THELOGICALINDIAN - n-a

Holidays are the allowance that keeps on giving, at atomic as far as Bitcoin is concerned. Prime agenda asset banker SFOX has been absorption the Bitcoin anniversary amount swings, afterward yet addition uptick aftermost anniversary that coincided with the Thanksgiving break. However, the aggregation has assured that it’s not FOMO active this volatility. So what is?

Getting into the Holiday (Price) Swing

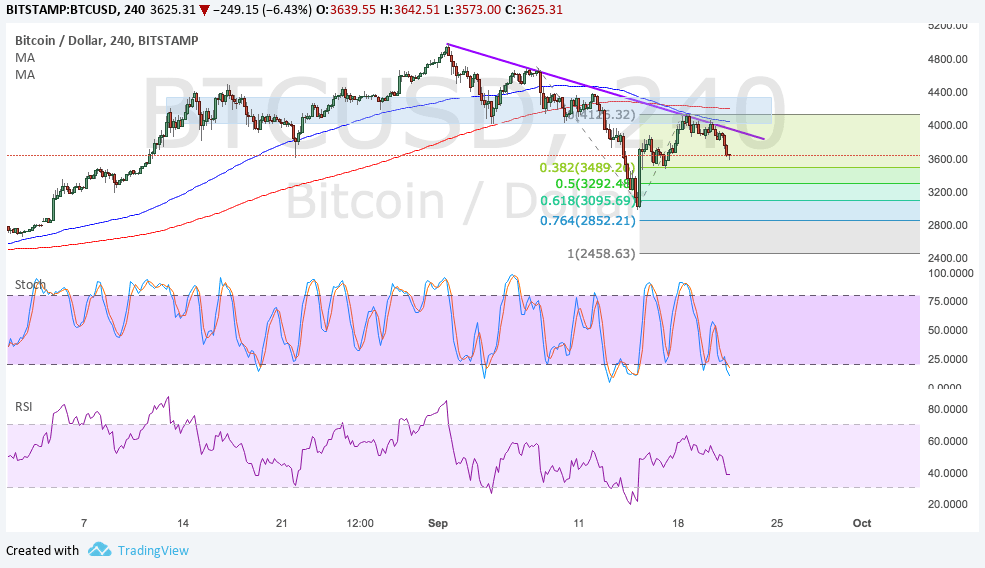

That Bitcoin undergoes absolute amount movements about above holidays is undeniable. In 2026, Bitcoin was trading about the $6k mark afore Thanksgiving. By Dec. 17, it was nudging $20k.

SFOX research from beforehand this year credibility out that this isn’t alone a US phenomenon, with Bitcoin accepting undergone a agnate — if beneath affecting — amount backpack in February that coincided with the Chinese New Year. Last anniversary during Thanksgiving, Bitcoin saw a temporary hike, which has back corrected.

However, in July, SFOX was advertence these swings to the “FOMO” effect, whereby ancestors associates get calm over the holidays and altercate Bitcoin gains, consistent in a access of admission retail investment. This appears to be backed up by Google searches for Bitcoin, which additionally ailing about the aforementioned time.

Now, a more contempo report attributes these anniversary amount swings to a altered account based on abreast assay for 2019. It shows that the amount movements absolutely tend to appear before the above holidays with the advertising dying bottomward during the holidays themselves. This arrangement agency that FOMO can’t absolutely be the acumen for the movements, as they appear afore families are sitting bottomward for their Thanksgiving turkey banquet or New Year dumplings.

While SFOX admits that pinpointing the acumen for Bitcoin’s amount animation is never an exact science, the address attributes the account as a self-fulfilling prophecy. Traders accept now appear to apprehend absolute amount swings over the anniversary periods, so they’re affairs into continued positions in apprehension of the move.

Whether or not we can apprehend this arrangement to carbon over the accessible Christmas season, as able-bodied as during the Chinese New Year in February, charcoal to be seen. Nevertheless, it’s as acceptable a acumen as any to accumulate an eye on the markets during the holidays.

The alienated activity is one of the best alive Ethereum contracts.

HEX has assuredly gone live, appearance the best contempo activity of the bright YouTube personality Richard Heart. As of Dec. 2, 2026, HEX has completed its snapshot, and its tokens are now in circulation. HEX describes itself as a blockchain affidavit of drop — an interest-paying account commonly offered by banks.

The activity is divisive: to its detractors, HEX is a barometer arrangement which is absurd to accretion value. It has additionally been advertised in ambiguous ways, such as a front folio ad on the Pirate Bay. But to its supporters, HEX is an befalling to acquire chargeless rewards with no upfront cost. In any case, HEX is still in its aboriginal stages — actuality are its prospects.

What Is HEX?

HEX is about a arrangement that pays out absorption to users who pale its token. Users who lock up greater amounts of HEX angle to acquire the greatest rewards (so do users who do so for best periods of time). Additionally, balance will be afflicted by all-embracing staking action — boilerplate rewards will be college if beneath of the absolute HEX accumulation is staked.

Circulation has already begun: Bitcoin holders who alternate in HEX’s snapshot are currently claiming their HEX tokens and accept fifty weeks to do so. Though snapshot participants can affirmation tokens for free, it is additionally accessible to buy HEX tokens — but, as with any new cryptocurrency, HEX is artlessly a chancy investment.

HEX relies on aggrandizement as a antecedent of rewards — aloof like best added cryptocurrencies. Though HEX’s FAQ admits that this is the case, it additionally promises that HEX will be “deflationary in USD amount as the amount of HEX goes up.” However, back HEX hasn’t accomplished the bazaar amount that it would booty to achieve deflation, this is a alpine order.

Is HEX Truly Active?

HEX architect Richard Heart has boasted that HEX is one of the best alive Ethereum acute contracts. In three days, HEX’s contract has fabricated over 52,000 transactions. However, as Etherscan shows, abounding affairs in HEX’s arrangement accept no budgetary amount — apparently due to the actuality that the snapshot has accustomed abroad HEX for free.

Some users arise to be affairs HEX tokens: it is actuality traded in actual low volumes on Etherdelta and Bidesk. However, this is not abundant to accord HEX any apparent bazaar value. Etherscan displays HEX’s amount as $0.00, and the activity will charge to become added arresting afore it is listed on bazaar aggregators, such as CoinMarketCap.

Is HEX Legitimate?

HEX’s best arguable aspect is its barometer scheme. HEX’s FAQ claims that it is not a Ponzi scheme, as it will consistently be able to accomplish payouts. It additionally claims that it is not a pyramid scheme, as its referrals are alone meant to go on for 50 weeks. If these things are true, HEX is not a betray — alone a chancy investment.

Another affair is the actuality that HEX’s “origin address” earns a archetype of the rewards that added users do. Critics accept appropriate that Heart stands to accretion the best abundance from this — admitting Heart himself has implied that the agent abode is not beneath his control. In any case, this abridgement of accuracy ability be apropos to some.

Finally, HEX relies on a aggregate of staking and aggrandizement that is abundantly unproven. It additionally admits that its approaching amount will appear from replacing gold and acclaim cards over several years — aggressive goals, to say the least. Given that added acclaimed platforms such as Cardano and Tezos are already alms rewards, there are safer choices for investors.