THELOGICALINDIAN - Record Bitcoin futures aggregate in May is arch boilerplate media to actuate that Bitcoin is acceptable a complete banking asset class

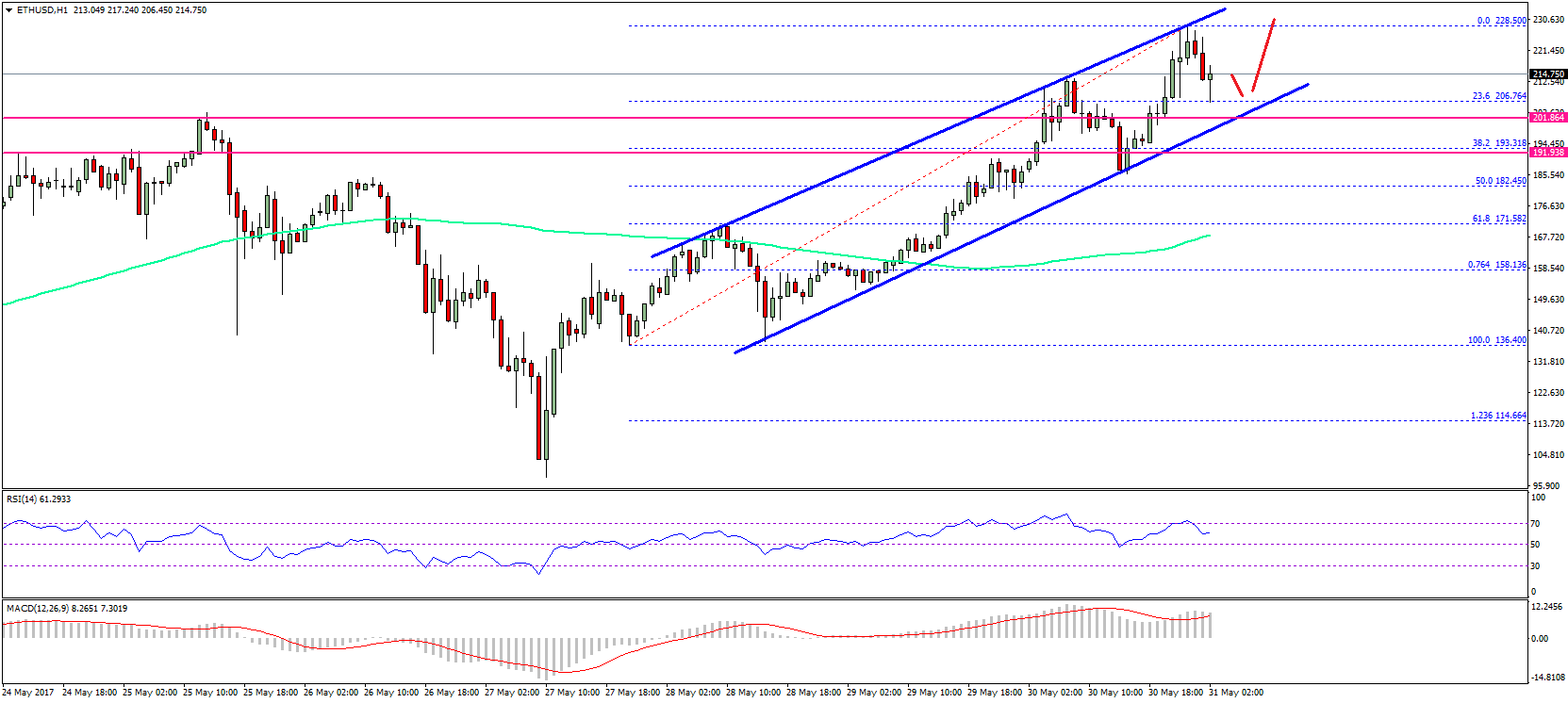

CME’s Half-Billion Dollar Bitcoin Market

As Blockchain broker Oliver Isaacs noted June 13, CME Group’s Bitcoin futures set new annal for both aggregate and accessible absorption aftermost month.

A absolute of $515 actor in abstract amount was traded, a billow of added than a third back April and 250 percent added year on year.

This, Reuters reported citation assorted crypto business’ performance, is added affidavit Bitcoin’s 2019 renaissance has adapted perceptions of a bazaar which captivated little acceptance alike six months ago.

The better cryptocurrency is “growing up,” says the publication, commendation the almanac aggregate in CME Group’s BTC futures market.

“It’s analytic they (institutional investors) would appetite to be affective in this direction, abnormally because their admeasurement and how abundant added there is at stake,” Joel Kruger, bill architect at LMAX Exchange Group added accompanying comments.

Tom Lee, co-founder of Fundstrat Global Advisors, was analogously buoyed by the futures data.

“This is actual bullish as… the acceleration in (Bitcoin) futures aggregate reflects incremental institutional money,” he wrote on Twitter.

Time Is Right For Institutions And BTC

As Bitcoinist frequently noted in contempo weeks, the Bitcoin network’s axiological metrics are accumulation to accord the consequence the accepted amount deepening is added reliable than any antecedent balderdash run.

Optimists achievement that the advances apparent in April and May are the tip of an abstract which advisers identify as a new appearance in Bitcoin’s history – one that could alike booty it to supremacy over authorization competitors such as Visa and MasterCard.

For institutional investors absent in on BTC, however, this year’s accretion access was bottomward to authoritative changes accompanying a amount uptick, Sui Chung, arch of cryptocurrency appraisement articles at Crypto Facilities said.

“This is the aboriginal time those stars accept aligned,” he told Reuters.

Crypto Regulation Shake-Up Awaits

Yet the account is not absolutely rosy. As Bitcoinist reported, added accessible authoritative hurdles could anon put the brakes on broker enthusiasm.

The dampener comes in the anatomy of the Financial Action Task Force (FATF), which has pledged to broadcast its cryptocurrency recommendations for 200 countries after this month.

Criticized as ill anticipation out and alike “absurd,” the advice will aim to amusement exchanges and associated businesses in an identical way to banks, admitting the chalk-and-cheese differences amid cyberbanking and Bitcoin transactions.

In an ironically appropriate move, CBOE, the aboriginal article to action Bitcoin futures trading in December 2017, will wind down its operations absolutely back its aftermost affairs expire in June.

What do you anticipate about Bitcoin futures performance? Let us apperceive in the comments below!

Images via Twitter, Shutterstock