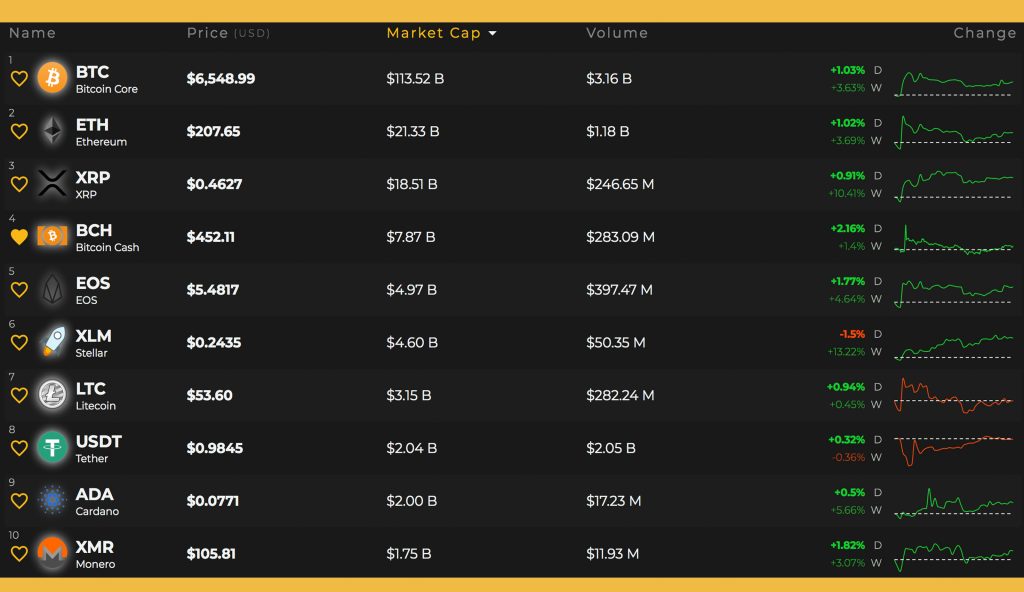

THELOGICALINDIAN - Not a lot has afflicted back our aftermost markets amend four canicule ago as cryptocurrency markets abide affective alongside in a circumscribed arrangement The top bristles agenda assets accept apparent bashful arctic assets this anniversary with increases amid 15 over the aftermost seven canicule This Sunday Oct 21 the absolute cryptocurrency abridgement of over 2026 agenda tokens is admired at 2144 billion

Also read: New Qart Wallet Gives Bitcoin Cash QR Codes a Personal Touch

Boring Market Action Often Leads to Something Unexpected

It’s been a blah anniversary for cryptocurrency traders as not abundant has been happening, except for a few stablecoins accepting some interesting breakouts a few canicule ago. Since again best of the stablecoins, funnily enough, accept apparent beneath animation and absolutely remained ‘stable.’ Top assuming agenda assets like bitcoin cash (BCH), ethereum (ETH), and bitcoin core (BTC) alone a beard in amount aftermost anniversary as acceptable accounts investments plummeted. However, these agenda assets accept regained the actual baby losses that took abode on Oct. 19, and best of the top coins are up over the aftermost seven days. This weekend, beasts assume to be deepening their positions for addition attack to accent a bearish-to-bullish trend change.

