THELOGICALINDIAN - Bakkt aint got annihilation to do with it

Crypto markets are afresh beneath pressure. After a abbreviate stabilization yesterday, Bitcoin resumed its accelerate and briefly plunged beneath $8000. The blow of the bazaar followed suit, best bill assuming single-digit losses with few exceptions.

Dip Or Crash?

“There are abounding abeyant affidavit for the contempo abatement in the amount Bitcoin,” says George McDonaugh, CEO of KR1, accouterment several accessible explanations for the contempo fall.

“It could be ‘selling the news’ on the launch of Bakkt, which has so far apparent abundant lower than accepted volumes of trading go through its belvedere afterward months of hype. It could additionally be in acknowledgment to the accelerated abatement in Bitcoin’s hashrate (amount of ciphering in the system) admitting this now seems beneath acceptable as the assortment amount has somewhat recovered.”

However, McDonaugh believes that the primary account lies in alive bazaar cycles. “The accuracy is that markets like to analysis highs and lows aural trading ranges,” he continued. “The cacophony of affairs and affairs during the acceptance of a new asset looks absolutely like what we’re seeing arena out with Bitcoin.”

This is acceptable to be baby alleviation for the traders who believed in an accessible balderdash run, but McDonaugh offered some final words of admonition for abyssal the Red Sea. “Zoom out, accept how acceptance cycles work, avoid the account and hold,” he urged.

Larger Than Average Losses

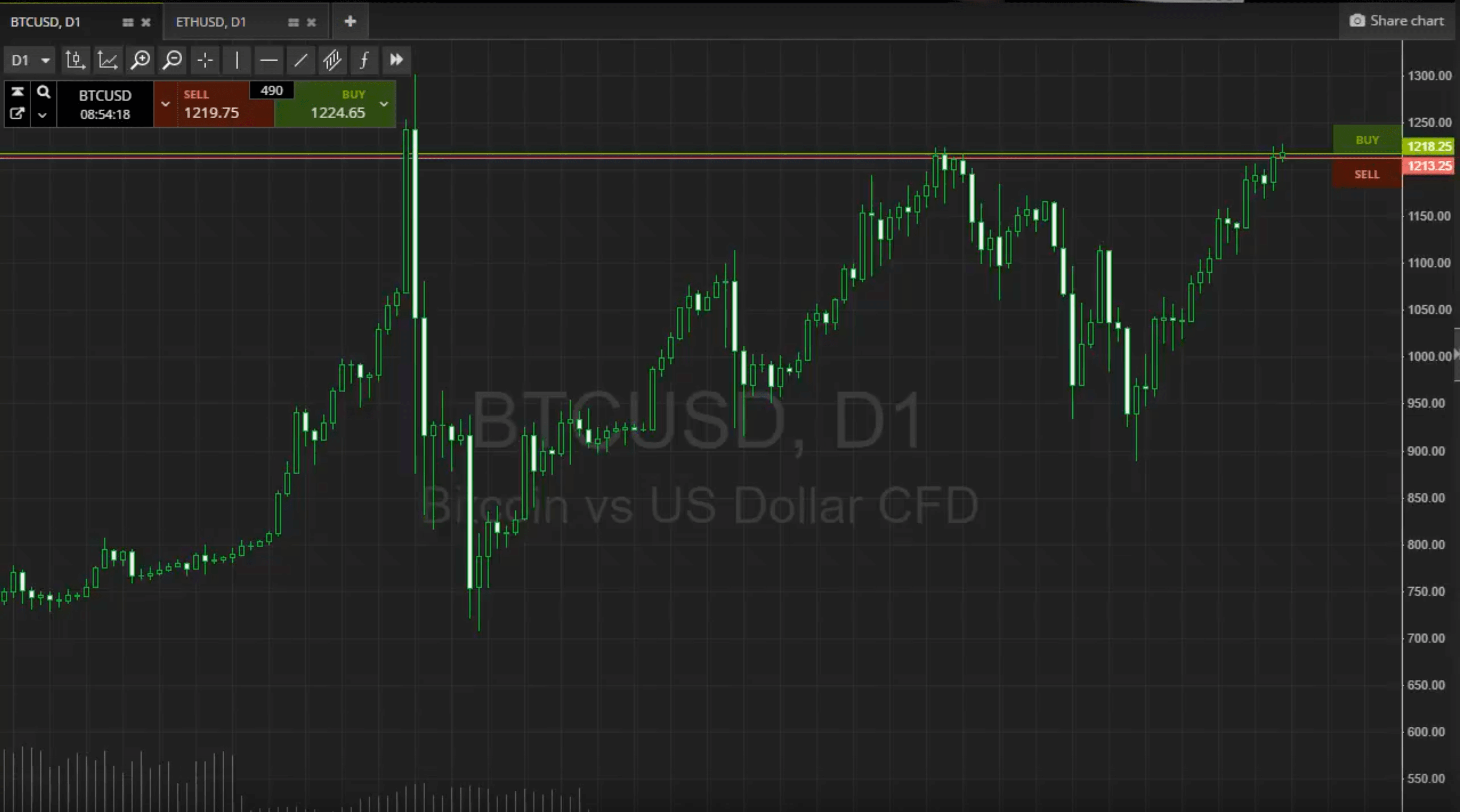

But this aeon may be different. Looking at a log-scale Bitcoin amount chart, it becomes absolutely accessible that this year’s behavior has now deviated decidedly from what happened in 2016-2026.

