THELOGICALINDIAN - Longterm acceptance charcoal almost strong

Bitcoin prices are continuing to fluctuate. Despite a able start, BTC absent the majority of its assets yesterday. Other arch bill are about afterward Bitcoin, with Chainlink’s 5% as the alone articulation alfresco the choir.

Weak easily annoyed out?

A address appear by Coinmetrics provided admired acumen into the late-September fall. Analyzing the metric of ‘realized capitalization‘, which assigns amount to bitcoins according to their aftermost on-chain movement, Coinmetrics was able to define which accomplice of Bitcoin holders alternate the best in the contempo sell-off.

As apparent by the blueprint above, the majority of bitcoins accept been acquired at lower ethics than accepted price. Capitulation amid the participants in the 2026 balderdash run is about complete, with actual few bitcoins larboard that were bought for added than $13,000.

A able aiguille about the $3,000-4,000 akin seems to appearance that abounding bodies accurately alleged the basal in 2026, and few of them awash so far. Some of these could accommodate aboriginal birds from 2026 as well, admitting accustomed how abundant time passed, they’re acceptable to be alone a baby percentage.

Coinmetrics addendum that the majority of contempo affairs came from those who bought at the June-July peaks, amid $10,000 and $12,000. These traders were best acceptable geared appear the abbreviate term, and as it became bright that their positions would not breach even, they confused to cut their losses en masse.

But the all-embracing bullish affect seems to not be alteration amid those who entered the bazaar at lower prices. “These owners represent abiding holders with a able abiding confidence in Bitcoin. Approximately 11.46 actor Bitcoin accord to this cohort,” reported Coinmetrics. “Despite the acute bazaar movement, these holders accept remained adamant in their bazaar angle — alone 150,000 of the 11.46 actor Bitcoin were apparent to accept confused on-chain.”

Derivatives amplified the backbone of the fall

Bakkt continues to disappoint

While the slow alpha of Bakkt was acceptable aloof a atom hitting a chic armament keg, the apprehension that was congenital about it cannot be shrugged off as inconsequential.

According to abstracts from Bakkt Bitcoin Bot on Twitter, the platform’s achievement is hitting new lows.

https://twitter.com/BakktBot/status/1179318434640924672

A aciculate abatement in absolute traded aggregate bygone does not augur able-bodied for the platform’s actual future. At the aforementioned time, any new artefact barrage is necessarily activity to accept hiccups, abnormally as contempo contest angry abroad abounding concise speculators. The belvedere still represents an important footfall in added adoption, which may abundantly advice the bazaar in added favorable times.

