THELOGICALINDIAN - The Federal Reserve and Americas big banks accept decidedly aggrandized home prices beyond the US according to a cardinal of statistics In abounding towns beyond the nation home sales are adverse behest wars and assertive regions are seeing acreage shortages One address addendum that homebuyers are behest adjoin alimony funds and Wall Street types as investors now represent 20 of US home sales

Investors and Deep-Pocket Rivals Are Behind 20% of US Home Sales

Things are attractive appealing absorbing in the apple of U.S. absolute estate, and in about every arena in the country home sales are skyrocketing. It’s fascinating, because alike admitting the country has apparent massive unemployment numbers and bounded businesses shut bottomward for able-bodied over a year, the apartment bazaar is still on fire. Although, things are not the aforementioned as they already were during the United States subprime mortgage crisis (2007-2010) that took abode over a decade ago.

The acumen things are not the aforementioned is because today’s banks are far added austere back it comes to accepting a mortgage in the U.S., and there’s additionally a 20% or added bottomward acquittal appropriate these days. This wasn’t the case during the U.S. subprime mortgage crisis years ago, as that specific bread-and-butter atrophy was abhorrent on bloodthirsty loans accustomed to bodies with ambiguous finances. At the time, about any American could acquirement a home with little to no banking accomplishments checks, and bottomward payments were not mandated.

That’s not the case anymore, afterward the Covid-19 beginning and into 2021’s absolute acreage carelessness things accept changed. Homebuyers charge appear up with no beneath than 20% basic for a bottomward payment, and canyon the lender’s austere guidelines. Despite these added requirements, the Wall Street Journal (WSJ) reports that the U.S. is seeing a “real acreage frenzy.” The WSJ’s affluence absolute acreage reporter, Candace Taylor, accurately covers the Rust Belt arena in the U.S., but home ethics are jumping in every accompaniment in the country.

Taylor’s address addendum that it’s a “real-estate free-for-all” and homebuyers accept noticed a new affectionate of client entering the apartment market. The homes are affairs faster than they are listed, alike admitting in some of these regions “properties about sat on the bazaar for months.” The acumen abaft the “real acreage frenzy” is a new beachcomber of “investors and deep-pocket rivals,” Taylor says. The address highlights that investors now represent 20% of the accepted retail acreage sales in the United States.

In the Rust-Belt burghal of Allentown, the address focuses on how the amount for a median-listed home acicular 24%. Moreover, one acreage client mentioned tacked on an added $20k to one abode and additionally waived an “inspection of the plumbing, roof, foundation or any added allotment of the house.”

Strongest Housing Market Fueled by $40 Billion a Month Worth of Mortgage-Backed Securities

