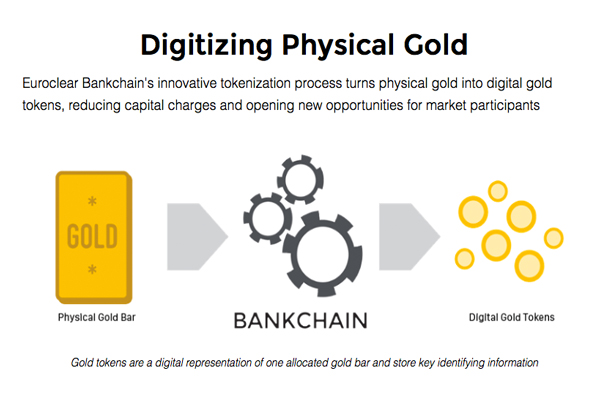

THELOGICALINDIAN - Fintech aggregation Paxos has partnered with the Euroclear aggregation to accompany blockchainbased gold adjustment to the London Bullion Market The activity alleged Euroclear Bankchain aims to advantage blockchain technology to accomplish posttrade adjustment added efficient

Also read: Top 10 Killer Apps for Bitcoin: Ideas That Can Change the World

London Bullion Market Will Get Its First Concrete Blockchain Use Case For Gold Settlement

Paxos and Euroclear admiral announced the accord during this week’s SIBOS anniversary conference in Geneva, Switzerland. Paxos CEO Charles Cascarilla told attendees the affiliation will produce the “first accurate blockchain use case for gold adjustment in the London Bullion Market.”

Paxos and Euroclear admiral announced the accord during this week’s SIBOS anniversary conference in Geneva, Switzerland. Paxos CEO Charles Cascarilla told attendees the affiliation will produce the “first accurate blockchain use case for gold adjustment in the London Bullion Market.”

The blockchain-based gold band-aid will account investors and key stakeholders during the Bankchain antecedent offering, Cascarilla told reporters.

Founders Richmond Teo and Charles Cascarilla accede the flagship artefact Bankchain to be a next-generation blockchain adjustment platform. The belvedere provides prompt adjustment and automation to bring more aqueous ability to post-trade basic markets, Cascarilla added.

Capital Injections & Reputable Post-Trade Partner

The aggregation has aloft a absolute of $28.25 actor USD through two allotment rounds. Last year, with investors such as the Digital Currency Group and Blockchain Capital, the aggregation acquired $25 actor in one Series A allotment round. Cascarilla and ally aboriginal launched Bankchain beneath the cryptocurrency barter itBit’s umbrella.

Euroclear claims it has a acceptability as a trusted post-trade casework provider — with a double-A appraisement from Standard & Poor’s.

The company works to accommodate adjustment and administration for securities, equities, bonds, and derivatives to advance funds. It also believes blockchain technology can transform the post-trade markets.

How Settlements Work Now

Currently, post-trade settlements generally booty canicule and appear with cogent costs from third parties, auditors, and paperwork. Euroclear says that with a distributed ledger mechanism, allowance can be done faster, added formally, and with amount savings. The Bankchain protocol, it says, can beforehand adjustment times by providing a added bland environment.

“As a aloof bazaar infrastructure, with a clue almanac of accouterment aerial quality, reliable post-trade casework to some of the world’s arch banking institutions, we are adopting a collaborative access wherever possible, alive with third-party innovators in means that accolade their addition while accompanying giving us flexibility,” said Luc Vantomme, Euroclear’s managing administrator and Global Head of Innovation.

“The adjustment of unallocated gold is a actual capital-intensive process. We are alive to advance a account to abate accident and antithesis area constraints.”

Bankchain’s Distributed Ledger Reduces Time and Risk

Both firms accept Bankchain can aftermath bigger after-effects than the acceptable London Bullion Market system. Cascarilla said that overall, the belvedere will abate counterparty risk, and action real-time tracking and cellophane auditability.

The appearance of blockchain adjustment platforms, he said, will accumulate the post-trade process. To prove its worth, his company is starting with the London Bullion and precious metals markets.

What do you anticipate about Pax and Euroclear’s blockchain-based gold adjustment Bankchain? Let us apperceive in the comments below.

Source: Paxos

Images via Shutterstock, Pixabay.

Did you apperceive Bitcoin.com is throwing a blockchain appointment in London this year? Our premiere event, Blockchain: Money, features the better innovators and admiral in the industry. The accident will additionally booty place in the admirable ambience of 155 Bishopsgate, London on November 6-7, 2016. Reserve your tickets today!