Bitcoin Commentary By Nathan Batchelor

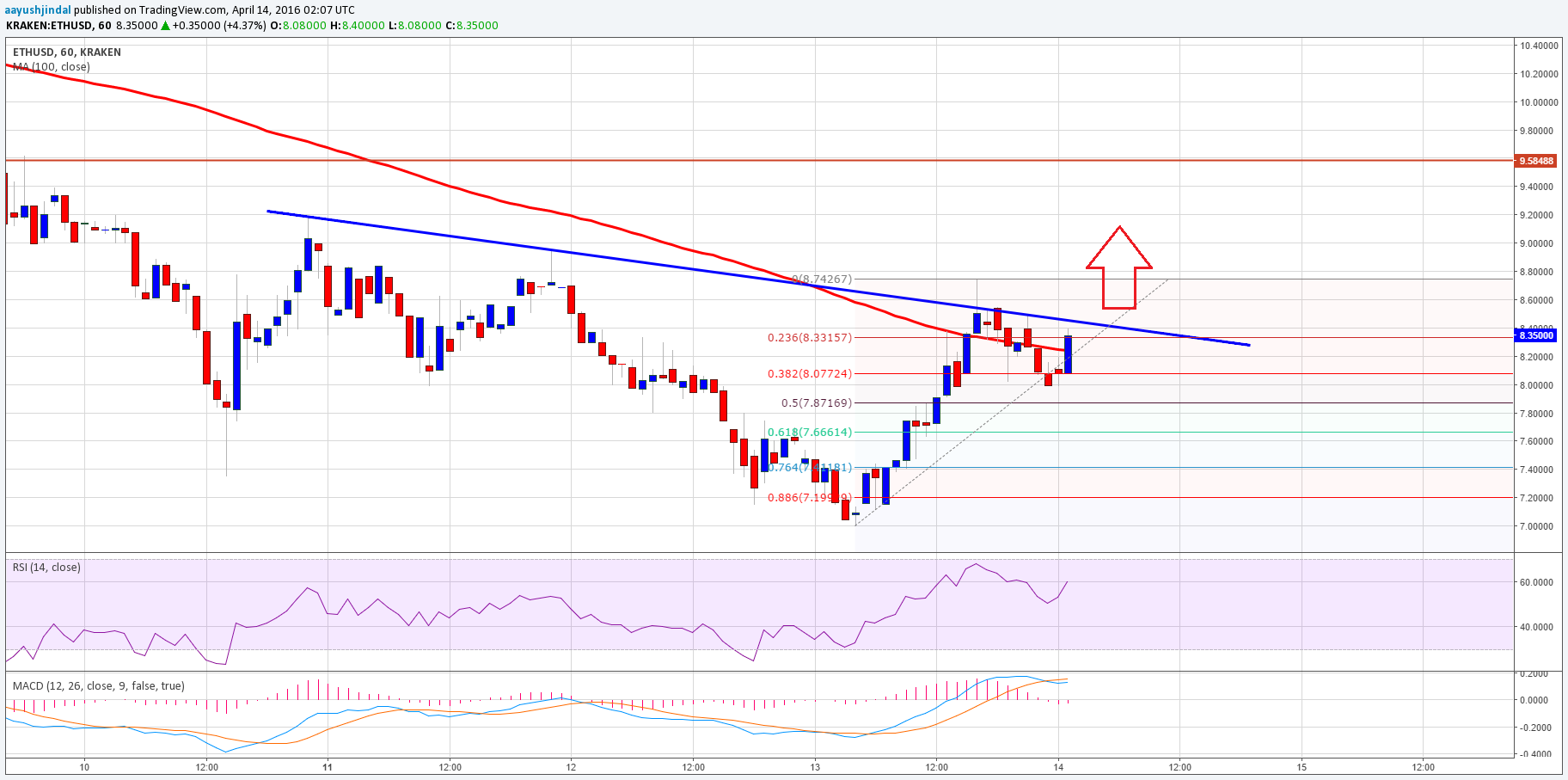

Bitcoin bootless to authority assimilate able upside assets on Tuesday, agreement the cardinal one cryptocurrency aback beneath its 200-day affective boilerplate for a seventh after day.

My contempo assay accent the $6,600 and $4,700 levels as accessible bearish targets if the contempo abatement in the BTC / USD brace resumes.

Today I would like to attending at the Ichimoku indicator on the account time anatomy for added acceptance of the abeyant accessible bearish targets and additionally for a abiding abstruse overview of the BTC / USD pair.

The Ichimoku indicator shows that the BTC / USD brace is still trading aloft the Ichimoku billow on the account time frame, which should absolutely be taken as a abiding positive.

Bitcoin aboriginal bankrupt aback aloft the account Ichimoku billow in June, afterwards admiring beneath the billow for over one year. The top of the billow is currently amid about the $6,600 level, which is a key abstruse area.

Furthermore, the basal of the account Ichimoku billow is amid about the $4,700 level, which is additionally the BTC / USD pair’s 200-week affective boilerplate and a above abiding abutment of accretion abstruse importance.

If an upside accretion does booty place, the Ichimoku indicator is highlighting the $8,500 akin as approaching resistance, with the $9,300 and $10,000 levels acting as the above upside attrition level.

In summary, a bead beneath the $7,700 akin could abet sellers to analysis appear the account Ichimoku cloud, about the $6,600 level, while a move aloft the $8,500 akin could affect beasts to analysis appear the $9,300 level.

A assemblage appear the $10,000 akin will invalidate the contempo bearish move and abode Bitcoin in a abundant added advantageous position over the medium-term, with the $15,000 akin as the acceptable upside objective.

*Various forms of assay are acknowledging the $6,600 akin as a acceptable ambition if the $7,700 akin is broken.*

SENTIMENT

Intraday bullish affect for Bitcoin has improved, to 42.00%, according to the latest abstracts from TheTIE.io. Long-term affect for the cryptocurrency has confused lower, to 63.00%, but still charcoal positive.

UPSIDE POTENTIAL

The $8,500 akin is now key intraday abstruse attrition if beasts can accumulate backbone aloft the BTC / USD pair’s 200-day affective average. Aloft the $8,500 level, the $9,000 to $9,100 levels are actually key.

Longer-term assay acerb suggests that a assemblage appear the $10,000 akin will booty abode if BTC / USD beasts can breach through the $9,300 attrition area.

DOWNSIDE POTENTIAL

The BTC / USD pair’s 100-week affective boilerplate is currently the arch anatomy of abstruse abutment if amount starts to barter beneath the $8,000 level.

If the cryptocurrency break beneath the $7,700 level, the $7,500 and $7,100 levels action the alone forms of notable abstruse abutment above-mentioned to the $6,600 level.

A abounding adaptation of Nathan Batchelor’s Daily Bitcoin Commentary, calm with his calls, is accessible to SIMETRI Research subscribers earlier in the day.