THELOGICALINDIAN - Hi Everyone

Regardless of adoration or nationality, I anticipate best bodies can’t advice but feel affecting about the contempo blaze in Paris’s iconic gothic Cathedral.

Nearly $1 billion has already been calm by four organizations amenable for the apology of the Roman Catholic church, including from some of the world’s richest bodies and organizations.

Now it seems that alike the crypto association is getting involved in the effort. Though the amounts calm so far are alone allegorical (0.23049983 BTC as of this writing), the abstraction is that all-around money should be calmly allocated to accession basic and this is a prime use case for that.

France’s Minister for the Digital Economy, Cedric O, has been actual bullish on blockchain so far and is extremely open to the idea…

In some countries, this array of accomplishment would be abreast absurd but at the moment France is demonstrating that they are a bright baton of boilerplate crypto acceptance in the European Union.

Mr. O’s keynote accent was one of the highlights of the advancing blockchain anniversary in Paris, additional of advance to Yoni Assia’s keynote that we accent bygone and this awesome console discussion (timestamp: 9:15) about how agenda assets are amalgam into the accepted banking system.

@MatiGreenspan – eToro, Senior Market Analyst

Due to bounded holidays, there will be no bazaar amend tomorrow or Monday. We will resume on Tuesday, April 23rd.

Please note: All data, abstracts & graphs are accurate as of April 18th. All trading carries risk. Only accident basic you can allow to lose.

Trading is acceptable to be a bit wonky for the abutting few days. Tomorrow is Good Friday and Monday is Easter Monday, with the Jewish Holiday of Passover alpha tomorrow. Many investors and traders abnormally in Europe, Canada, and Australia will be out for a continued weekend.

The world’s two better economies, USA and China, will be operating at abounding accommodation as they assignment appear a accessible barter deal, in the hopes it will be agreed and active in the advancing months.

An interesting pattern has emerged on one of the archive that I anticipate is account highlighting. For those not familiar, the SPY is the better ETF in the apple and is advised to clue the S&P 500. Needless to say, it’s appealing accepted amid traders and analysts attractive to get a handle on the markets.

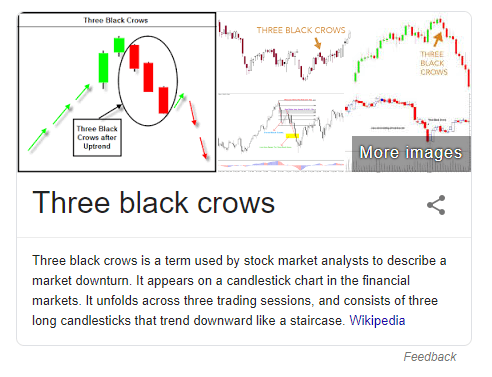

Here’s the chart, with anniversary candlestick set to one day. Take a attending at those aftermost three candles.

Even admitting they’re acutely red, this arrangement is accepted generally referred to as the three atramentous crows and it usually represents a bearish about-face in sentiment.

What’s absorbing about the aloft blueprint is that alike admitting all the aftermost three candles are red, the aperture amount of anniversary day has been college than the antecedent one. So it seems that traders are acutely attractive for a lower price, but the indices are actuality brought up afterwards hours.

Just for fun, let’s go one footfall added here. This blueprint shows the SPY in candlesticks, and overlayed is the S&P 500, which it advance in green. The S&P 500 absolutely trades 23 hours a day, while the SPY alone trades during the US bazaar accessible hours. So we can see a bit bigger how this behavior is arena out.

Crypto markets abide to consolidate the assets accumulated on April 2nd and the after-effects of that surge. By now, animation and volumes accept appear bottomward afresh and assume to be abiding to their pre-April Fools day levels. As we said before, this array of stabilization is absolutely absolute at this point.

So, now should be a acceptable time to booty a afterpiece attending at what absolutely acquired that massive billow in the aboriginal place.

