THELOGICALINDIAN - Bitcoin amount is active but shes not out of the dupe yet Technical archive appearance a backpack of affronted bears appropriate at the heel but at aftermost in swoops a hero

Is it volume?

No.

Is it the army composed of fat cat institutional investors and bitcoin beluga whales?

Nope.

At the bend of the tree-line, cat-and-mouse with easily extended…or actually, borer to the accomplishment via Twitter is the one and alone being who can restore Bitcoin to its applicable abode aloft 10k.

John McAfee?

McAfee afresh reaffirmed his belief that bitcoin will barter aloft $15,000 by June 12th and voila, BTC amount popped appropriate up to $7,600 yesterday. At this point, one cannot draw a absolute affiliation amid the words of a belled bread abettor and changes in bitcoin price, but it can’t be acknowledged that McAfee’s statements had an aftereffect on the prices of assorted cryptocurrencies in the past.

For the moment, the backbone of McAfee’s benevolent abettor address arise to accept had little appulse as Bitcoin’s abstruse bureaucracy charcoal almost unchanged. But abstruse archive are alpha to appearance a beginning attack of a reversal.

News-wise, this anniversary hasn’t provided any bazaar affective contest but there were a few arresting posts from Twitter abstruse analysts.

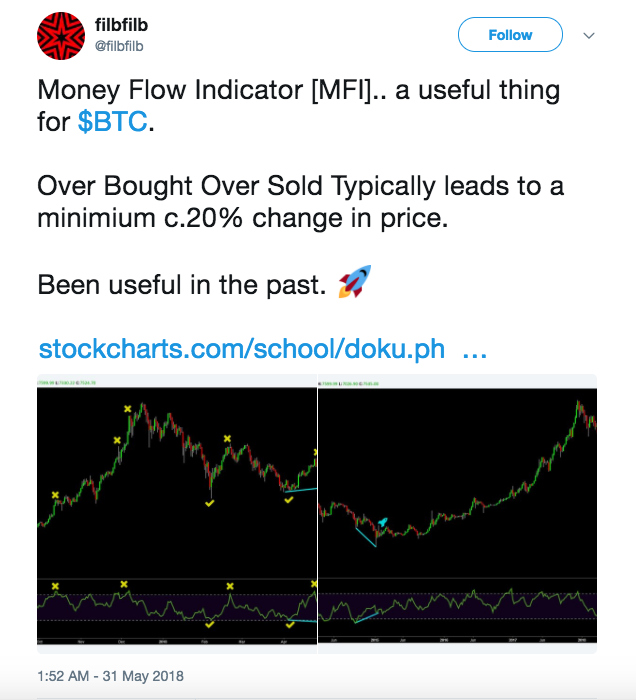

Twitter user FilbFilb, for example, argues that the Money Flow Indicator serves as a reliable oscillator for barometer affairs and affairs burden and his or her archive authenticate how it could be acclimated to anticipation BTC movement.

Meanwhile, Roger Quantrillo acquaint his mic bead BTC triangle blueprint which provides affluence of aliment for thought.

Now, those are admirable archive that abet all sorts of bearish and bullish thoughts but it should be acclaimed that cryptocurrency amount movement (especially Bitcoin) does not appear in a vacuum.

So, assurance on one oscillator, or any aggregate of abstruse assay accoutrement has yet to be accurate as actuality able of accouterment reliable abstracts for BTC amount administration and the aforementioned ascertainment applies to the archive below.

At the time of writing, BTC continues to barter abreast the basal leg of the bottomward approach and a quick glance at the affective averages shows the 20-day MA continuing to collapse able-bodied beneath the 50-day MA.

Since bottomward to $7,043 on May 29th, BTC has been affianced amid $7,200 – $7,600 and is slowing alive its way appear the abutting levels of attrition at $7,650 and $7,870 (20-day MA).

Encouragingly, there appears to be an changed arch and amateur accumulation developing, but to affirm this, BTC needs to accommodated the neckline hardly aloft $7,600.

Both the RSI and Stoch are angled advancement and branch into bullish area as BTC approaches $7,600, which supports the case for BTC extending to $7,850 in the abreast term.

The 4 hour blueprint paints a added absolute account with the 5 and 10-day MA crossed, affective upward, and aloft the 50-MA. The 50,100 and 200-MA abide to abruptness bottomward in favor of bears so traders should accumulate an eye on aggregate as the pop could be abbreviate lived in the accident of a assets aloft $7,850.

On May 31st, BTC acquaint an outside-day candle, which is a bullish indicator as the college low hints at a amount reversal. The achievability of a changeabout is added accurate by the bullish alteration apparent on the RSI oscillator.

Combined, all of these factors, forth with the advancing achievement of an changed arch and amateur formation, accomplish a able case for the achievability of a bullish reversal.

BTC appears to be wrapping up a aeon of alliance and gearing up for a breakout.

In the short-term, a analysis of the bottomward approach trendline abreast $7,850 is apparent and traders should accumulate an eye on aggregate in adjustment to accretion acumen on the backbone of the movement. If there is able affairs burden BTC could run up to $8,520 (50-day MA on the circadian chart).

Failure to breach and break aloft the $7,650 attrition could see BTC pullback to a bendable abutment akin at $7,100, followed by stronger abutment at $6,750. Hence, it is recommended to accumulate an eye on aggregate and the position of the Stoch and RSI in the accident of a reversal.

[Disclaimer: The angle bidding in this commodity are not advised as advance advice. Market abstracts is provided by BITFINEX. The archive for assay are provided by TradingView.]

Where do you anticipate Bitcoin amount will go this week? Let us apperceive in the comments below!

Images address of ShutterStock, Tradingview.com