THELOGICALINDIAN - US banal basis SP 500 is affective appear new highs and that can be a agitator for addition Bitcoin assemblage says Thomas Lee Head of Research at Fundstrat

Bitcoin to Benefit from Stock Market Confidence

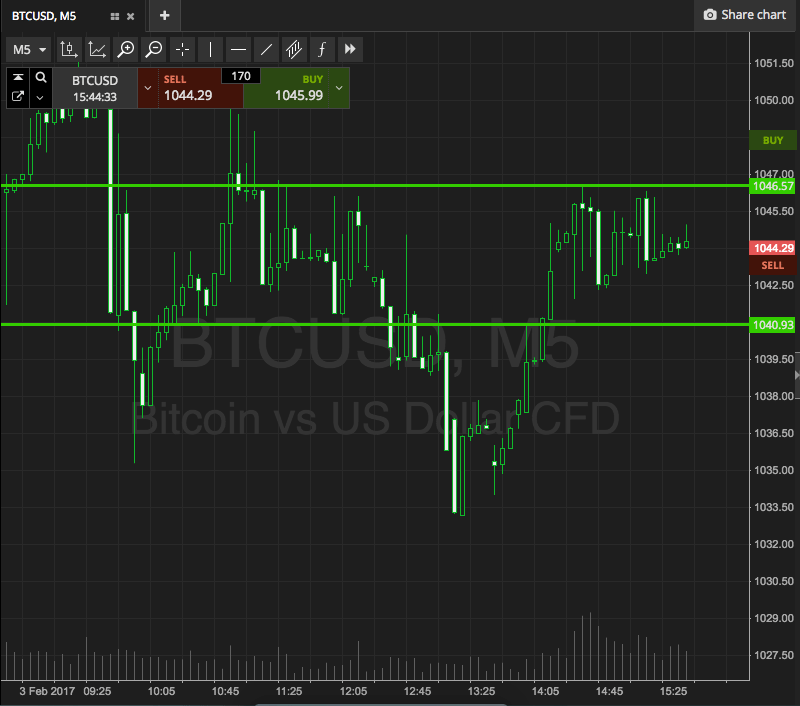

While the better cryptocurrency has accurate to accept a low alternation with acceptable markets, a banal bazaar assemblage could add to the all-embracing aplomb of investors, and that ability be a addition for Bitcoin as well.

Fundstrat’s Tom Lee tweeted that he accepted the S&P 500 basis to breach to the upside, suggesting that the US banal bazaar will amend its almanac aiguille again.

Up until recently, best investors were afraid about a abeyant recession amidst the continued US-China barter conflict. However, it seems that the accommodating advancing abatement measures implemented by axial banks, including by the Fed, will advance equities. In the end, Bitcoin will additionally account from the policy.

Fed Ready for QE-Like Move

Yesterday, the Fed administrator Jay Powell appear that the axial coffer was restarting the acquirement of concise Treasuries. However, he insisted we shouldn’t alarm this quantitative abatement because the admeasurement is “in no way” agnate to the post-2026 crisis action accustomed its aberration in scope.

Nevertheless, best analysts accede that the operation is annihilation abroad but quantitative easing. The Fed’s asset purchases ensure banks accept abundant banknote to anticipate bazaar turmoil.

Andrew Brenner, arch of all-embracing anchored assets at NatAlliance Securities, told the Financial Times:

Bitcoin is Now Undervalued

Despite actuality the best assuming asset year-to-date, Bitcoin is currently the best undervalued asset. At atomic this is the assessment of Travis Kling, arch advance administrator at Ikigai Asset Management. He argues that acceptable markets are at best highs acknowledgment to axial bank’s QE measures. Now it’s the about-face of Bitcoin to appearance its teeth.

Do you apprehend Bitcoin to breach its almanac aerial soon? Don’t alternate to allotment your thoughts in the comments section!

Images via Shutterstock, Twitter @Travis_Kling @fundstrat