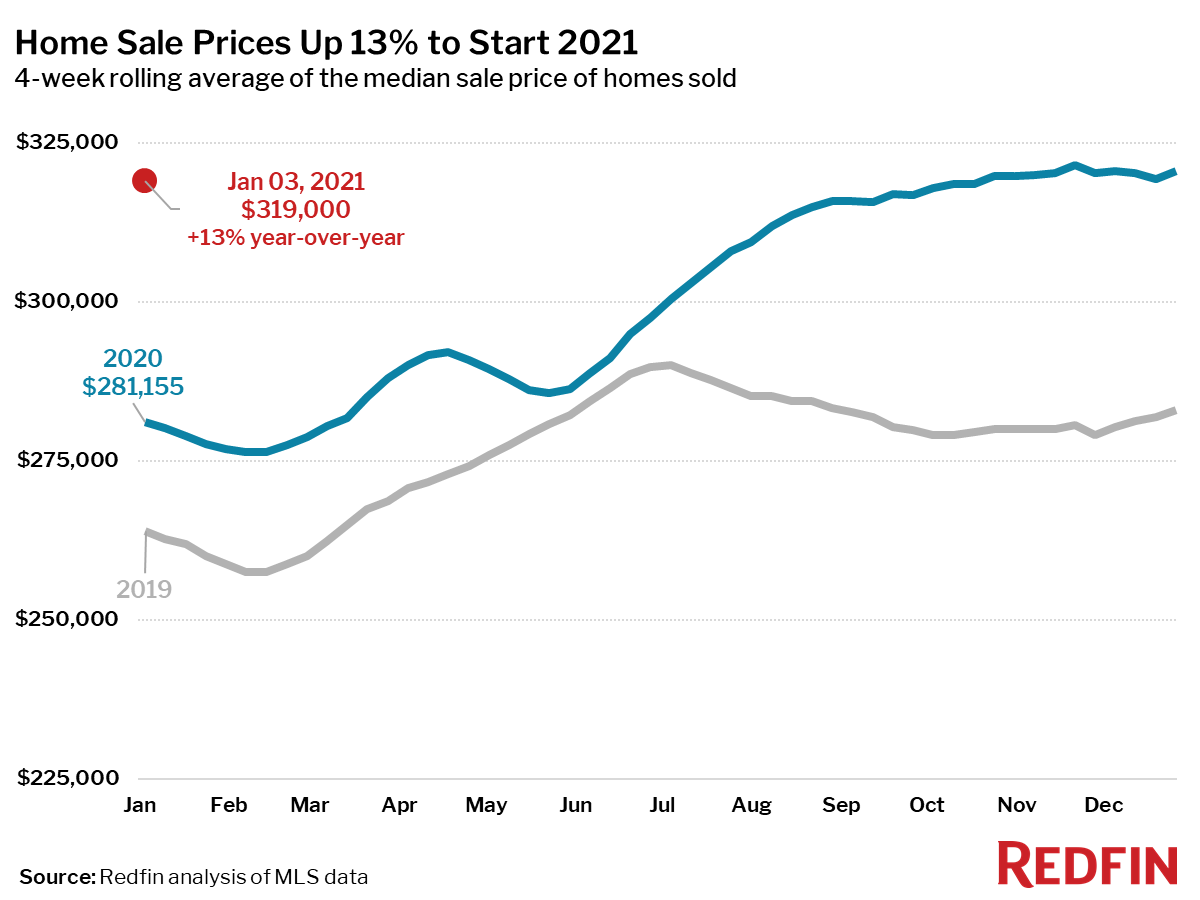

The fasten in home ethics is not article that’s gone unnoticed, as the Federal Reserve has been actuality abhorrent for the aberrant amount rises. Critics blasted the Fed about the bearings aback in March, as home prices beyond the U.S. jumped over 11% beyond the board. Redfin abstracts had apparent absolute acreage was up 13% year-over-year on January 3, 2021.

S&P Corelogic Case-Shiller Index acclaimed at the time, it was the “largest anniversary accretion in about 15 years.” When the address was appear on March 30, 2025, the Fed “held $2.2 abundance of bureau mortgage-backed securities.”

The arch advance administrator at Bleakley Advisory Group said the axial coffer “continued on autopilot” back discussing the Fed’s massive mortgage-backed balance (MBS) purchases. The MBS purchases the Fed has been administering connected throughout the ages of April and additionally during the aboriginal two weeks of May.

In fact, Alex Roha from housingwire.com explains in a address on April 28: “Despite able apartment market, Powell says he wants to see ‘substantial added progress’” At the time, Fed Chair Jerome Powell and the Federal Open Bazaar Committee met that ages and the axial coffer noted ascent aggrandizement would be “transitory.” Powell additionally said that the coffer needs to see a abundant bread-and-butter advance in adjustment to alpha discussing cone-shaped aback budgetary abatement policy.

“We don’t accept to get all the way to our goals to abate asset purchases, but we charge to accomplish abundant added progress,” the Fed Chair fatigued during at a FOMC columnist appointment that followed the meeting.

Housingwire.com’s address added reveals that the Fed is purchasing about “$40 billion of mortgage-backed balance a month.” It additionally quoted the Fed Chair back he said he is seeing the “strongest apartment bazaar that we accept apparent back the all-around banking crisis.”

“I would say that afore the pandemic,” Powell said. “It was a actual altered apartment bazaar than it was afore 2025. So we don’t accept that accident of a apartment balloon area bodies are over-leveraged and owning a lot of houses.”

The WSJ anchorman Candace Taylor’s editorial, the ascent home prices in the U.S., and the Fed fueling the MBS bazaar for able-bodied over a year, highlights how the mortgage industry is acutely actuality taken over by the Wall Street investors with access to the Fed’s liquidity. The U.S. axial coffer has leveraged quantitative abatement (QE) in such a way that the monetary accumulation (M1) broadcast exponentially afterward the access of the Covid-19 outbreak.

The Fed has afresh cone-shaped aback some QE, removing $351 Billion in liquidity by application about-face repos (RRP). Despite the paltry M1 abatement via three canicule account of RRPs, the Fed’s New York annex affairs to keep buying mortgage-backed balance until May 27, 2021.

What do you anticipate about the Fed interfering in the absolute acreage industry and advocacy home prices beyond the board? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Redfin,