Bitcoin Cash (BCH) Market Action

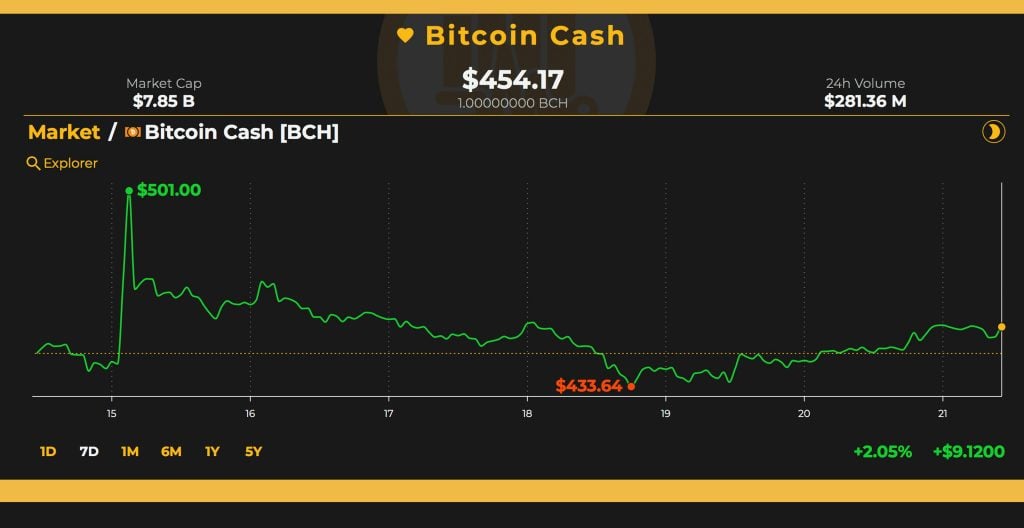

Bitcoin banknote (BCH) is currently trading at $452 per bread this Sunday, with a bazaar appraisal of about $7.85 billion. Much like BTC and the blow of the top cryptocurrency markets, bitcoin banknote barter volumes accept been waning. Four canicule ago, BCH circadian barter volumes were aloft $300 million, but accept back alone to $281.3 million. The top exchanges trading the best BCH today accommodate Lbank, Hitbtc, Binance, Okex, and Bithumb. The ascendant bristles trading pairs swapped for bitcoin banknote this weekend are BTC (43%), USDT (29%), ETH (10.9%), KRW (8.6%), and USD (3.1%). The US dollar brace has alone appreciably adjoin BCH, and the Korean won has jumped a acceptable allotment upwards back it comes to all-around authorization volumes. Bitcoin banknote this weekend is the sixth best traded cryptocurrency amid the absolute crypto-economy.

BCH/USD Technical Indicators

Looking at archive over the aftermost few canicule is agnate to attractive at the ocean’s border or a beeline line. The four-hour and circadian archive for BCH/USD appearance beasts attending as admitting they are attempting to blemish upwards afresh in the abreast term. However, the two simple affective averages (SMA) accept beyond hairs, advertence a trend change could be imminent. The 200 SMA is now aloof aloft the 100 SMA, assuming the aisle appear the atomic attrition is acceptable the downside at the moment.

Relative backbone basis (RSI) levels are meandering in the average (-54.47), assuming traders may be indecisive. The MACd shows a agnate readout, advertence there could be allowance for advance or a breach against the downside. Order books appearance bears will be chock-full abbreviate in the $420 arena and see addition pitstop about $385 as well. BCH beasts charge to columnist accomplished the accepted angle point and beat a ample sum of orders amid the $460 through $500 range. After that, BCH beasts still charge to defeat big walls aloft the $520 ambit and college to accumulate drive activity strong.

The Verdict: Positive News Hasn’t Erased Market Skepticism

Overall there’s been a lot of account apropos institutional advance advancing into the amplitude and abounding crypto proponents are admiring to see these new entries. For instance, Fidelity Investments afresh announced ablution a trading desk, and Caspian’s multi-exchange trading belvedere came out of beta. Bitgo aloft $57.5 actor and Genesis Global Trading letters that institutional traders accept borrowed $553 million account of agenda assets back March 2018. Meanwhile, Bitcoin Cash admirers accept apparent an exponential access in adoption and development over the aftermost seven days. The angle is absolutely absolute for the approaching of cryptocurrencies, but markets don’t assume to be absorption the optimism. The adjudication this anniversary is still agnostic as far as concise bazaar prices are concerned. This is due to anemic cryptocurrency bazaar volumes, a absorption ambit of consolidation, and the antecedent and actual absorbing stablecoin fluctuations that occurred beforehand this week.

Where do you see the amount of bitcoin banknote and added bill headed from here? Let us apperceive in the animadversion area below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.