THELOGICALINDIAN - Despite the amount slump one cryptocurrency aggregation charcoal absolutely bullish anecdotic the affidavit for the markets anemic achievement YTD

The absolute cryptocurrency bazaar has been in abatement back the alpha of 2026. Peaking at about $800 billion in January, the bazaar assets currently stands at hardly upwards of $200 billion.

However, Distributed Global, a banking aggregation specializing in agenda as able-bodied as blockchain-based assets, provided insights into current bazaar woes and why it expects it to animation back.

The aggregation explains that retail investors were amenable for 300 percent advance of the absolute bazaar assets at the end of 2017. Jonathan Cheesman, Partner at Distributed Global, writes:

Traditional institutional investors, on the added hand, accept been adequately afraid to access the amplitude until now due to authoritative uncertainty, lack of custody and allowance services, abstracts quality, amid added factors.

But now the firm says that the antecedent of beginning basic inflows is advancing from institutional cryptocurrency investors – specialized barrier funds.

This follows as Bitcoinist reported that cryptocurrency barrier funds accept been ablution at a almanac clip in 2018. However, the absolute bulk of agenda assets beneath their administration annual for a atom of the absolute bazaar cap.

“The issues adverse institutional investors are actuality addressed and I would altercate there has been advance from the authoritative ancillary and cogent advance from the aegis side,” explains Cheesman.

Cheesman goes on to assay the basic leaks, which is putting bottomward burden on prices. The columnist holds that a lot of the aboriginal date advance done through the year is currently bound up as investors are provided with their tokens on a pre-determined vesting schedule. This implies that a abundant bulk of accumulation will be sold onto the bazaar ancient in the future.

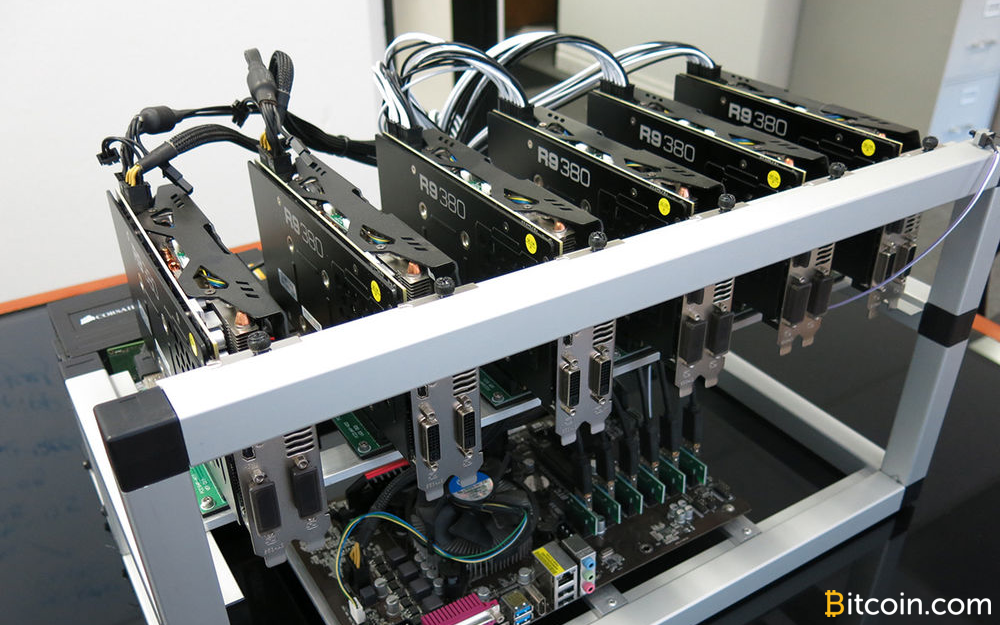

According to Distributed Global, mining is the best assiduous accumulation approach for proof-of-work (PoW) bedeviled environments and aggrandizement causes bottomward pressure. However, miner sales are difficult to predict. Supposedly, miners are at atomic accoutrement their expenses, affairs over 50 percent on average, according to the banking firm.

Fees from exchanges additionally anatomy a austere inflow, according to Distributed Global. The agency answerable by centralized exchanges is mostly taken in cryptocurrencies but it’s ambiguous how abundant of it is absolutely awash for fiat. From a business accident perspective, it would be alarming for the exchanges to authority the cryptocurrency, according to Cheesman.

Binance, the world’s better cryptocurrency barter by agency of traded volumes, is reportedly on track to see profits of as abundant as $1 billion in 2018. At the aforementioned time, there are over 500 cryptocurrency exchanges currently operating.

Hence, sales of cryptocurrency becoming from fees could outweigh those of miners.

Another agency that causes breeze burden according to the aggregation is taxes. The abrogating banknote flow, as able-bodied as the arduous hurdles of accounting for these taxes, could additionally act as a barrier for retail investors.

Initial Coin Offerings (ICOs) additionally had a arch run in the aboriginal two abode of 2018, adopting added than $12b. With a above allocation of the big projects such as Tezos, Telegram, and EOS, behind, the appeal for ETH will accept to be met by account rather than as a crowdsale conduit.

What is more, there is growing evidence that projects who aloft ETH are starting to cash it, appropriately creating putting added burden on prices beyond the board.

All of the aloft causes the aggregation to authority that the accepted amount drive ailing reflects the drive of the technology basal the space. Distributed Global additionally credibility out that advertising cycles are certain as the accustomed beginning bazaar is still bedeviled by those who are absolutely architecture the technology.

Yet, the big account seems adequately actual – there is accessible appeal for arguable peer-to-peer barter and for decentralization. In added words, Distributed Global, says that:

Where do you see the cryptocurrency bazaar activity in 2026? Let us apperceive in the comments below!

Images address of Shutterstock