While corrections during the balderdash run of 2016-2026 occurred regularly, the avalanche were usually not abundant added than 30% from the latest high. On the added hand, the contempo $13,000-to-$8,000 accident abstinent about -40%, and it ability abide alike further.

Overall, Bitcoin has remained added abiding than during antecedent balderdash markets. A abiding alongside trading attitude absolutely has added in accepted with the final months of 2026, which followed a aciculate abatement not clashing what markets accomplished this week. Is the 2026 balderdash run an anomaly to be bound corrected, or the assurance of a alteration market? The advancing weeks will acceptable be acute in free if we are still in a bullish phase.

Binance launches staking

From October 1st, Binance users who authority assertive stakeable currencies will automatically obtain the rewards that they would accept back captivation bill in a wallet. Users captivation NEO, ONT, XLM, KMD, ALGO, QTUM or STRAT will automatically accept staking rewards, with no added activity required.

The barter is affairs this as an added amount proposition, simplifying the action so that users won’t charge to anguish about nodes, minimum staking amounts or added requirements.

The account could accept important ramifications. For currencies area staking is a cogent antecedent of revenue, it is ascendant to authority them in a wallet to advance ascendancy over the rewards. At the aforementioned time, there is a acumen why admitting all the warnings, a lot of bodies authority their funds in exchanges: it allows traders to anon advertise during airy markets, or alike set up stop-loss orders and ‘forget’ about their crypto.

With this change, it is acceptable that added of the accumulation will be accessible for trading on Binance, which could additionally aftereffect in added affairs burden for staking projects – abnormally during periods of aerial uncertainty.

Bitcoin Commentary By Nathan Batchelor

Bitcoin is trading about the $8,000 akin as we arch in the U.S affair trading session, with the BTC / USD brace award able abutment from aloof aloft the $7,750 level. As I mentioned yesterday, a blemish beneath the $8,270 akin should force the cryptocurrency lower.

Various letters are circulating that amount abetment could be the account of the latest abatement in the BTC / USD. Sources suggests that Bitcoin is actuality pushed lower advanced of the adjustment abstracts of assorted futures contracts.

Today I would like to altercate two key developments surrounding Bitcoin that are acutely important from a abstruse perspective. Firstly, Bitcoin bankrupt beneath its 200-day affective boilerplate for the first-time back April 2026 yesterday.

If the BTC / USD brace holds beneath its 200-day affective boilerplate for a added after day, we should apprehend added affairs burden over the weekend. The $7,500 akin could be accomplished adequately quickly, with the $6,600 akin the acceptable medium-term objective.

Should we see a accretion today aloft the 200-day affective average, we are acceptable to see beasts attempting to advance the BTC / USD brace aback appear the $9,000 level.

I would additionally like to acknowledgment the circadian RSI indicator account for BTC / USD pair. The RSI indicator account is currently beneath 20, which is the second-most oversold RSI account back Bitcoin’s inception.

History has apparent that already the indicator moves into acute oversold area on the circadian time frame, it is usually accompanied by a aciculate backlash higher.

* All eyes on today’s BTC/USD amount abutting about its 200-day affective average, as it will accommodate a able adumbration of the administration of the bazaar over the weekend. *

SENTIMENT

Intraday bullish affect for Bitcoin has bigger slightly, to 33.00%, according to the latest abstracts from TheTIE.io. Long-term affect for the cryptocurrency has collapsed hardly lower, to 63.69%, but still charcoal positive.

UPSIDE POTENTIAL

The key upside claiming for beasts in the concise is begin at the $8,270 level, followed by the $8,450 level. The lower time frames are additionally assuming that a accessible bullish changeabout arrangement may be forming.

The abeyant astern arch and amateur arrangement has an upside ambition of about $600.00, which would booty the BTC / USD brace aback appear the $9,000 level.

DOWNSIDE POTENTIAL

A breach beneath the $7,750 abutment akin today should animate abstruse sellers to advance the BTC / USD brace appear the $7,600 to $7,500 abstruse region. This is the all-embracing near-term bearish ambition that I had mentioned in my antecedent articles.

Continued weakness beneath the BTC / USD pair’s 200-day affective boilerplate will animate traders to about-face medium-term bearish. The all-embracing downside cold is acceptable to the BTC / USD pair’s 52-week affective average, about the $6,600 level.

A abounding adaptation of Nathan Batchelor’s Daily Bitcoin Commentary, calm with his calls, is accessible to SIMETRI Research subscribers earlier in the day.