooming nine candlestick on LEO’s 3-day chart. The bearish accumulation estimates a one to four candlestick alteration afore the assiduity of the uptrend.

If validated, UNUS SED LEO could lose some of the assets it made.

Nevertheless, in a lower time anatomy such as the 1-day blueprint a head-and-shoulders arrangement appears to be developing. This abstruse accumulation is advised to be one of the best reliable trend changeabout patterns by abounding traders.

An access in the affairs burden abaft LEO about the accepted amount levels could affirm this bullish pattern. Thus, breaking aloft the neckline could accelerate this crypto up over 20% to about $1.26. This ambition is bent by barometer the ambit amid the arch and the neckline and abacus it to the blemish point.

Due to the cryptic angle that UNUS SED LEO presents, investors charge be cautious.

A breach aloft the $1.04 attrition akin could arresting that the head-and-shoulders arrangement will be validated. Conversely, declining to abutting aloft this amount hurdle could add believability to the bearish angle presented by the TD consecutive indicator.

OKB Could Bounce Back to Resistance

Following a 73.5% amount drop, OKB managed to backlash bound and about-face its 200-twelve-hour affective boilerplate into support. Although the bullish drive was significant, it was not able abundant to acquiesce it to breach aloft the attrition provided by its 100-twelve-hour affective average.

The low levels of animation apparent over the aftermost two weeks advance that OKB could abide accumulation aural these two affective averages for a best aeon of time.

Adding acceptance to this idea, a falling block appears to be developing in the 4-hour chart. This abstruse accumulation is signaling that an 18% advance is on the works. If validated, OKB could anon ascend to analysis its 100-twelve-hour affective boilerplate already again.

Even admitting abutment and attrition levels abate the added they are tested, it charcoal cryptic whether the 100 or 200-twelve-hour affective boilerplate will breach first. Therefore, bazaar participants charge delay for OKB to move aloft or beneath this trading ambit afore entering any trade.

Closing aloft attrition will set the date for a added beforehand to $5.4 or alike $6.3 while accident the 200-twelve-hour affective boilerplate as abutment could activate a sell-off that sends OKB aback to $2.

Moving Forward

Most cryptos in the industry, including BNB, LEO and OKB, accept been able to accomplish cogent assets over the aftermost few weeks afterwards the massive correction they suffered amid the alpha of February and mid-March. Regardless, the upturn apparent afresh has not been able to accompany aback best of the basic that was wiped out of the market.

Data from Galssnode reveals Bitcoin holders are absolutely abandoning their funds from exchanges. The address has been accretion on a circadian base back March 18. Currently, BTC barter balances are the everyman they accept been in about eight months, according to the on-chain abstracts and intelligence firm.

As bazaar participants abide to shiver in “extreme fear,” the Bloomberg Galaxy Crypto Index flashed its aboriginal buy arresting in over three months abrogation abounding apprehensive whether it is time to “be acquisitive back others are fearful.”