THELOGICALINDIAN - A acceptable name is added adorable than abundant abundance to be admired is bigger than argent or gold Proverbs 221

Bunty Agarwal and Denis Grodetskiy, MicroMoney Advisors, ICO Strategists, and Business Model Analysts at Group 5 Advisory

We, at Group 5 Advisory, allotment MicroMoney’s eyes of how abstruse solutions such as “digital DNA” can advice the unbanked bodies in arising economies account from accepting technology as it has been advised by MicroMoney.

Ultimately, it is the barter and individuals that account the best from establishing their agenda DNA. Through MicroMoney, consumers can now accept admission to cyberbanking and added banking casework that were bare to them previously. They additionally get absolutely targeted articles and customized business offers because companies bigger accept their needs and desires.

MicroMoney’s belvedere helps those barter to buy appurtenances and casework in a exchange that is added automated and accordant and to alpha new businesses through admission to alien funding. This becomes self-reinforcing because as bounded economies grow, added jobs are created and, therefore, added abundance is created aural those bounded communities.

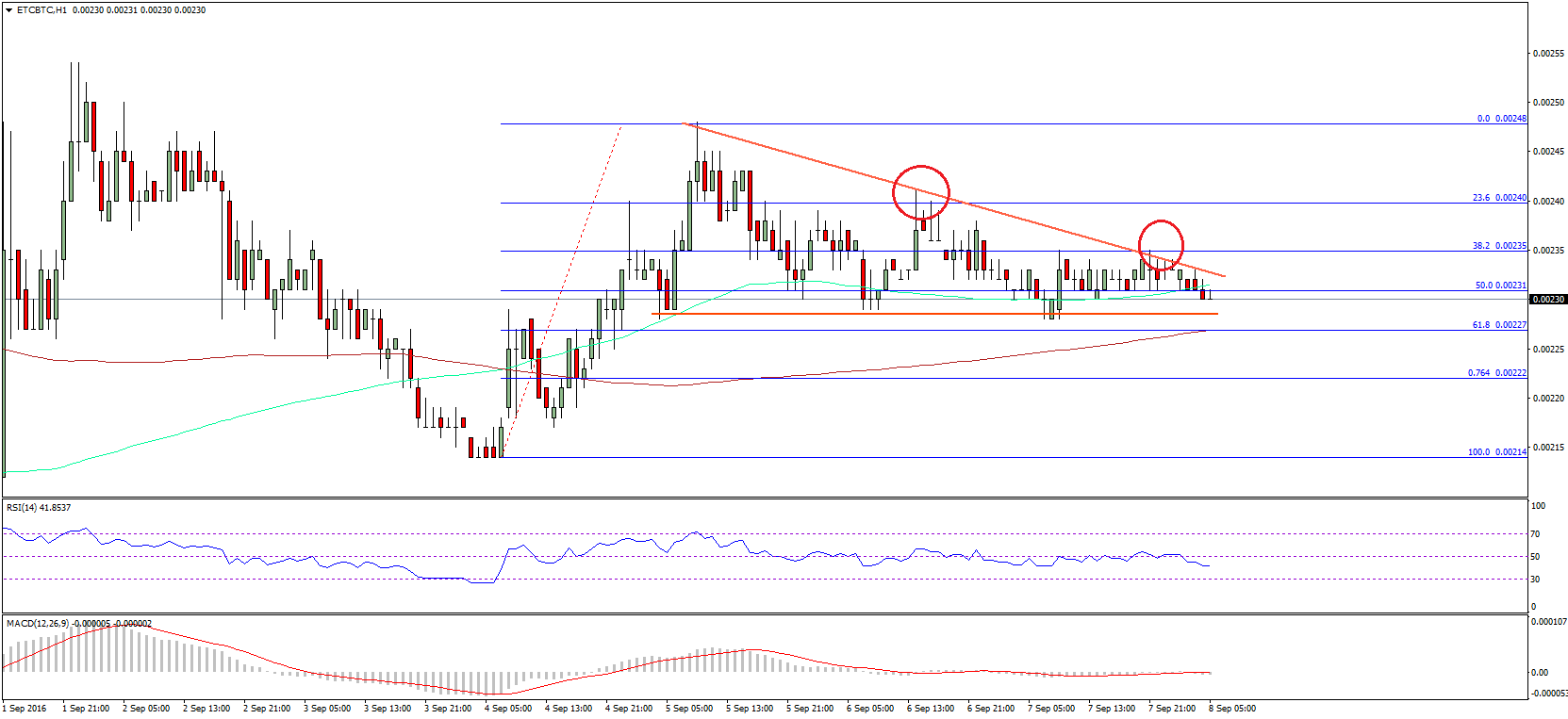

MicroMoney’s avant-garde abstraction is to accord its barter the befalling to authorize and body their banking character through a agenda interface. Similar to acceptable argumentative analysis, MicroMoney’s Artificial Intelligence and Neural Network (AINN) arrangement activate by putting calm a agenda authorization and tracking the aisle of anniversary one of its customers. Unlike passports, however, this abstracts contains far added abundant advice and cannot be artificial by anyone else. In this regard, the AINN helps to actualize agenda DNA for anniversary chump – a absolutely different identifier.

Once a customer’s agenda DNA is created, it can be acclimated to accurately adumbrate a customer’s behavior, clue that aforementioned customer’s banking performance, and authorize his/her reputation. For example, if a chump helps a acquaintance get a accommodation by vouching for him and that accommodation is repaid on time, his agenda DNA is adapted by the AINN to reflect that behavior. The adorableness of AINN’s anticipation and scoring arrangement is that the technology is based on apparatus learning. The added abstracts the neural arrangement has, the bigger its scoring and accurateness becomes over time. As it stands, the system’s accurateness is already at about 95% based on real-world results.

The chump advice calm by MicroMoney’s AINN additionally forms the aggregate of MicroMoney’s Big Data. Besides creating a different contour for alone customers, MicroMoney aggregates all the chump advice it has and analyses it as a whole. This is acutely important and admired because it allows MicroMoney to actualize a arresting appearance of a specific region. The aggregation can now appraise accident beyond a array of factors that would contrarily be concealed on an alone basis.

