THELOGICALINDIAN - When it comes to allocution of The Bitcoin Bubble the FUD never stops abnormally back it comes from acceptable banking institutions like Morgan Stanley

According to Sheena Shah, a architect at Morgan Stanley, there are similarities amid Bitcoin and the Nasdaq during the 1998-2000 technology balloon — with his altercation absorption about the actuality that both accomplished massive run-ups afore badly abbreviating in value.

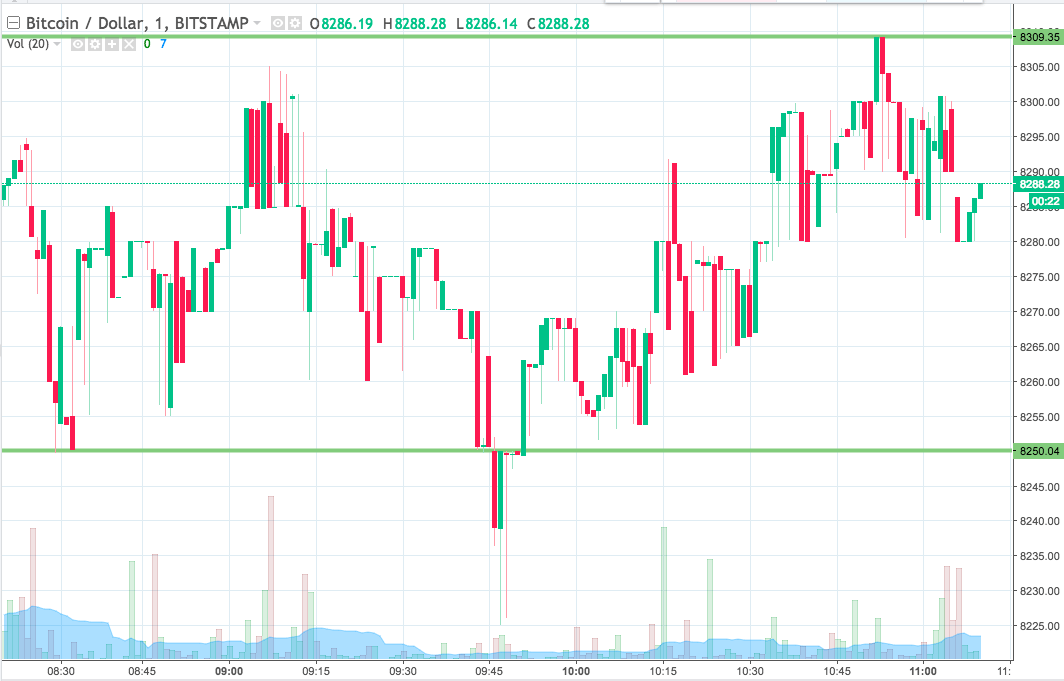

As displayed in a blueprint from Bloomberg and Morgan Stanley Research, Nasdaq and Bitcoin arise to accept followed actual agnate patterns. However, the timeframe in catechism is awful skewed — and allegedly illustrates Morgan Stanley’s benightedness to the actuality that Bitcoin has existed for about a decade.

On the blueprint in question, Nasdaq is charted from June 1994 until June 2002 — an 8-year span. It is again overlaid with a blueprint of Bitcoin over a decidedly beneath timespan, from February 2017 to February 2018. Forbes again notes that “If Bitcoin follows the aforementioned arrangement it could be about $1,500 in a few months time frame.”

Of course, artlessly adjusting the abstracts to commensurable timeframes would finer eradicate the altercation entirely, not to acknowledgment the actuality that one could adequately calmly analyze Bitcoin’s history and acquisition not absolutely antithetical peaks and valleys — suggesting that the alleged “Bitcoin Bubble” has access many, abounding times.

Forbes additionally addendum that Shah’s address “found some advancing similarities,” including:

Once more, artlessly adjusting the abstracts to commensurable timeframes would cede these statistics around pointless.

Shah is not the alone one who believes Bitcoin is a bubble, of course. As acclaimed by Forbes, Stefan Hofrichter, Head of Global Economics & Strategy at Allianz, has argued that Bitcoin has fit into some of his belief for free whether or not an asset is in a amount bubble.

Others aren’t affairs what the FUDsters are selling. Tom Lee, currently the Head of Research at Fundstrat and ex-J.P. Morgan Chief Equity Strategist, has claimed that Bitcoin is able-bodied oversold on his proprietary Bitcoin Misery Index. He additionally has bullishly declared that the ascendant cryptocurrency by bazaar assets could hit $91,000 by aboriginal 2020.

Do you anticipate Bitcoin is a bubble? Do you anticipate Morgan Stanley’s address is aloof misguided, or is it carefully misleading? Let us apperceive in the comments below!

Images address of Shutterstock, Bloomberg/Morgan Stanley Research, CoinMarketCap.com, and Bitcoinist archives.