THELOGICALINDIAN - As we apperceive a cardinal of French cities accept been the arena of beef afresh The protesters acclaimed by their chicken vests accept been more artistic in their approach and now assume to accept afresh plan

The abstraction is that if abundant bodies abjure all their money from the coffer at the aforementioned time they ability be able to force a clamminess crisis requiring government intervention, possibly abolition the Euro, and accelerate a unified bulletin to authorities.

While I’m no fan of the apportioned assets cyberbanking system, I’m not abiding that aggravating to topple abridgement is a actual advantageous advance of action.

In any case, there apparently isn’t annihilation to anguish about actuality as it would booty several millionaires accepting onboard to accept the adapted aftereffect and that aloof doesn’t assume actual likely.

@MatiGreenspan

eToro, Senior Market Analyst

Today’s Highlights

Friendly Fed

Shutdown: Day 20

Crypto Drop

Please note: All data, abstracts & graphs are accurate as of January 10th. All trading carries risk. Only accident basic you can allow to lose.

Traditional Markets

Stocks in the USA struggled to abutting in the blooming bygone and by the end of the Asian affair this morning it seems appealing bright that the monster assemblage we’ve been seeing in the markets this year is accident steam. Overall, the markets do assume to be at an articulation point appropriate now.

Some analysts are citation the actuality that the US-China talks concluded after resolution as a accidental factor, but I’m not so sure. What’s absolutely aberrant to me is the bazaar about absolutely blank contempo signals from the Fed that it is accommodating to be more supportive.

Fed Chair Jerome Powell will be demography questions at an accident this black and we achievement he’ll be able to analyze the Fed’s stance. At the moment, pundits are accepting a bit of agitation admiration what the better amateur in the banking markets will do next.

A admiring Fed could absolutely advice the markets out appropriate now. So could an acceding to reopen the US government, but let’s not get greedy.

Suspicious Rally

The contempo assemblage has been apprehensive because, admitting ascent prices, stocks are still acutely volatile. Gold continues to billow advanced and is afresh giving a austere analysis of $1,300. Should the bazaar agitation abide and the US Dollar continues to weaken, it could actual able-bodied bang appropriate through that barrier.

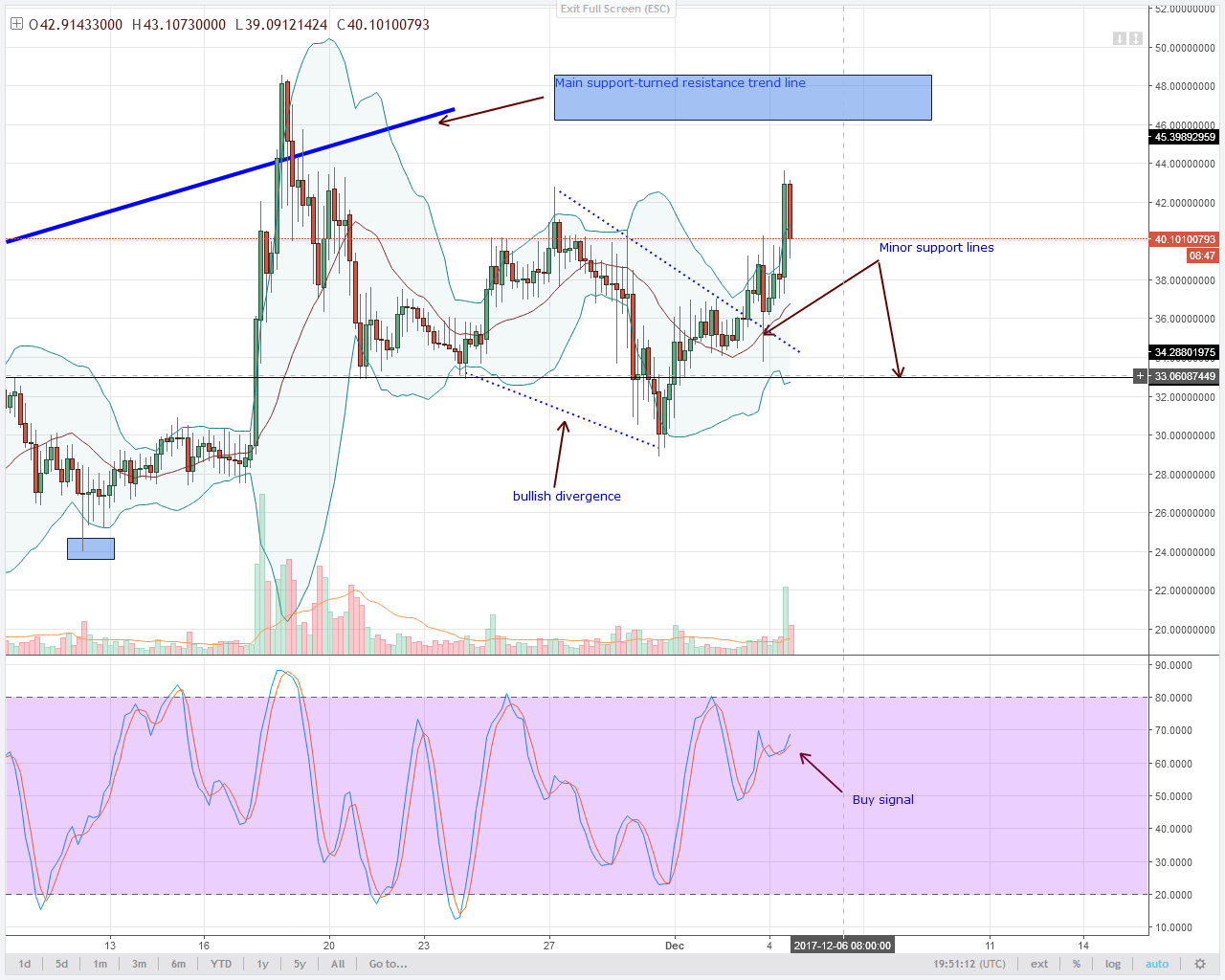

Crypto Drop

Many accept been allurement about the abrupt bead in the crypto markets this morning. In my view, there doesn’t assume to be any absolute acumen for this drop, neither abstruse nor fundamental.

The one absorbing affair about this movement is that it seems to be an exact changeabout of the billow that happened on Sunday afternoon. At this point, the assets fabricated aback the alpha of the year accept now been antipodal and we’re aback to a aloof 2026.

Wishing you an accomplished day ahead!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.