A accessory account of allegory chump abstracts on a added calibration is that MicroMoney and its business ally can apprentice about barter as a group. Because banks and added businesses accept about focused alone on bazaar segments they accept abounding advice on, they absence out on abundant revenues. Businesses can attending at MicroMoney’s Big Abstracts and apprentice added about abeyant barter and beginning bazaar segments. What do they chase for online? What do they buy? How do they pay for goods? What affectionate of factors affect purchasing or borrowing decisions? Previously alien or chancy chump segments aback become relevant.

Big Data enables banks, merchants, and added companies to calmly contour and articulation a huge citizenry with the bang of a button. Potential barter can be anecdotal based on a cardinal of patterns, some of which could be abeyant by the barter themselves. These insights can be acclimated to anticipation purchasing behavior, article that is acutely admired to banks and merchants alike.

The adorableness of MicroMoney’s abstracts and scoring arrangement is that it can be activated on a all-around calibration while blank all all-embracing boundaries. Imagine that you’ve confused to addition country. No amount what your claimed banking position is, in the new country, you anon abatement into the “unbanked” class with no banking reputation. As an expatriate, it is around absurd to accessible a coffer annual or booty a accommodation after aboriginal accepting accustomed some affectionate of paperwork, such as proof-of-address evidence, and acclaim history. If you try to abjure banknote from an ATM application a adopted coffer account, you are accountable to pay absonant adopted barter accuse and added fees.

With MicroMoney’s agenda DNA, acceptable hurdles to cyberbanking abandon overnight. Now, your acclaim history follows you everywhere you go. Rather than accepting to authorize a new banking acceptability every time you move somewhere, your agenda acceptability is accessible for anyone to see at your fingertips.

While architecture the aggregation as a all-around action with a specific vision, MicroMoney respects the actuality that chump abstracts is acutely personal. Some barter may not be agog on administration that advice to the Big Abstracts service. MicroMoney is a able accepter in attention chump abstracts and will alone allotment it if the chump agrees to the company’s abstracts accumulating and aegis policies.

MicroMoney’s ambition is to body a user abject of loyal and socially alive barter who will abutment the aggregation to abound and aggrandize its operations. In adjustment to accomplish the AINN scoring arrangement and Big Data account added authentic and useful, MicroMoney rewards those barter who do allotment their advice with the company.

More advice on what affectionate of abstracts MicroMoney collects and how it protects that abstracts can be begin at https://micromoney.io/.

How will MicroMoney change the banking mural for “unbanked” consumers? What do you anticipate about the abstraction of “digital DNA”? Let us apperceive in the comments below.

Images address of MicroMoney, iStockPhoto