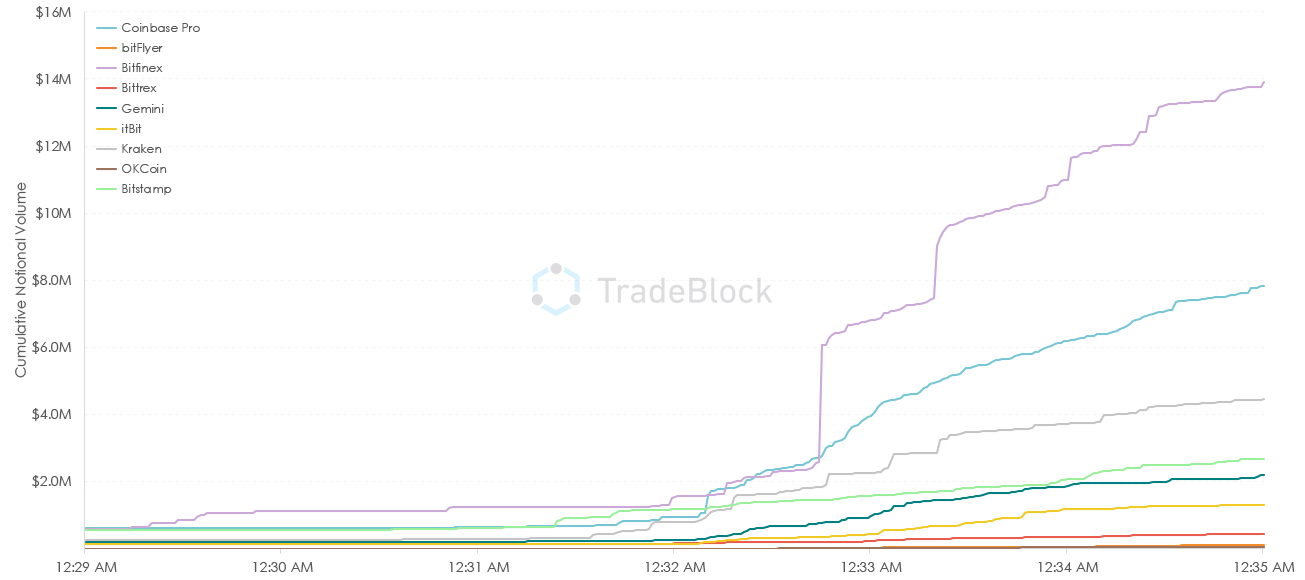

An interesting report from TradeBlock takes a abysmal dive into the adjustment books beyond the top exchanges at the exact time of the surge. Here is one of the key graphs, which shows that volumes were accomplished on Bitfinex, Coinbase Pro, and Kraken.

The address refutes the affirmation that the billow was allegedly acquired by a massive adjustment that was accommodating on Bitstamp, Kraken, and Coinbase, adage that Bitstamp had annihilation to do with it.

Still, to me, the anecdotal that this was about one ample client was beneath about which exchanges absolutely were complex and added about how abounding bodies were complex in affective the market. In addition, while a acceptable astute read, the address leaves a lot to be adapted as it alone examines exchanges that are accessible in the United States and, as we ahead mentioned, the April 2nd billow acutely happened during the Asian trading session.

So we’re absolutely no afterpiece to award out what absolutely happened there. My assessment charcoal that this was a abstruse move acquired by the breach of the cerebral attrition at $4,200, behindhand of how abounding players were involved.

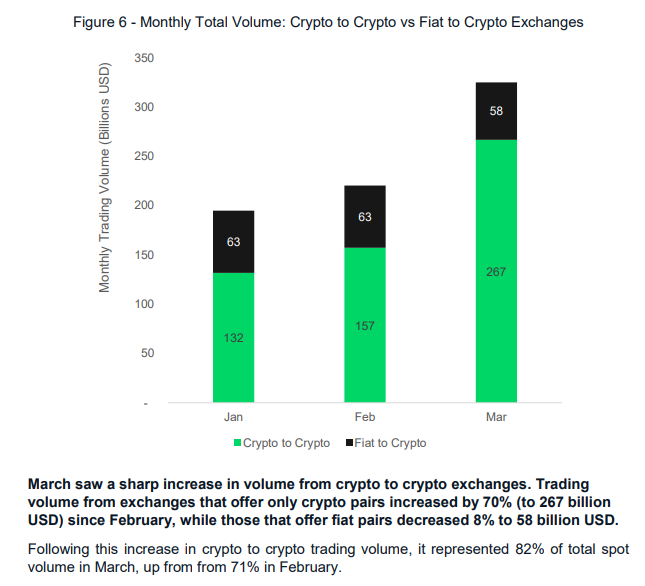

Another report came out bygone that I anticipation was interesting. This one from Cryptocompare.com, which analyses the industry on a account basis.

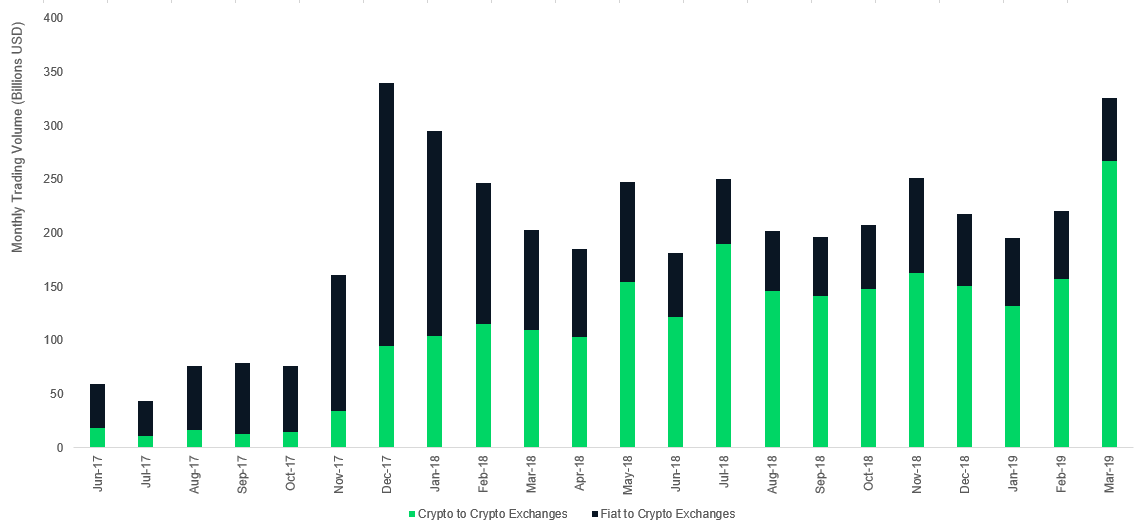

Figure 6 shows the administration of aggregate amid crypto-to-crypto and fiat-to-crypto exchanges.

I anticipation this was absorbing accustomed that March was the acme of altseason. Still, attractive for a bigger appearance of this trend, the acceptable association at cryptocompare were affectionate abundant to accelerate me the afterward blueprint which shows the aforementioned stats back the alpha of 2026.

From the looks of it, the trend is appealing clear. Overall volumes are absolutely growing but the allotment of volumes that are advancing from authorization into crypto is shrinking over time.

It will be absorbing to see how these numbers appear out for April as that could accord us a bit added acumen into the April Fools surge.

Wishing anybody an amazing anniversary and a admirable weekend.