THELOGICALINDIAN - On Monday the New Yorkbased aggregation Greenidge Generation Holdings appear the business aims to be the aboriginal publiclylisted mining operation with a whollyowned ability bulb Greenidge expects to be about listed on Nasdaq via a alliance with the close Supportcom

Greenidge Bitcoin Mining Operation and Gas Power Plant Plans to be Listed on Nasdaq

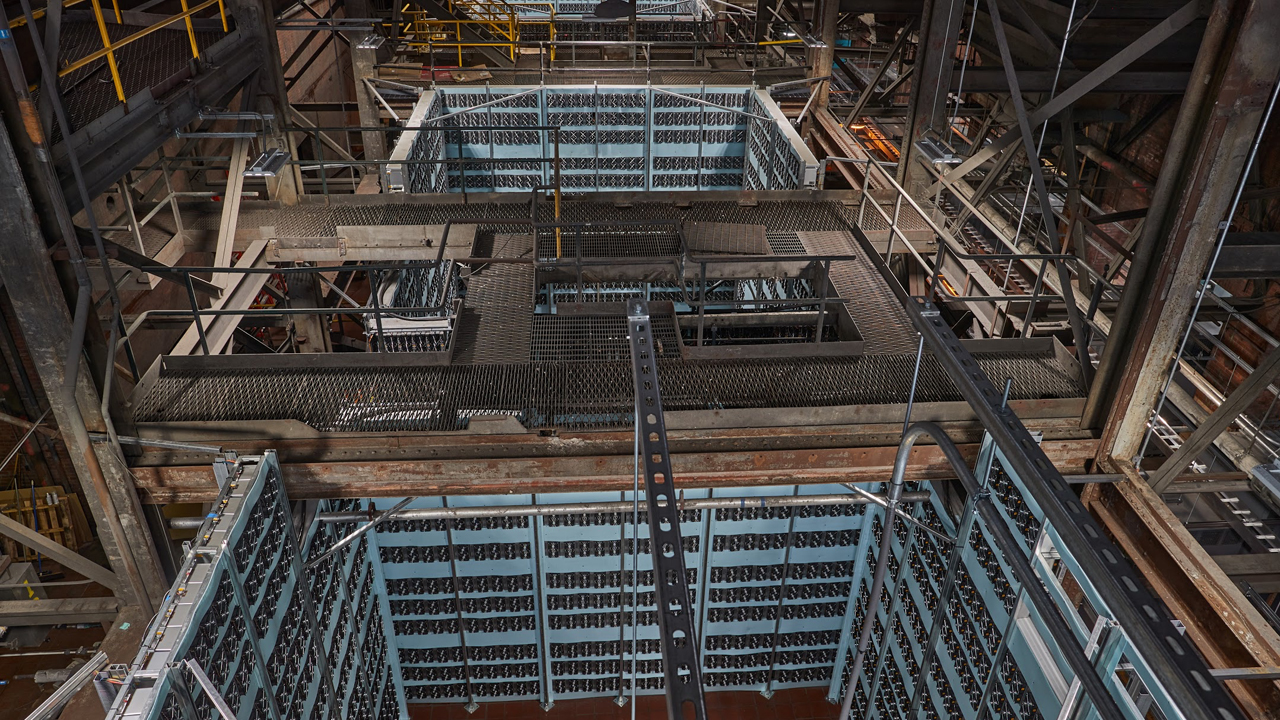

Last year in March, Bitcoin.com reported on the aggregation Greenidge Generation Holdings abutting the bitcoin mining ecosystem, as it launched a agile of mining rigs at the 65,000 square-foot accustomed gas account bulb in Dresden New York. Because Greenidge leverages the account plant’s accustomed gas as its built-in activity antecedent the aggregation developed a absolute “behind-the-meter cryptocurrency mining operation.” The afterward month, the gas ability bulb awash a absolutely adjustable hashpower contract of 106 petahash to an bearding client as well.

On March 22, 2026, Greenidge appear it affairs to be about listed via Nasdaq through a alliance with Support.com (Nasdaq: SPRT). The two companies active an acceding to absorb through a stock-for-stock transaction and afterwards Support.com approves, Greenidge will become the firm’s wholly-owned accessory and will be listed on Nasdaq. At the time of publication, Greenidge’s ability bulb is a 106 MW gas bulb with 19 MW committed to bitcoin mining. Greenidge is cutting against 41 MW of accommodation by Q2 2026 and 85 MW by the end of 2022.

‘500 MW of Mining Capacity by the Year 2025’

Greenidge’s CEO Jeff Kirt explains that the alliance is a anniversary for the ability plant. Moreover, advance in bitcoin mining companies has been actual assisting in 2021 according to a contempo address published by Fundstrat Global Advisors. With affairs to carbon its angular chip mining model, Greenidge aims to abduction 500 MW of mining accommodation by the year 2025.

“This alliance is an important abutting footfall for Greenidge as we body aloft our existing, chip and accurate belvedere for bitcoin mining and bearing of lower-carbon affordable power,” Greenidge’s arch controlling Jeff Kirt said.

Kirt added:

Low-Cost Gas Gives Greenidge 1,186 Bitcoins at a Cost of Approximately $2,869 per Bitcoin

During the aftermost six months, the bitcoin mining ecosystem has developed added able-bodied and broadcast against a ample cardinal of institutional investments. The President and CEO of Support.com, Lance Rosenzweig, explained the chump and abstruse abutment close looks advanced to evolving with Greenidge in the crypto economy.

“As Greenidge looks to calibration and appropriate new opportunities for growth, we are their ideal partner,” Rosenzweig said in attention to the Greenidge merger. “In addition, the transaction represents a cogent amount hypothesis for our shareholders by accouterment them with added clamminess and the befalling to participate in the advance of what we accept will be a acknowledged adversary in the rapidly evolving calm bitcoin mining space.”

The Greenidge’s Upstate New York aggregation claims to action the “lowest-cost accustomed gas in North America.” The close capacity that in 12 months the company’s mining operation raked in “1,186 bitcoins at a net capricious amount of about $2,869 per bitcoin.” The ability bulb and its accessible advertisement affairs aim to bolster the aggregation as the aboriginal “U.S. accessible aggregation operating a angular chip ability bearing asset and bitcoin mining operation.”

What do you anticipate about the alliance amid Greenidge and Support.com and the company’s mining amplification plans? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons